Hey there. Just a quick portfolio update.

INVL Baltic Real Estate Position

I first acquired Baltic Real Estate in 2016 August, then another time in the end of 2017 before the share capital changes took place back in 2017 April. My last purchase was in 2018 March.

Now the price roams around 2.58-2.6, where this week I took the trailing profits from INVL Real Baltic Estate. From first purchases prior to share capital changes and averaged purchase date, CAGR amounts to +9.6% or +25.18% including dividend.

Calculating from the last purchase, CAGR stands at +12.87% and a total return of +20.73%.

Reasons behind the sale

There’s nothing wrong with the operation and performance of INVL Baltic Real Estate. Except maybe for reporting. Company belongs to parent Invalda, which is a asset management company, and all of the subsidiaries do not report quarterly data, but instead provide investors with infographics. What a ducking joke. Always wanted to mock this publicly, excusez moi.

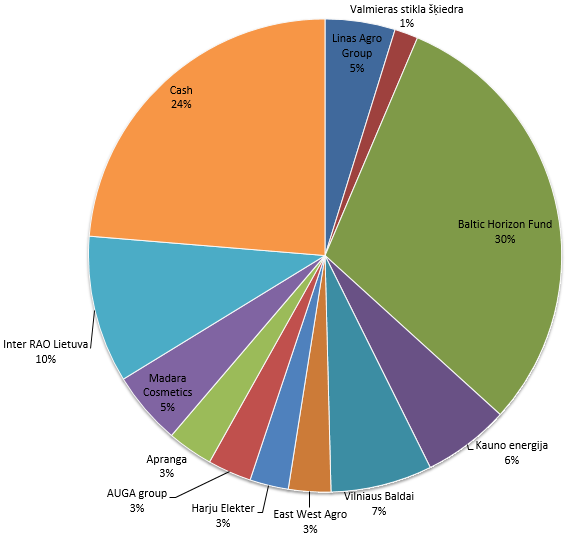

There is more uncertainty then there was few years ago, and after recent entry to Inter RAO Lietuva:

- I don’t feel comfortable with cash level in portfolio;

- There are higher liquidity AND higher dividend yield alternatives

even though INVL Baltic Real Estate has a higher discount compared to Assets Net Asset Value.

There are quite a few positions at loss in my portfolio, but time has not come for them yet, and INR1L has been touching skies as of lately and seemed like a good target to convert it to cash.

Few Words on Financials of INVL Baltic Real Estate

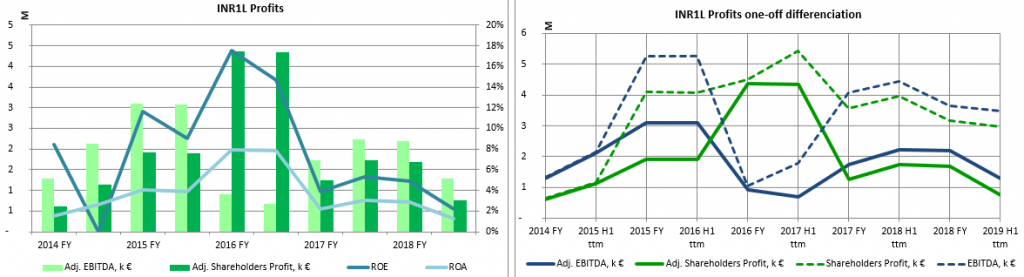

Another thing that really frustrates me looking at Invalda Group’s Reports is constant value adjustments.

Recent drop in profits are related to renovation works according to managing director Vytautas Bakšinskas.

The real estate investment company INVL Baltic Real Estate’s consolidated net profit for the first half of this year was EUR 1.7 million and compared to the same period last year decreased 10.5%. The company’s consolidated equity at the end of June was EUR 35.3 million, while equity per share was EUR 2.685 and compared to the end of June 2018 increased 8.7% (also taking dividend payments into account).

INVL Baltic Real Estate’s consolidated net operating income from its properties in the first half of 2019 was EUR 0.8 million, or 52.6% less compared to the same period last year. Consolidated revenue totalled EUR 3.0 million, or 1.9% more than in the first half last year. Of that, consolidated leasing income from its properties increased 2.9% to EUR 2.32 million.

“Our aim is to continue efficient management of the company’s assets. Since the beginning of the year we have concluded new lease agreements and announced the implementation of a new project in the Old Town of Vilnius – plans to open the first Talent Garden Vilnius co-working space in the Lithuanian capital by the end of this year. We believe that this space will not only become an attractive place for work, meetings and new ideas, but will also enable the effective use of the assets managed by the company, thus creating value for those who invest in INVL Baltic Real Estate too,“ says Vytautas Bakšinskas, the real estate fund manager at INVL Asset Management, which manages INVL Baltic Real Estate.

One correction though, if we eliminate value adjustments, net profit for 2019 H1 yoy fell from 1058 k to 131 k EUR, or -88%.

At this point I can not tell if 2 year dividends of EUR 0.13 is guaranteed for next AGM (refer to dividend policy).

Current Portfolio Composition

Current annual returns exceed un-taxed limits and I will probably take some losses later in the year as well, but for now, updated portfolio structure looks like this:

You can find all my portfolio actions explained here.

Leave A Reply