Commitment is a pain in the ass. Definitely so. Although in November I did my month long experiment without internet I still kept one eye on markets in work. Since I had my login details I had full access to making moves in portfolio and I made some.

Selling Latvijas Gaze

In 2013-2015 I was witnessing the changes in Lithuanian utilities companies before, during and after the implementation of III Energy Package which basically said distribution and transmission activities must be separated. As a result of this, major player in Baltics (first Estonia, then Lithuania and eventually Latvia) – Gazprom must sell it’s holdings and exit the market. Looking at what and how it happened in Lithuania buying Latvijas Gaze (ticker: GZE1R) was a no-brainer, really.

I entered GZE1R in two rounds. 2014, and doubling initial share count a year later. Following FIFO principle I took a profit from 2014 bought portion in late June of 2017. Below you can see the entry and exit of second batch.

Including generous dividends, which were always above (net) 7% for GZE1R. I took +35.7% profit or 15.57% CAGR.

Why sell Latvijas Gaze?

Well, you must see that dip in 2016 September. That’s when it was thought the split between Conexus Baltic Grid and Latvijas Gaze assets and underlying businesses should have happened. However this was postponed multiple times. (Gazprom might be having better friends at Latvia, I don’t know). Conexus is unlisted, but I continue to be a shareholder of that split piece, which will eventually continue transmission business of natural gas in Latvia. I expect 2-5% of overall position in GZE1R to be added to profits in the future.

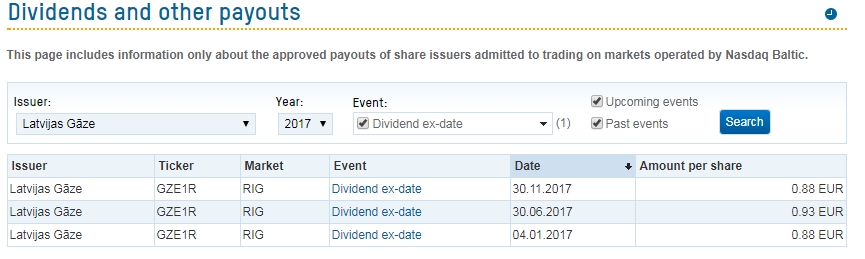

In past years Latvijas Gaze been distributing its retained earnings left and right. In 2017 it paid dividends 3 times, which is really uncommon in Baltic Market. Each averaging at 8.5% net yield.

When I last checked reports of Latvijas Gaze (2017 Q2 13page), retained earnings stood at 51,6M Euros. But this does not resemble dividends of 0,93 Euros/share paid just after reporting period ended. 2017 GZE1R dividends:

Then they took this 35M loan, which was used to cover dividends, rather than investments…

Anyway I did participate in the last dividend distribution and took advantage of high price tag to take profits home. Split of assets is inevitable, Latvijas Gaze will be left with inferior (as claimed by investment professionals) part of the business (distribution) and I definitely did not expect price to hold above 9,5 after last ex-div date. But… Baltic Markets are a wonderland. Fundamental valuations remain attractive, but with few asterisks:

- retained earnings of 2017 H1 do not show 35M paid few weeks(?) later after reporting period ended;

- balance sheet is continuously being drained, decreasing attractiveness from valuation side;

- asset split will eventually happen.

Damn, no wonder I’ve been postponing this tirade.

Selling ESO1L

After joining companies of Lesto and Lietuvos Dujos (main players on distribution of electricity and natural gas) in Lithuania we sure could have expected significant increases in profit margins. However electricity and natural gas distribution prices are determined by National Commission for Energy Control and Prices and I would say I am actually late to sell ESO1L. I knew tariffs because of higher profits from prior periods will be cut (hooray for consumers), and this could have been predicted, only I did not have enough attention span. Gains from merger is slowing down, and tariffs for upcoming periods will be squeezing revenue and profits.

Nonetheless I still came out from ESO1L position with +18,2% profit, or +7.9% CAGR (first buy before merger July 2015).

Selling General Electric

In late 2014 I was looking outside of Nasdaq OMX Baltic Market with around 20% portfolio at the time to purchase something conservative, which would grant steady dividend flow. After looking at ETF’s, I decided to go with General Electric, which looked damn sexy in that channel:

In 2016 I waiting the price to bump into channel resistance. Greed ate my hopes. Oil crashed, fundamental picture changed, balance sheet got worse and GE eventually broke resistance line. I was full aware of how ignorant I was about this position. I took some more lessons and in December 2017 sold all GE with a net loss of -15.6% (including Forex rates and dividends), or at CARG of -5.22%.

Full picture of position from entry to exit:

Adding INVL Baltic Real Estate (INR1L)

I have more than tripled INR1L position at 0.475, which now accounts for 8,2% of “traditional” portfolio. This somewhat close to REIT company operates in Real Estate development and rental business. Trades at a -3.5% discount to NAV. Has conservative dividend policy and is known to make bargain deals in the market, which adds investor’s additional value.

General meeting of shareholders has decided to increase the nominal value of share and decrease share count. I expect some turmoil in the market, which may offer some reasonable gains in short term. If that won’t fly, staying long on this isn’t a bad deal as well.

Retrospect on previous calls

Last time I updated portfolio, or made a 2017 Q3 review on Baltic market I made few market calls. Let’s see how everything went.

SAF Tehnika

This was indeed a great deal after all. SAF1R topped at 7.92€ before going ex-dividend, and even taking profits on ex-dividend day there few days to take profits above 7€ (reminder: gross dividends were 0.67€/share).

At 6.45€ it’s a net 8.8% yield). First December days were very busy, although I saw the market. Decided to stick with the shares and look at 2017-2018 H1 (Q1 revenues up, profit slightly down due to EUR/USD). Company moves into IoT and management seems optimistic.

AUGA Group

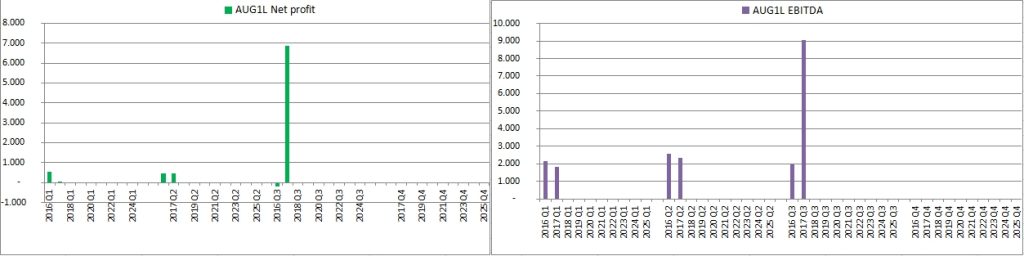

Company changed it’s ticker from AVG1L to AUG1L. 2017 Q3 report blew investors hats off.

This was a one-off revaluation of property which resulted in x9 profit compared to previous periods. This stock seemed overvalued to me at 0.5, today it closed at 0.625 at the chart looks like this:

AUGA gains reputation and seems to be favored by analysts. I know the organic harvest will show at full in 2018 Q3-Q4, but I did not expect the market to react and prepare that fast. I would like to believe it’s not a dumb money looking at one off profits. Congrats to holders, anyway. I’m enjoying the view.

Disappointment on Vilniaus Baldai dividends

This was a total miss on my behalf. VBL1L announced it would pay 0.27€/share (same as the year before), which is around 1.7% net dividend yield. Nonetheless I’m staying for the better picture in fundamentals. 2017-2018 FY Q1 looks great and market keeps the price in the same level. Revenues for Q1 are up +9.9%, Net profit +66%, EBITDA +54% and poor dividends contribute to stronger balance sheet. How conveniently biased.

Leave A Reply