Position Details

Before 2019 year ended I have sold my Auga Group position at the average loss of -24.07%. After holding Auga equities for a little less that 1.5 years this constitutes CAGR of -17.21%.

Result is abysmal, what are the reasons?

Why Exit Auga Group Position

What I outlined in Auga Group SPO article presenting it as a potential investment idea mainly still holds, but on a far longer horizon than I initially thought.

Partly that is again my mistake of jumping around from decade-long thinking when I’m buried below learning to code, work projects to more speculative half-year vision when I’m more available.

Tax purposes

The primary reason to take the loss is that I need one for tax purposes. Out of positions, that have negative performance in portfolio and outlook a year ahead, Auga Group was the least painful to fix.

Bonds vs Equities

Auga Group recently attracted 20M through its 5-year green bond issue. It was mentioned of going through other bond issue traches up attracting up to 60 Million.

The base yield is 6%. Investors, that purchased more than 3M got even higher coupon yield. I expect, over the next year bondholders will outperform shareholders.

SPO financials

Agriculture sector took third consecutive difficult year (meteorological conditions) and fixing a loss is not the best time, I have to admit.

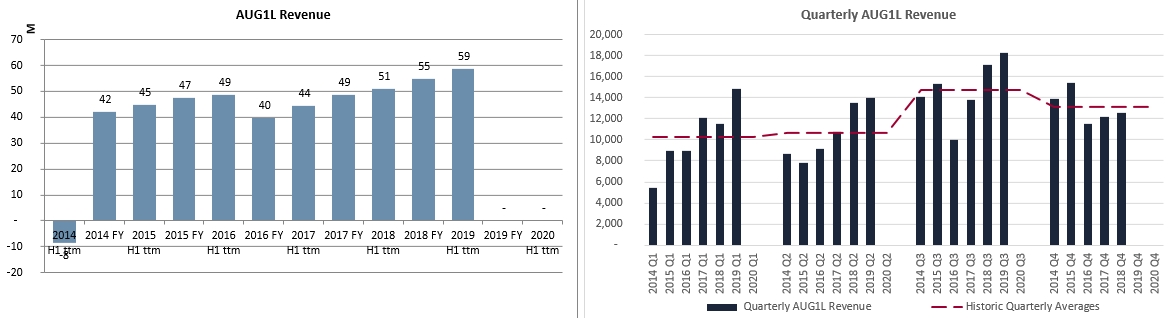

Company is successful in opening new export doors and raising revenues:

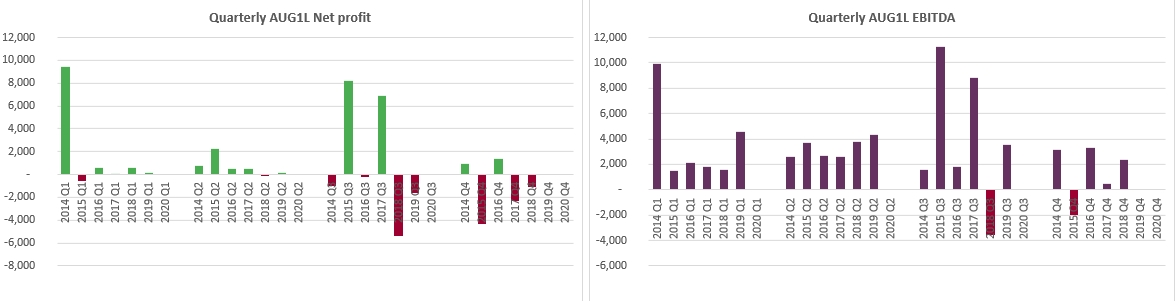

But profits are much more unstable. More so after the introduction of IFRS16 standard. Since Auga Group rents most of its cultivated land, this significantly impacts metrics – a reminder for current investors.

At 0.364 price, current financial ratios for Auga Group:

- 16.7 EV/EBITDA

- 0.9 P/tBV

- 1.28 Debt/Equity

- 8.68 Net Debt/EBITDA – auch.

I will watch the stock closely and look for re-entry when shareholder returns have brighter prospects.

Current Portfolio Structure

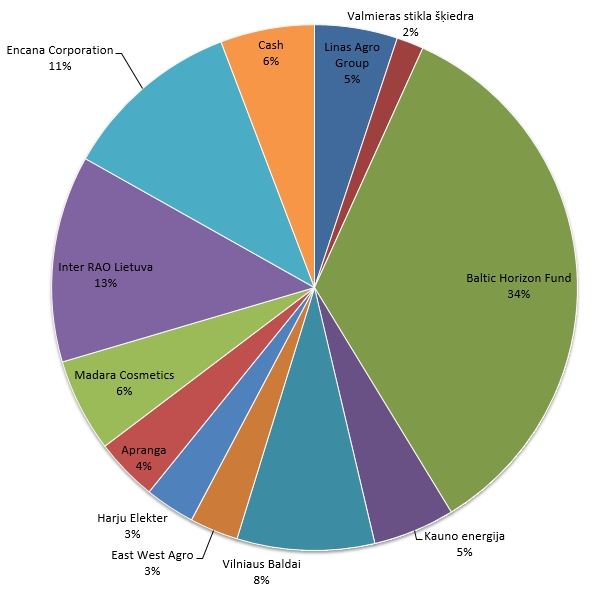

As of 2020.01.01 portfolio structure looks like this:

You can find all my portfolio actions explained here.

Leave A Reply