Portfolio Updates

This is exceptional year for most, including for my portfolio. I had been selling and adding positions at higher pace than any year before. In the the process of quitting Orion broker, reorienting my portfolio to growth (there are exceptions) about which I’ll try to expand in January 2021.

Naturally I can not possibly craft a quality post explaining every change in portfolio, fortunately investing and writing is not everything I do. Lately I can honestly say I got tired of markets and news feed on companies, investment thesis, investing podcasts, webinars. I’m loosing a wider worldview in a process. I’ll try to recalibrate in upcoming months.

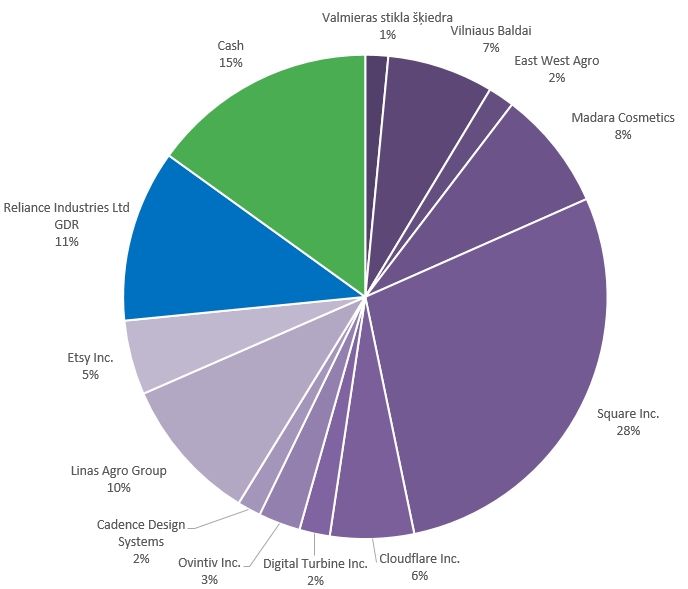

Ok, so onto latest position changes and resulting portfolio:

Reliance Industries Position

As a follow-up to post on Reliance. There’s no easy way to invest directly in companies listed in India. Swedbank suggested GDR listed on London Stock Exchange under ticker RIGD. Each GDR represents rights to 2 ordinary shares of Reliance Industries, denominated in US Dollars.

Staying away from rupee directly is both easier and safer for foreign investor. When reading on Reliance, you might have asked yourself why not stay off legacy business and gain partial exposure with Facebook and likely soon – Amazon, with 10-20% stakes in highest growth businesses – Jio Platforms and Reliance Retail.

I’m concerned, Big Tech will get a punch in the face quite soon. Also diversifying a bit away from US market.

Two Friday’s in a row I have added Reliance, first at 60.2 USD, and this Friday at 57.3 USD. Reliance now has ~11% weight in portfolio. I would gladly increase position at better prices after US election dust settles.

Adding Etsy

In case you missed arguments on entering this ecommerce platform, here’s a quick twitter thread:

Market dipped and on October 22 I increased position ~60% at 134.8 USD to a total current weight of 5% in portfolio. I may be increasing position in between Q3 and Q4 earnings.

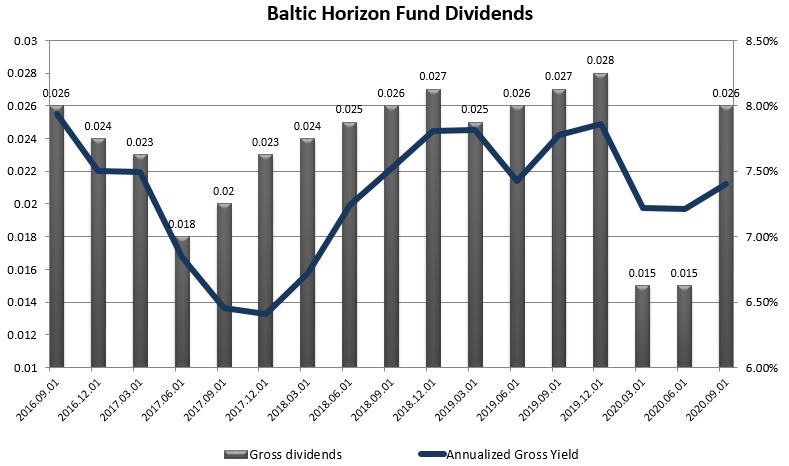

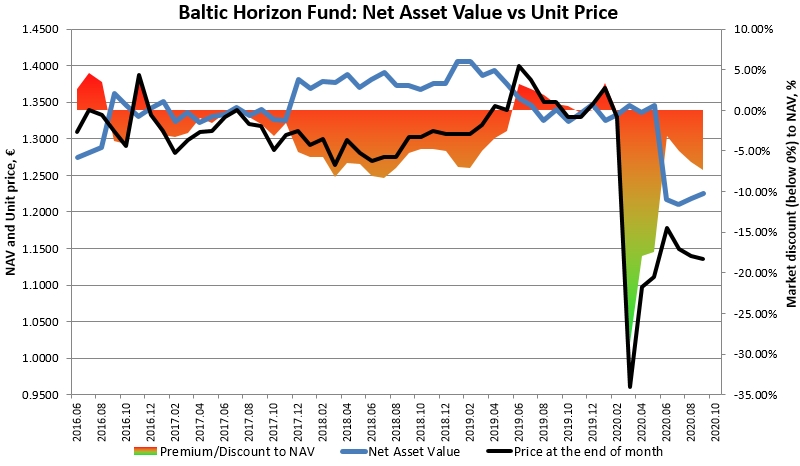

Complete Sale of Baltic Horizon

A while I was a huge fan of this REIT, what I did not evaluate writing thesis on the fund was a pandemic. I blame my self for ineffectiveness during pandemic, because the wave from China to Italy, to north was clearly visible. I had expected a more positive market reaction to proposed 0.026€ dividend distribution. Lack of market optimism reinforces my conviction fund is no longer as attractive as it has one been.

Under FIFO principles remainder position was sold this week, post-dividend announcement at 1.148€, including dividend that’s -0.7% loss or -2.7% CAGR.

I have purchased and sold BHF in lots of batches in the past. This year I have both migrating BHF units between brokers and decreasing position, which at one point had 30%+ weight in portfolio. Previous reductions in BHF have been (incl. dividends) both profitable and losing. Maximum loss I took from BHF was in end of September at -9.7%

All the best to current unitholders, I just continually get bombarded with investment ideas, that honestly seem far more lucrative than REITs.

Change in Business Landscape

Real Estate business had a shock and in my opinion trends towards e-commerce (retail sector) and remote work (data is pre-covid and US based, but trends transfer to Baltics with a delay) have been firmly established, which over time has and will continue to put pressure on pricing power from RE owner perspective.

ECB has fed the market with money, local governments have also introduced reliefs for retailers, but what I have learned from e.g. Apranga Group CEO interview to media outlets, that they will be very aggressive towards renegotiating their RE rental agreement terms. Which brings me to rental income.

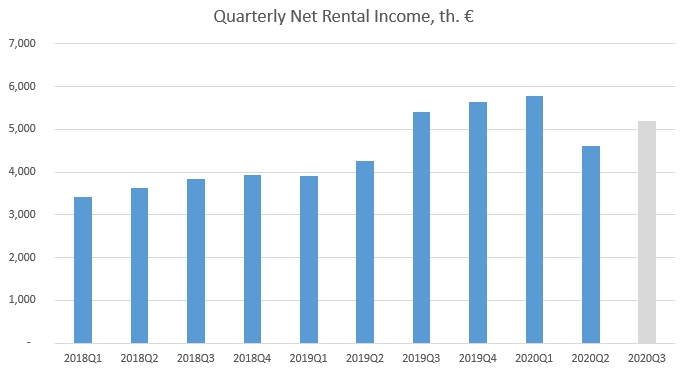

Rental Income Dynamics

Ever expanding fund, with a dream of managing a billion-worth assets. Rental income has been growing mainly due to acquisitions. Covid has almost no effect on Q1. Various forms of quarantine in Baltic states were introduced in middle of March. In Q2 fund had -20% less rental income than in 2020 Q1. I expect Q3 result to be somewhere between Q1 and Q2 around 5.2 Million EUR.

Bad Diluting & Communication

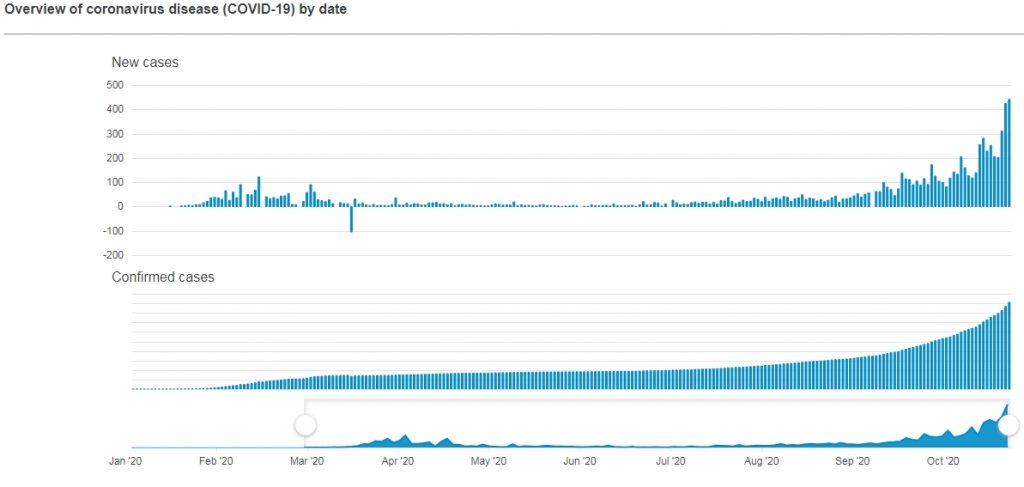

Timing. Why raise capital now? This is Lithuania:

There’s a non-zero chance new quarantine in some form will be introduced this autumn/winter, which would weight heavily on fund’s operations. On one hand I understand opportunities may open up during times like these to acquire something in distressed situation, but I was not convinced neither by SPO announcement, nor webinar presentation that fund has particular acquisition in mind.

Most of previous offerings were at NAV price, which was below market price and current unitholders were getting a cheaper capital. What this offering did (raised ~20% of planned upper bound) was a value destruction for current unitholders.

Looks like treading water to me, that’s just personal opinion.

Fund targets 7-8% dividend. It can sustain this ever-beautiful goal by destroying Net Asset Value, Unit Price and nominal dividends – which is what has been happening past half-year.

In recent webinar Tarmo invited investors to increase their BHF position during SPO proportional to current holding % in Fund to avoid dilution. (!?) How about addressing positions of current unitholders?

At one time fund has been buying back units on the market, so close the gap between NAV and unit price. Question to ponder for current unitholders: why fund doesn’t do buybacks now, trading at -7% discount to NAV?

2 Comments

Interesting reviews. Surely you looking into a growth stock investments, I would propose you to look into tool called delta tool, where more clearer picture of valuation of growth stocks shows up and if you do, would gladly read it in your blog Good luck!

Thanks; will take a look!