Commitment – first dot in a trend

From this point on, I will be posting quarterly overviews of Baltic Stock market movements. So, let’s see what was the Performance of Baltic Equities in 2017 Q3 (third quarter).

Nasdaq Baltic Indexes Performance

Considering we look only at 3 months period, Baltic Stock Market Indexes showed substantial gains. Main index OMX Baltic Benchmark (OMXBB) which comprises largest and most liquid companies in Baltic Stock Exchange was up +8.14%, while national indexes climbed a little less: OMXT (Estonia) +7.28%, OMXR (Latvia) +4.95%, OMXV (Lithuania) +7.95%.

3 months…? What the..? Well, welcome to our sandbox – Baltic Stock Market Exchange.

Baltic Equities Market valuations

Company’s reports for 2017 first half (H1) are fully in. I cover 46 companies and for trailing twelve month reports with 2017.09.30 prices, main Baltic market valuations are as follows:

- EV/EBITDA: 7.79;

- P/tBV: 1.82

- P/E: 12.03

- Debt/Equity: 0.93

- ROE: 12.08%

You have got to love this market…

Baltic Fund

Although OMX Baltic Benchmark GI grew by +21.57% in 2016, 2017 Q3 was noticeably driven by institutional investors, mainly INVL Baltic Fund.

Baltic fund over 2017 Q3 issued 379 990 new units times the rough average unit price over Q3 (38.25€), that results in 14.5 M €. Not so few for Baltic box. Though estimate might had affected market more drastically, actual movements were subtle and only few positions showed evident fund actions.

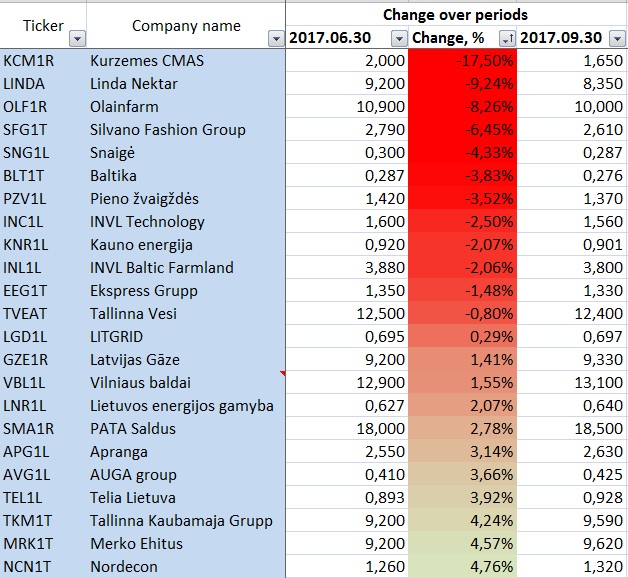

Baltic Stock performance over 2017 Q3

Let’s begin with under-performers:

KCM1R suffered a -17.5% dive. Company burned all Q1 profit with equivalent loss over Q2. Lack of liquidity positioned stock as a worst performer over 2017 Q3.

LINDA Q2 report disappointed investors with lower revenue and net profit numbers. However solid balance sheet stopped stock to loose ground. Linda bottomed at 7.36, ending quarter with -9.24% decline over the period.

OLF1R Q2 in short: Revenues up; Net profit down; EBITDA up. Nothing particularly terrible, but investors got used to +20/30% rise monthly sales and I suppose expected net profit to follow. After topping at 11.5€, OLF closed quarter with -8.26% decline.

SFG1T Q2 was somewhat counter-balancing terrible Q1 result and could be viewed as neutral. After Q1 market participants were very worried and pushed SFG1T price from ~3€ to ~2.43€.

It’s quite easy to see 2.6 holds a support line. SFG1T is one of most volatile stocks in Baltic market. -6.45% performance over Q3 isn’t a surprise.

VBL1L financial year ends on August 31 and full year result is yet to be considered. Ask’s are usually placed over 13.1 and it seems 12.8 is a firm bottom. I see a 10-15% upside over the next quarter. Fundamentals look great, market punished stock last year for lower dividend yield and proposals for general meeting could trigger stock to beat ~14.5 mark. Flat 1.55% performance could be seen as accumulation.

APG1L +3.14% is between two forces. I think stock is damned to improve it’s market valuations. On one hand fundamentals are strong, H1 revenues, net profit, EBITDA are up, while Q2 yoy result shows impact of growing wages in Baltic region, with a slight decline in EBITDA and net profit rows. Solid company, solid dividends, but if shit hits the fan in consumer spending, APG1L would be one of the first to feel it and I can feel market knows it too.

On the positive note

SAF1R finished its financial year with extraordinary good Q4 (ended on June 30) and respectably remarkable +34.02% increase in price. I wrote in short about adding some more SAF to portfolio.

PRF1T Q2 showed +33% yoy increase in revenue, however EBITDA decreased compared to 2016 Q2 and 2016Q2 net profit was substituted with net loss of -167 k€. So fundamentals certainly was not the driver to boost +33.05% over Q3. Recent news about acquisitions by PRFoods were greeted generously. For a reason. Oy Trio Trading Ab company seems to have a healthy cash flows and net positive result, which consolidated with PRFoods would significantly improve PRFoods outlook.

VLP1L is hand in hand with other Lithuanian dairy producers to use a beneficial profit margin gaps between higher product prices and lower milk procurement prices. Solid +27.18% prince increase does not catch up with even better fundamentals. EV/EBITDA: 5.22; P/tBV: 1.79; P/E: 4.87. However we all know dairy business is cyclical and fundamentals might be topping soon as milk procurement prices increase. What differs VLP1L from other dairy companies in Baltic stock market is transparency.

GRG1L price rally to all time high 1.35 marking +19.47% over Q3 was evidently supported by Baltic Fund purchases. Nonetheless GRG1L did report a strong Q2 and announced a sale of it’s subsidiary UAB Grigeo Baltwood. Market participants expect a solid price for healthy company and possibly higher dividends that that for 2016 FY.

HMX1R added +17.33% to it’s cap. Company decreases it’s debt burden, cleaning balance, increasing sales and profits. Growing know-how and a strong product all adds to stock being in my watch list. I remember bidding the stock earlier this year, but never caught it into my portfolio. Keeping an eye, attending webinars.

TAL1T rally to 1.15 was concluded at +16.48% over Q3 after all. Announcement about potential take-over/strategic investments, stock buy back or other feasible futures massed institutional investors to pump price to 1.10 – what current major shareholders paid for company in early 2012.

IVL1L +14.48% was driven by successful motions in it’s subsidiaries, investments and controlling funds. Knowing Invalda likes buy back it’s stock at net asset value (NAV), market participants do not let price to loose NAV too far out of sight.

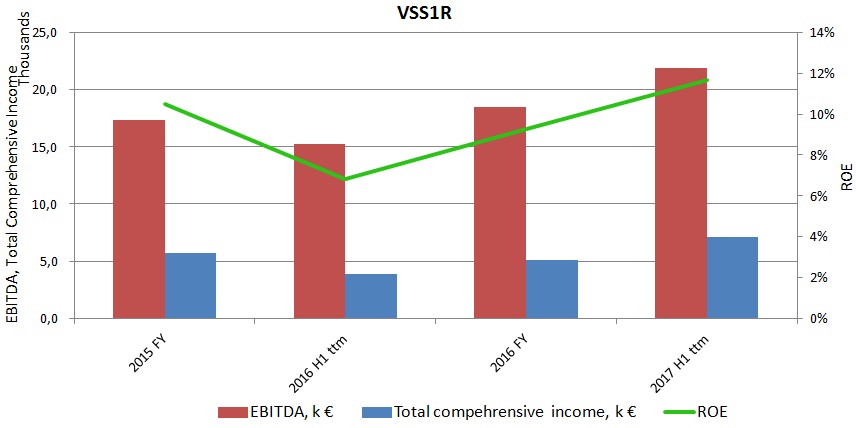

VSS1R Q2 hints a start of a revenue and profit growth after multiple quarters of investments in US manufacturing plant. Market responded +12.50% over Q3. Sneak peak into Valmieras Stikla Skiedra Group’s fundamentals below. Note, that debt/equity for VSS1R is around 1.4 (ROE subjectivity).

AMG1L, to my surprise actually, added +11.54% over last quarter. I suspect market participants have a strong availability bias. They just can’t forget those ~14% yielding dividends last year and keep a close eye on a stock. Q2 fundamentally was only a slightly better than that of 2016. H1 for 2017 was even worse that 2016 H1 in all three rows: revenue, net profit, EBITDA. However current ttm free cash flow over market cap stands at 12%~, which is somewhat promising.

ESO1L grew conservative +6% in Q3. Mainly due to upcoming dividends for half year period, which company distributes. General meeting Friday approved proposed dividends of 0,046 € per share. Which is around 5% yield for half year. Got to love utilities.. Half year result was however worse due to lower electricity and gas prices set by regulator. Revenues down -8.1% Q2 yoy.

RSU1L (+5.86%), another Lithuanian dairy manufacturer announced it’s plans to sell a portion of company to Fonterra. Negotiations are still in progress, but market received news with positivism, since new institutional investor is expected to increase company’s transparency and trust among residential investors. Q2 result was unexpectedly pretty bad, by market consensus. 2017 H1 net profit was 844 k€, while 2016 H1 held -1902 k€ loss. Revenues were up +26%. Suspicious, taking into account how other manufacturers were performing.

LNA1L after bottoming at 0.63 ended Q3 with +5.45%. I suspect rally to 0.74 was again supported by Baltic Fund actions. After really strong last FY quarter ended June 30, I expect a little higher dividend than last year, but still conservative ~2% yield. Announcement about general meeting date and proposals should be this week.

Summing up Baltic Equities in 2017 Q3

OMXBBGI YTD is up impressive +18.91%. Since everything around is expensive AF, Baltic Stock Market finally sees larger inflows from foreign investors both through market purchases and merger and acquisitions. I expect OMXBBGI to close 2017 above +24%, if nothing particularly terrible in international markets will happen.

Good luck.

Leave A Reply