Litgrid Company Profile

Litgrid is a Lithuanian national electricity transmission system operator. Put simply: buys wholesale electricity in NordPool, collects percentage allowed by regulator, sells to distributor ESO.

Price performance over the years in secondary list of Nasdaq Baltic:

One more liquidity star, that I will try to ride.

Litgrid Financial Performance

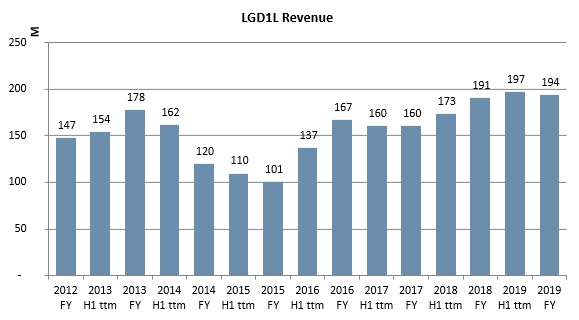

In one word – terrible. At that’s what the price chart above represents. Revenues have been fluctuating on energy demand and selling tariff set by regulator:

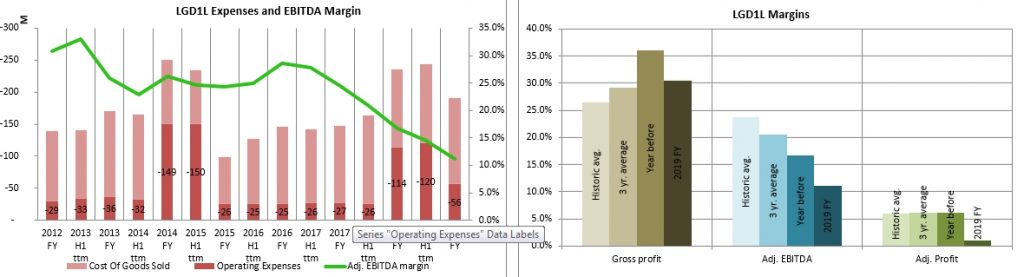

Margins have been squeezed next to nothing in recent years:

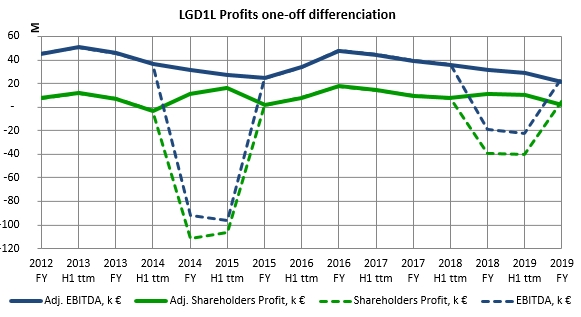

And occasionally Litgrid management reevaluates scrap metal it operates, which further weighs on bottom line (2018 FY -51 M loss from revaluation; 2014 FY EUR -123 M).

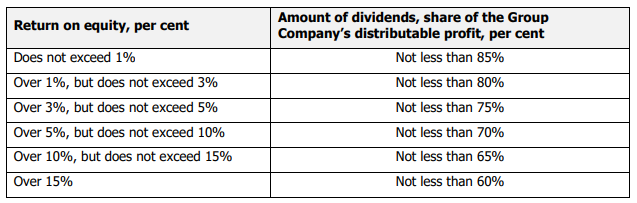

Dividend policy exists and is tied to ROE, however… yield has been around or even below 1% in recent years.

So… where’s the catch?

Investment Thesis or Reasons for Entry

Ins – what is allowed to earn

The approved electricity transmission average price from 1st January 2020 is 0.814 ct/kWh, system services price – 0.785 ct/kWh.

From company announcement in October 31, 2019

And a year before:

The approved average electricity transmission rate as of 1st January 2019 is 0,658 ct/kWh, system services rate – 0,615 ct/kWh.

Announcement in October 26, 2018

That is +23.7% and +27.6% increase accordingly. Adjustments have been made to electricity distributor ESO, but not yet, and perhaps won’t be any for the rest of 2020 for operator Litgrid.

Outs – what company spends on

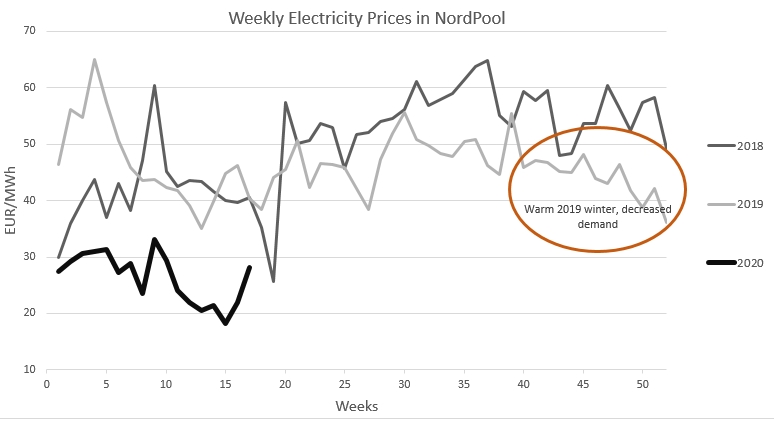

Electricity purchased in NordPool is the sole cost of goods sold. And dynamic of electricity price are as follows amid Corona triggered crisis:

2020 Q1 COGS will be significantly lower than that of 2019 or 2018 for that matter.

Yes, electricity demand drop, but these positive margin scissors will have much higher effect in my opinion and I don’t think the market is putting this together. And those that do – can’t enter due to liquidity.

Or, of course possibly I don’t know the delicacies of electricity trade…

Litgrid Position

One of the stocks that did not recover nearly at all from the bottom formed across all markets and majority of equities recently is Litgrid. After tracking the stock for several months I finally formed my position this week in the price range below 0.54 EUR.

By the way, this is not the first time I am ambiguous about the date or exact price of purchase. Blame the market illiquidity, folks.

Targeting 10-15% return in under half year according to market sentiment. Waiting for dividends is worthless, as Litgrid has massive investments planned up to 2025.

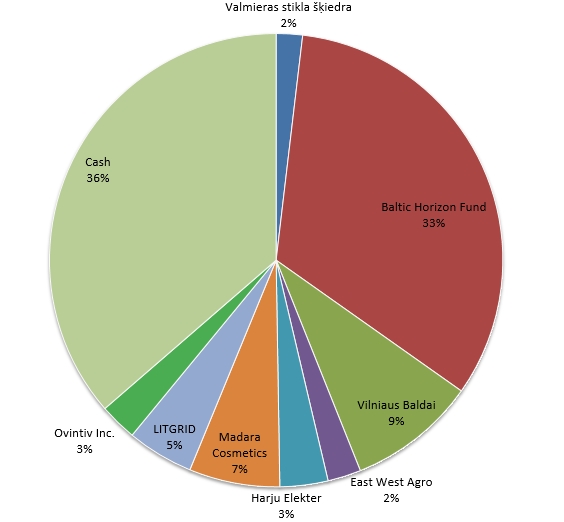

Current Portfolio Structure

Based on Fridays closing prices, equities in portfolio:

This is not a financial advice. Read my poorly written disclaimer.

Leave A Reply