This week, as discussed previously, I managed to spin around some of Baltic Horizon units around. In the end of last post I also alluded, I was looking at Inter RAO Lietuva and this week I made the call.

Inter RAO Lietuva

AB Inter RAO Lietuva is an independent electricity supplier. Stock is traded in Warsaw Stock Exchange. Utilities is a safer haven when times are less certain, right? I’ll expand on this later. Let’s check the financials first.

Brief Financial Analysis

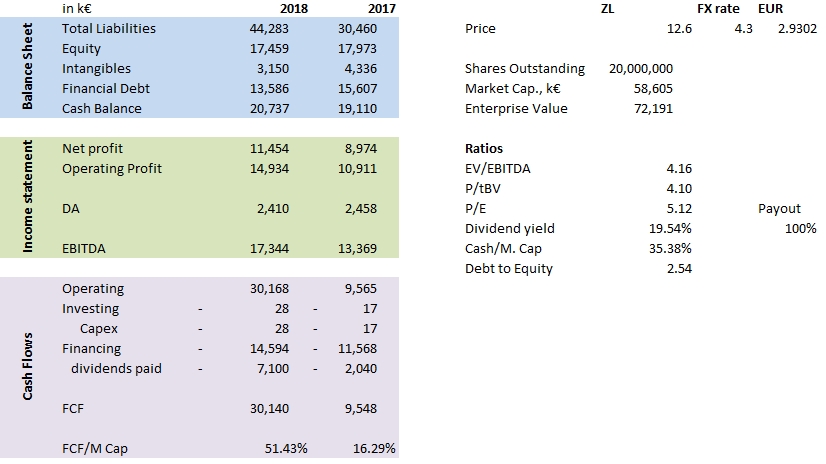

Annual audited report is here, if you want to take a look yourself. General meeting of shareholder’s is about to be announced soon. Wednesday evening I wanted to get a clearer picture what was behind some of the numbers, and so I derived at this sketchy sheet:

Some comments:

- Debt to Equity level is above what I like to see in companies, however interest bearing debt is 1/3 of total liabilities;

- 2017 dividends as seen in Cash Flows statement (-2040 k€) is the amount paid to free float shareholders. Distribution for 2016 FY was in fact 10.2M € and were accounted as loans payable to major shareholders;

- For 1 € shareholder currently gets 0.354€ in cash and cash equivalents (high cash accumulation);

- Healthy cash flows for 2018 FY provide an opportunity to pay even 50% reaching yield;

- At 100% payout, current estimated dividend yield stands at 19.5% (minimum as declared in dividend policy – 70% payout would constitute 13.7% dividend yield).

- Price to tangible book value is considerably high (4.1);

- Other valuation metrics are really attractive: EV/EBITDA: 4.16; P/E: 5.1.

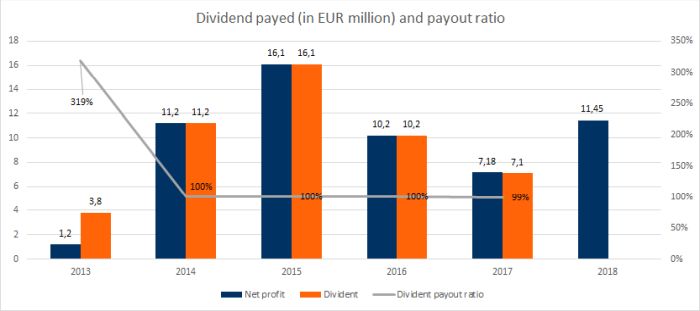

Inter RAO Lietuva Dividends

Company has solid payouts and throughout the years have proved itself to be a consistent dividend payer. Dividend policy states at least 70% shall be allocated to dividends, while in reality for the last 5 years company paid all annual net profit.

So where’s the catch? Why the stock is so cheap? What are the risks around Inter RAO Lietuva?

Management comments on 2018 financial results

Giedrius Balčiūnas, CEO of Inter RAO Lietuva commented 2018 performance:

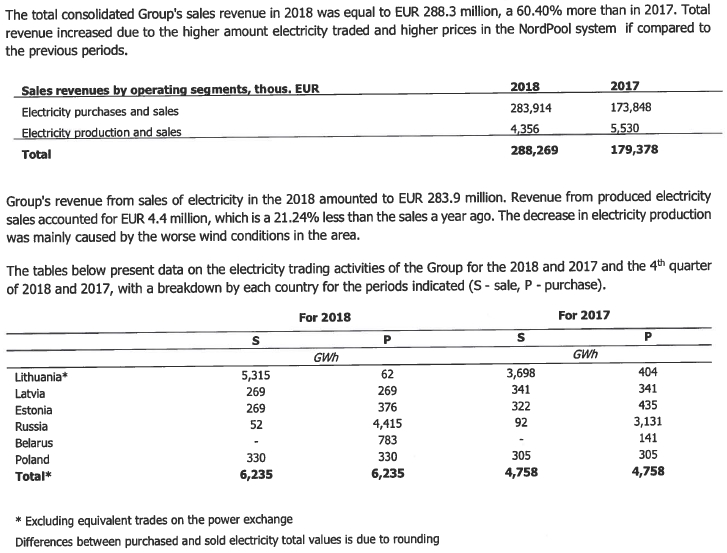

The year 2018 was challenging for all market participants. Due to a number of unexpected factors average prices in the NordPool system increased by 40 percent y/y in 2018. Despite this increase, the INTER RAO Lietuva Group fulfilled all its contractual obligations and delivered electricity to its clients at prices agreed upon in the contracts. The Group managed to balance its trading activity and deliver the best possible results in this challenging market situation. The electricity sales volume increased by 30 percent and the net profit reached EUR 11.5 million. The Group’s gross profit margin stood at 7.9 percent and the net profit margin amounted to nearly 4%. The Group generated a net profit of EUR 0.57 per share.

More financial figures and complete announcement here.

Inter RAO Lietuva Risks

Politics in Electricity Market

Ah the energy… Broad topic, indeed. Since the electricity market liberalization in Baltic States companies like Inter RAO Lietuva could compete with domestic, usually state-owned enterprises and have a business of it’s own. For years this model was sound and good money was made. As we seen before, it still does make good money, however the surrounding sentiment has changed dramatically.

Inter RAO Lietuva is 51% owned by Russian based parent company INTER RAO UES. It buys energy from Kaliningrad, where it is produced at lower prices using cheap Russian gas. Company has it’s own wind farm in Vydmantai, Lithuanian west, however own production only has a marginal portion of electricity sold by Inter RAO Lietuva.

Here is the excerpt from annual report:

Estonian government clearly does not like to compete with cheaper third party electricity, since Estonia has shale gas and renewable energy power production facilities. Last year, under Estonia’s initiative import tariffs for electricity from third countries were proposed. Lithuania’s position most of the times is to bite the big neighbor, plus it would lay the better ground work for blocking electricity from Astravyets Nuclear Power Plant (Belarus). Latvia is lagging at this point. Last year it elected pro-russian parliament and I suspect this will delay common position of Baltic States. More on tariffs in this article.

Power Grid Context

The Baltic grids are still part of the post-Soviet BRELL ring, which also includes Russia and Belarus, and remain dependent on the control center in Moscow and the Russian electricity system. The Baltic states want to synchronize their power system with that of continental Europe via the existing Lithuanian-Polish power link, LitPol Link, and a new submarine cable “Nordbalt” between the two countries by 2025.

Naturally these pose a high risk to Inter RAO Lietuva future activities. I intend to visit general meeting of shareholders and perhaps will ask how management will counter the upcoming obvious challenges.

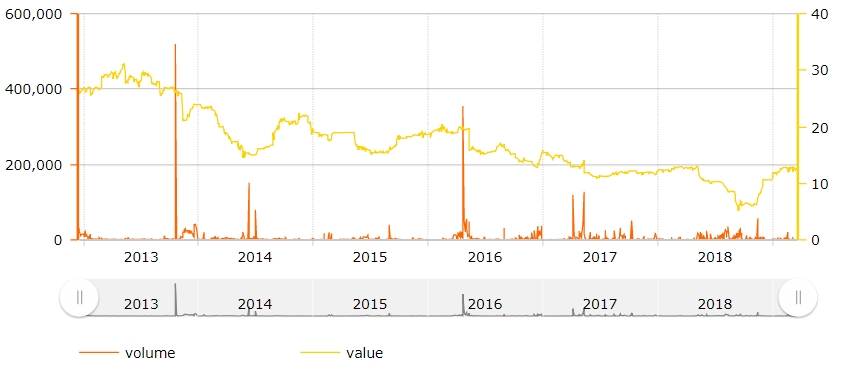

Price Performance

Last year share price tested the record lows at around 6 zl, while currently trades at ~12.55 zl at the time of writing.

I saw that dip, however I was too detached from markets during those weeks. I suspect the decline was initiated by arrest of former executive on the charges of espionage. More on this story.

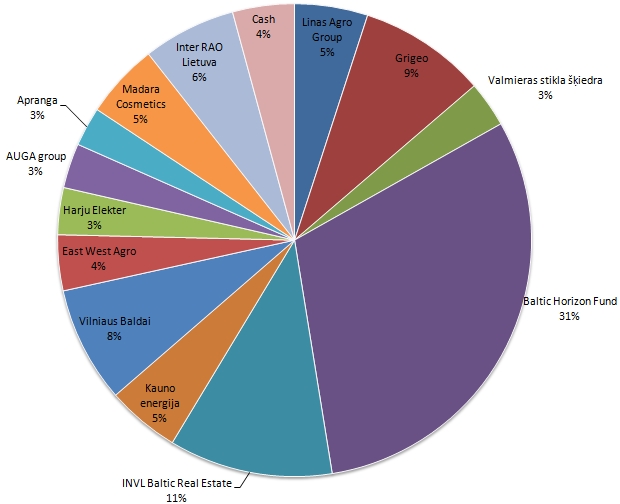

Updated Portfolio Structure

I consider this position as highly risky, market obviously thinks the same. However I don’t think the company would collapse in the near future. Target time: <6 months. Target profit: 10-20%.

Updated portfolio pie chart at Friday’s prices:

This is not a financial advise. Read my poorly written disclaimer. Recent portfolio changes here.

Leave A Reply