Recent Inter RAO Lietuva Stock Developments

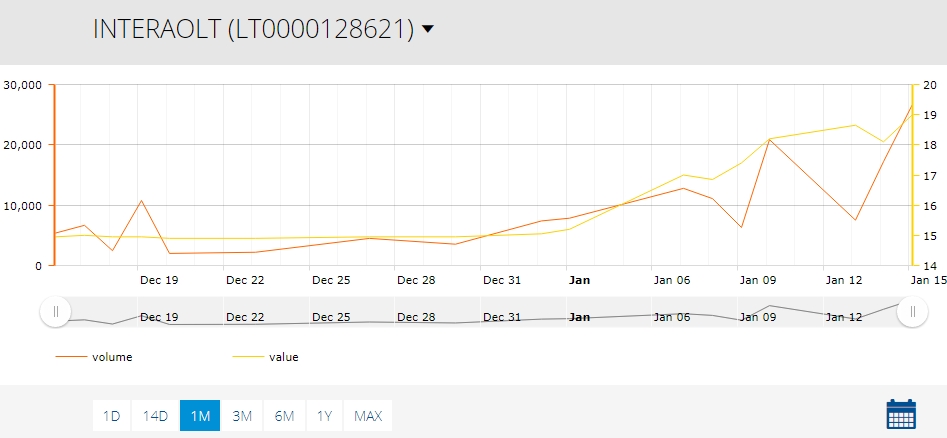

No new press releases were announced. Inter RAO Lietuva company’s Q4 report is due in around a month, but the stock price has rocketed last week with unusual volatility. I suspect more people have come to realize 20% dividend yield is very very realistic.

Price chart for recent month:

Position Result

My sell limit order above the market price got completed on monday at 18.6zl.

To remind, I re-entered Inter RAO Lietuva in the second half of September. Weighted average profit: +46.4%. CAGR for these less that 4 months of holding: +231.3%. One of the best trades in recent years. Currently stock is priced at 20zl.

According to Plan

As I mentioned before, such high dividend yield CAN NOT be unnoticed for a long time. The less time till payouts, the more interest is shown and the price is squeezed to top by increased demand.

At my averaged entry price of 12.82 zl, ttm dividend yield at a typical 100% payout stood at 28.8%. It was a matter of time before the price would start climbing uphill.

Mistake of Early Exit

As I mentioned in blogpost when I acquired a stake at Inter RAO Lietuva, I was targeting a 20-40% return. In my mind, I had a target of 30%. Recent stock rally has surpassed my target return too fast and left me confused. I don’t like this state.

I’m not accustomed to my portfolio positions rallying up to 50% in a matter of few months and I have broken fundamental rules of selling.

You shall only sell when:

- Sell quickly when a thesis is broken;

- Sell if you would not be buying today

These come from the article I recently shared on discovering a selling point. Ideally, I would have sold between unaudited annual report and ex-div date. That’s when full dividend potential in stock price would be priced in.

Expectations

I expect a strong annual result and stock price topping at 25-32 zl range before ex-dividend date. At current 20 zl price, dividend yield stands at 18.48%. Still way beyond any market average.

However, I will be watching from the bench. Good luck to current investors. Don’t get too euphoric. Stock still has geopolitical risks.

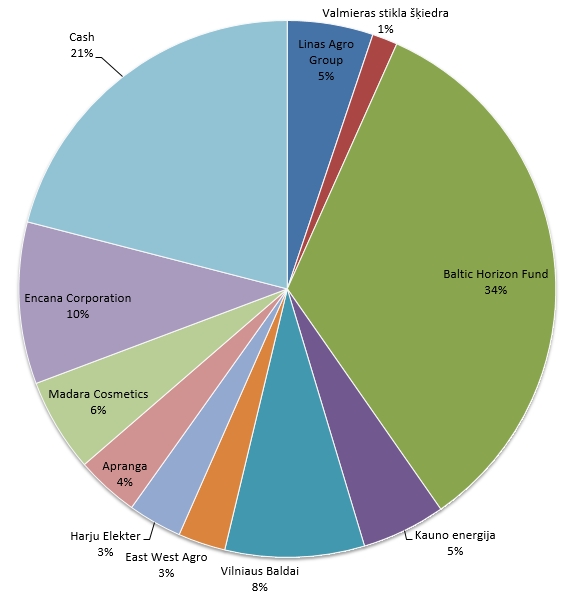

Current Portfolio Structure

At this evening’s last prices, positions’ value proportions:

You can find all my portfolio actions explained here.

Leave A Reply