Aim

In this article I’ll try to make a case for cryptocurrencies via the criticism towards today’s faulty monetary system. Hopefully in part 2 I’ll cover how exactly cryptocurrencies might solve trust and societal problems that come with centralized power.

Growing interest in cryptocurrencies

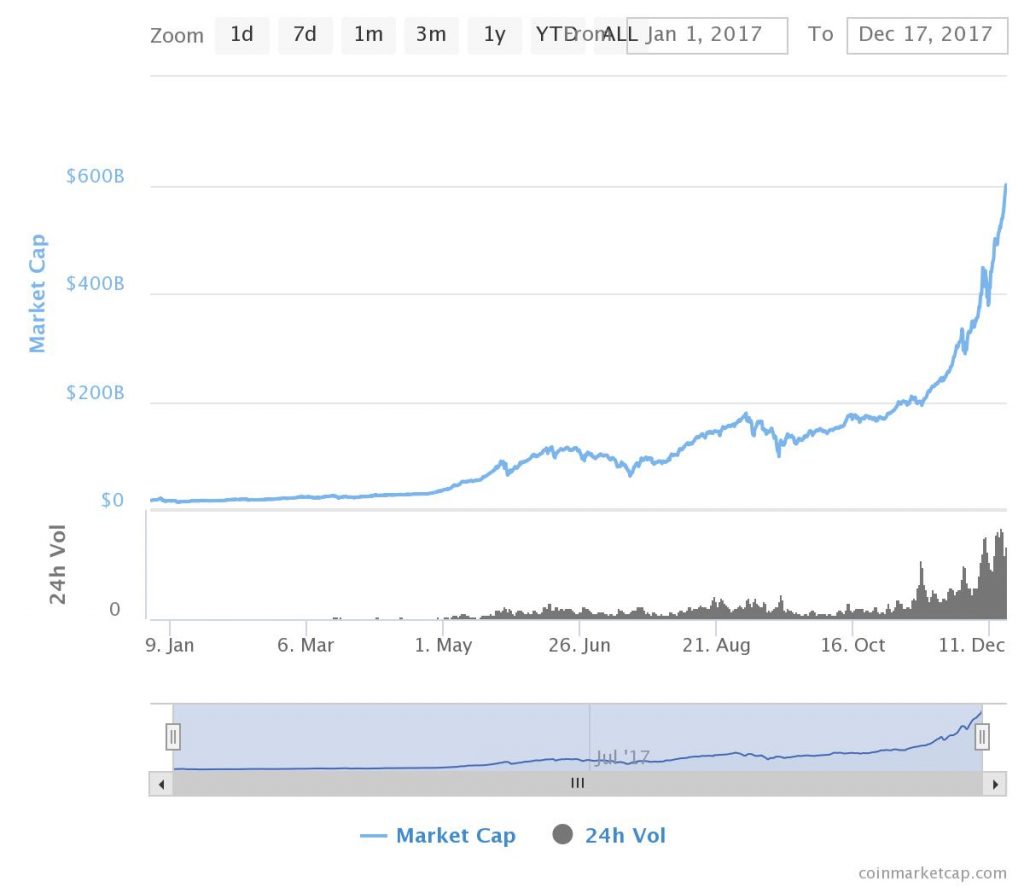

At this point, every person spending a reasonable amount of time online has probably heard of cryptocurrencies. Today (2017.12.17) total cryptocurrency market capitalization surpassed 600 billion dollars.

There are only three companies in the world exceeding 600 B market capitalization today: Microsoft, Alphabet and Apple. Personally I prefer to look at other metrics, as capitalization is a very subjective buzzword, that is often far from intrinsic value. This comparison was indented merely to put cryptocurrencies in context of real world economics and scale.

In, say, 2010 the few people that had heard of Bitcoin were most likely to say that it was some weird geek money at most. That starts to change. But I’ll try to refrain from digging into technological and speculative aspects today. Instead I want to point out issues in current monetary system, which cryptocurrencies might be able to solve in the future.

Grand theft

Inflation is taxation without legislation. – Milton Friedman

Nearly every government has debt. In fact, this monetary system relies on debt.

As Bill Mitchell explains in his 2011 interview for Harvard international Review:

There are some rare instances where governments have run down their overall stock of debt, like in Australia between 1996 and 2007. The conservative government of the period was enamored of this neoliberal idea that it would get rid of all its holdings of outstanding debt, and so it started running very large surpluses and paying back its debt. After about five years, the public bond markets became so thin—that is, there was such a small amount of debt left in the system—that the big investment banks started to protest, since they relied on government debt as a risk-free asset upon which to benchmark all other risk. Curiously, the Austrialian federal government agreed that even though it would continue to run budget surpluses, it would also continue to issue debt at a certain amount to ensure that the corporate sector would have its risk-free asset. So while the Wall Street Journal runs op-eds condemning the evils of debt, the reality is that the financial sector can’t get enough of it. This is a very beautiful example of the function of debt in modern times.

So governments have debt and nearly every first world citizen (I’m sorry I have to classify) has some capital. As the narrative goes, 2% inflation is healthy for the economy, so most governments aim their monetary policy to reach this target. Debt and bearing interests are easier to maintain, when inflation eats on the nominal value of debt. On the other hand, people get robbed without realizing with decreasing purchasing power of their money.

Most people have nothing to do with finance and put personal financial discipline aside. Some have basic understanding that money tends to loose value over time and purchases real estate. And only few dig into financial markets trying to beat inflation and have some reasonable capital gains.

Your money is not your money – Case for Cryptocurrencies

Central banks

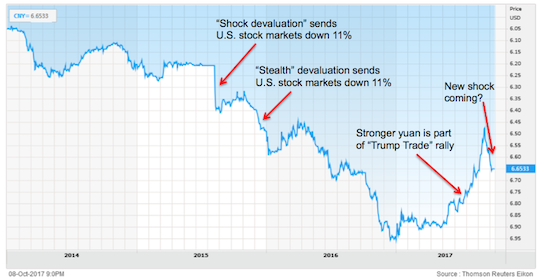

People in western world rarely get reminded of the fact their equity in fiat currencies is a property of central banks, that have issued currency in the first place. But say, hypothetically, one day ECB decides Euro and dependent European manufacturers are not sufficiently competitive anymore in global markets and devalue the currency 10%. We might not feel this effect, until we travel or transact outside of Eurozone, but this does not change a fact the value of currency by governing authorities can be reduced that easy. Though unrealistic in present day, we can not deny the possibility it might happening in the future. Especially having great examples from People’s Bank of China.

Unpredictable supply is another unsustainable feature of current monetary system. Ever increasing supply guarantees ever decreasing purchasing power and casual people are chasing a running target of financial freedom in a rigged game.

Government

We tend to underestimate the power of authorities until we have personal accounts. In the aftermath of global financial crisis, Cyprus government levied a one-time tax on bank deposits. Atlantic article reads:

“This tax will take 6.75 percent from insured deposits of €100,000 ($129,000) or less, and 9.9 percent from uninsured amounts above €100,000. Depositors will get bank stock equal to whatever they lose from the tax. If you’re wondering why anybody would keep their money in a Cypriot bank now, well, they wouldn’t. This is an open invitation for an old-fashioned run on their banks. The only reason that isn’t happening now is their banks are closed for an extended holiday.”

Article ends up with great reminder:

There’s nothing more destructive than giving people the idea that insured bank deposits are not so inviolable.

Let me remind you we have been talking about first world, democratic western nation. But there are far worse examples in the world. For instance grand seizure of land ownership in Zimbabwe in 2000.

Personal account

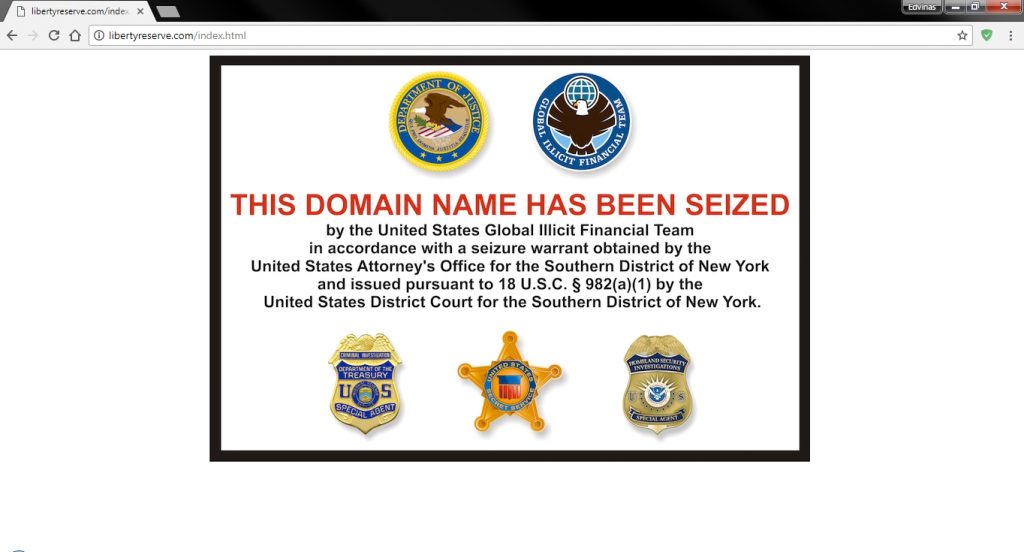

Back in 2012, when I was learning important lessons about money on high yielding internet projects I used Liberty Reserve as one of few payment processors. And one evening, instead of login page, I was greeted with this:

I was not doing anything illegal. Nor did other majority of users. Nevertheless I had around 700 USD locked away by US authorities without any explanation, warning etc.

Restricted (political) freedom

I have pointed out in past, that money is being transformed into data pretty fast. Adam Carroll did a perfect job of explaining societal and educational aspects of this shift. This isn’t new. Future kids will probably never touch tangible banknotes or coins. However teaching children personal finance isn’t today’s topic.

I believe we are less than a decade from digital only money. Cash will soon be obsolete. This carries a massive risk of personal freedom of expression for any vigilant citizen. Apparently supporting some journalists is illegal. I don’t want to get into argument about what Wikileaks publish and why they were cut off donations, but the bottom line is this: this is a direct attack on freedom of speech via power of centralized authority. When all transactions are online, surveillance and violation of privacy will be unavoidable side affects.

This year Wired magazine covered China’s Social Credit System, which should be in full action since 2020. I highly recommend you check it out. Some hints below:

For instance, people with low ratings will have slower internet speeds; restricted access to restaurants, nightclubs or golf courses; and the removal of the right to travel freely abroad with, I quote, “restrictive control on consumption within holiday areas or travel businesses”. Scores will influence a person’s rental applications, their ability to get insurance or a loan and even social-security benefits. Citizens with low scores will not be hired by certain employers and will be forbidden from obtaining some jobs, including in the civil service, journalism and legal fields, where of course you must be deemed trustworthy. Low-rating citizens will also be restricted when it comes to enrolling themselves or their children in high-paying private schools. I am not fabricating this list of punishments. It’s the reality Chinese citizens will face. As the government document states, the social credit system will “allow the trustworthy to roam everywhere under heaven while making it hard for the discredited to take a single step”.

It sure sounds like paranoid Orwellian dream, but damn, this is happening today.

Emerging alternatives

All these examples lay a perfect groundwork in the case for cryptocurrencies. And then, one day, back in 2009 someone named Satoshi Nakamoto, published his ideas on a different monetary system. Since then we started crawling for alternative world. The surge of cryptocurrencies supply as well as market capitalization is in my opinion an early call for change. Covering this invention and fundamental differences from the way we “do money” today requires a separate look. Stay tuned.

Comment

Uzjauciu… viskas crashino…