They wash out Olympic Entertainment Group out of the market

Prior to public announcement by OEG1T on voluntary takeover bid, we saw an increased trading volume which suggests the information was available to some parties earlier. Anyway, we have what we have – shareholders of one of the main flagman’s in Baltic stock exchange – Olympic Entertainment Group are selling their business and are exiting the stock exchange.

Price of take over: 1.90 €. At this price, company’s ratios are:

- 5 EV/EBITDA;

- 3.24 P/tBV;

- 9.59 P/E;

- 0.171 Debt/Equity, while 0 financial debt and

- 0.385 cash per share in their nice looking balance (12.5% FCF/Market Cap)

A lot of small investors, me included, got pretty pissed at the price offer. After the initial announcement I planned to liquidate half of the position and “see what happens” with the rest. But after reading a commentary by V. Plunksis and realizing what the consequences of that might look like I just took out my money and left Olympic Entertainment Group ticker for good. Not even mentioning I’ll have a helluva busy rest of April.

My entries to OEG1T (FIFO principle) were at 2015.12; 2016.05 and 2016.06 with average price of around 1.86 €. Including dividends, these positions earned +16.71%, +9.46% and +10.03% or looking through CAGR: +6.89%; +4.86% and +5.48% correspondingly.

Not the best entry points, to be honest. Modest return, brilliant company, great pity.

Adding more Baltic Horizon Fund

Honestly, I’m not currently fully comfortable with the Baltic Horizon fund portion in portfolio. But the market sometimes opens up opportunities which are too beautiful to miss out.

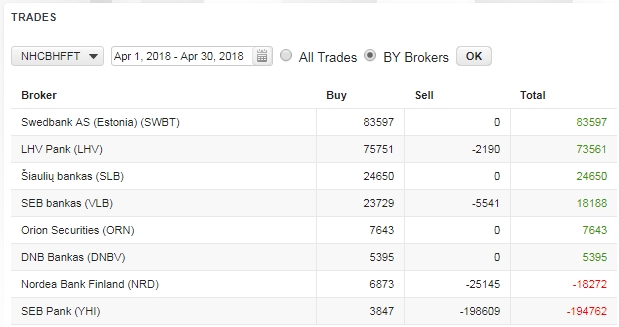

Estonian SEB seems to be reducing or even exiting the position and push the price down.

2017 Funds audited report says on 2017.12.31 SEB owned 4,766,470 fund units. And I hope they are not about to sell them all. Because in my estimation they sold only a small portion of this stake.

On a positive note:

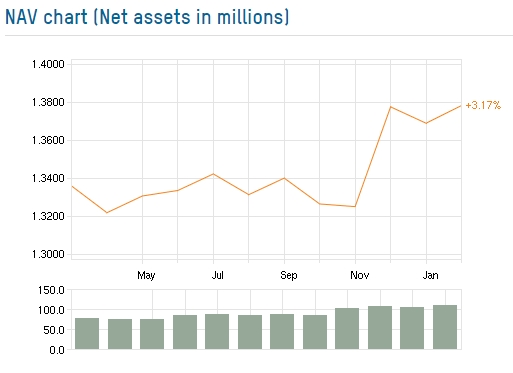

- Fund currently trades at 10% discount to its Net Asset Value:

- Among the Buyers we see LHV Bank, they usually know what they are doing;

- A quick public commentary reveals they will focus on efficiency of current holdings rather than new acquisitions as they see prices are somewhat high right now, which is a fine message to hear when you buy for dividends.

Past call: promising Grigeo dividends

Last time I wrote on portfolio update I pointed out the high free cash flow to market cap ratio for Grigeo (GRG1L).

Indeed that proved to be the case. While last year GRG1L paid out gross 0.04 €/share dividends, for 2017 management suggests to pay 0.06 €/share. Or x1.5 the year before. A timely supplement of GRG1L shares.

As for my GRG1L position: I want to see 2018 Q1 and H1 reports before moving any shares, as mentioned previously, Grigeo’s ratios look attractive and management seems optimistic on year 2018 as well.

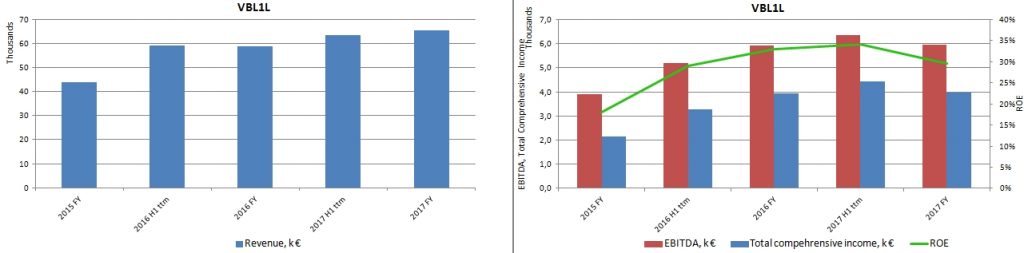

Disappointing result of Vilniaus baldai 2017-2018 FY H1

While revenues were still up, company failed on the bottom line and trailing 12 month result looks like this:

I haven’t yet paid enough attention and somewhat knowing my self I know I won’t. Will see in FY 9 months report if there are reasons to worry. In portfolio VBL1L position sits at -7.7%.

Trailing ratios at 12.2€:

- 8.85 EV/EBITDA;

- 3.19 P/tBV;

- 11.9 P/E;

- 1.04 Debt/Equity;

- 7.42% FCF/Market Cap.

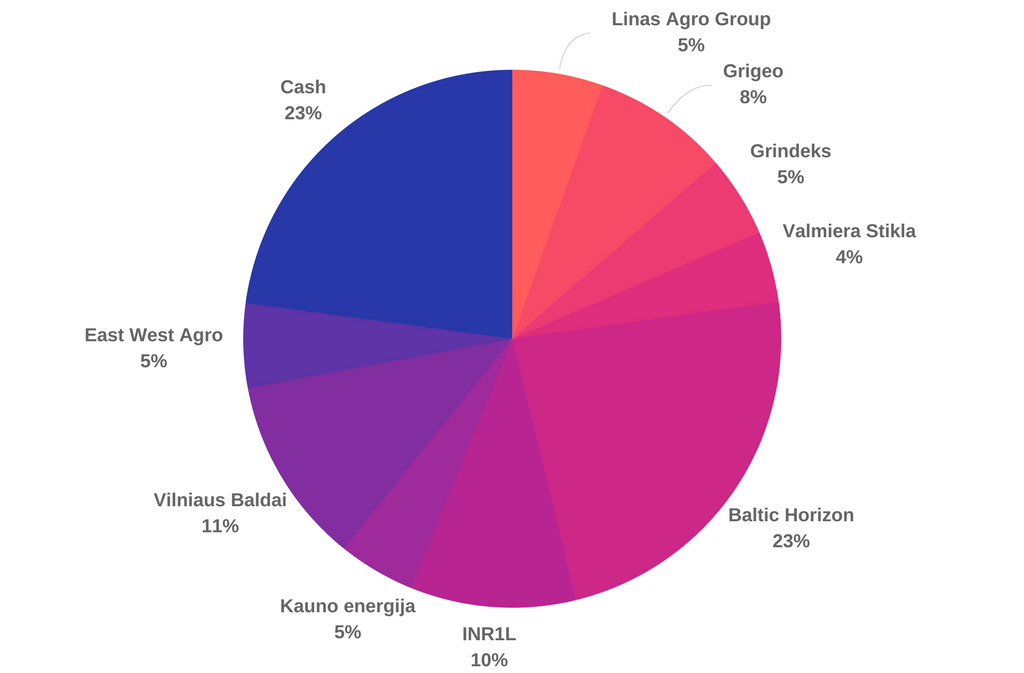

Current portfolio composition

As of 2018.04.08 with Friday’s prices my Baltic market portfolio structure looks like this:

Comment

Och camon, Vilniaus baldus reikejo parduot po 15…