Initial Spark – Facebook Acquisition

In the midst of COVID19 Pandemic (2020 April 22 to be exact) Facebook announced it had purchased 9.99% minority stake in Jio Platforms – digital arm of Indian conglomerate Reliance Industries. I’m not a fan of Facebook, it’s policies, Mark’s personality, but still I have to admit, Mark Zuckerberg is an excellent capital allocator and from April Reliance Industries was put on my learning – watch list of companies.

What’s Reliance Industries?

Resource List

I could not ever top some of native writers. In rest of analysis, I’ll be referencing material from selected list of resources on Reliance Industries before adding my own thoughts.

- Vedica Kant article Reliance: Origins. Vedica walks through the culture inherited from its founder Dhirubhai Ambani who first founded Reliance Industries in 1957. Company went public 1977 and as a teaser, has been compounding at 30%+ annually ever since.

- Part II of same author From Oil to Jio. This touches on a lot of points: Family disputes over Dhirubhai’s empire, network, that Reliance has built, why investors are piling in, Indian government plans, telecom market.

- Vivek Raju: #9 What makes Jio different? Primer on telecom infrastructure. Most importantly – how network laid by Reliance is vastly different and superior compared to traditional telco’s.

- Packy McCormick: Reliance: Gateway of India. Another 2-part write up on founder, history, politics, succession, what Reliance Industries is today.

- Part two “Reliance’s Next Act” goes into investment landscape of Middle East, China. Strategies and similarities of Softbank, Tencent, Alibaba Group in the context of India and Reliance Industries in particular.

- Ben Thomson also noted what’s happening in India and made an input in article India, Jio, and the Four Internets. Bird’s eye view on American, European, Chinese and Indian models for Internet. Furthermore – touch on recent geopolitics (China no no no, India yes yes yes) and of course – a take on Jio ambitions.

- Financial Times on Mukesh Ambani, successor and CEO of Reliance Industries (should I tell you how to pass paywalls?). Article briefly goes on the succession battle between two brothers, but mainly focuses on Ambani’s persona, ties and influence.

Later I’ll be referencing 2019-2020 FY Annual Report (Financial year ends on March 31) and Q1 presentation.

Also I encourage everyone seriously thinking about this company to go through Annual General Meeting of Shareholders held in 2020 July 15th:

Seriously – What is Reliance Industries?

That’s a 50+year old conglomerate that started with textiles, moved to petrochemicals and has recently shifted focus to transforming India to digital society with it’s venture, that got A LOT of big tech attention: Jio Platforms.

How big are we talking?

- At the end of 19-20 FY Reliance Industries directly employed 195 618 employees;

- ~100 Billion USD Revenues (~0.9% Indian GDP for 2019);

- Operates largest Jamnagar petrochemical refinery in the world launched in 1999;

- Reliance 4G network covers “almost” 99% Indian population, fiber wireline broadband connection in works, slowed down by pandemic;

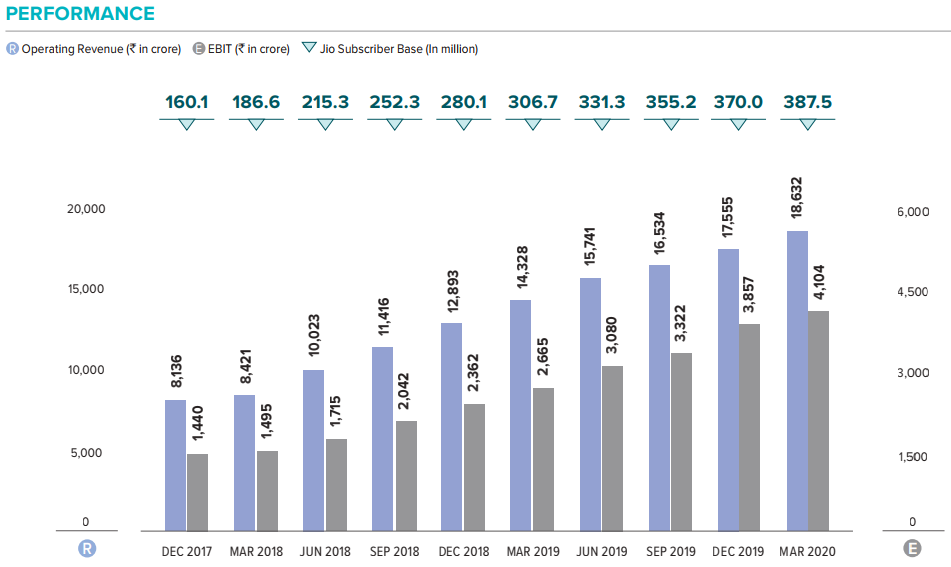

- 387.5 Million Jio Subscribers in ~1.360 Billion Indian Population (17′-18′ nominal growth ~12 Million);

- Reliance Retail is tapping into fragmented retail opportunity with 11 784 physical stores and expanding;

- At the time of writing market cap: 185 Billion USD.

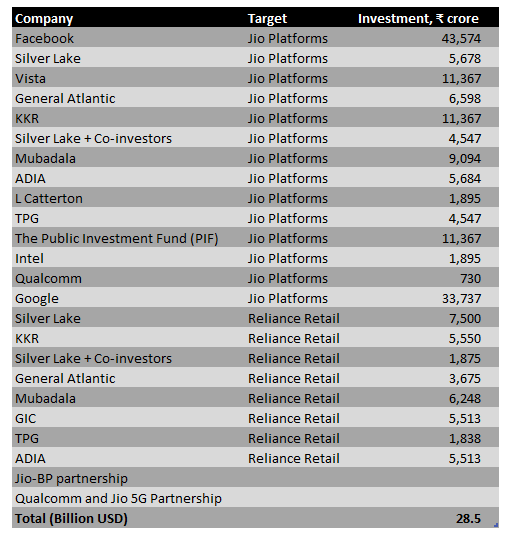

- In 2020 Reliance has been selling minority stakes in Retail and Jio Platforms, totaling: 28.5 Billion USD:

Reliance Industries and Amazon Inc. were in talks of selling Retail arm stake at 20 Billion, but so far – Bezos has no bite in modern Indian retailer.

RIL’s Operating Segments

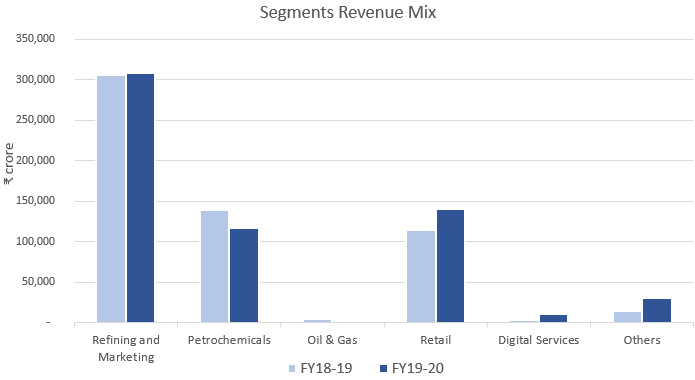

Revenue mix from annual report:

Note on digital services revenue: Revenue from contract with customers differ from the revenue as per contracted price due to factors such as taxes recovered, volume rebate, discounts, hedge etc.

Majority of revenue still comes from Refining and Petrochemicals. Retail is gaining significant momentum in revenue mix.

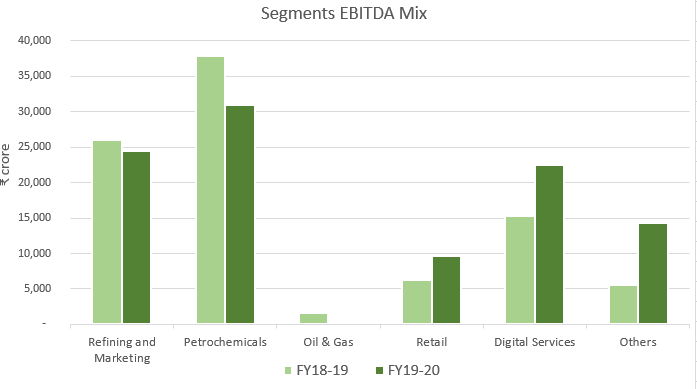

EBITDA Mix

Completely different picture. Digital Services is posed to become the main profitability driver in coming years.

Reliance Retail

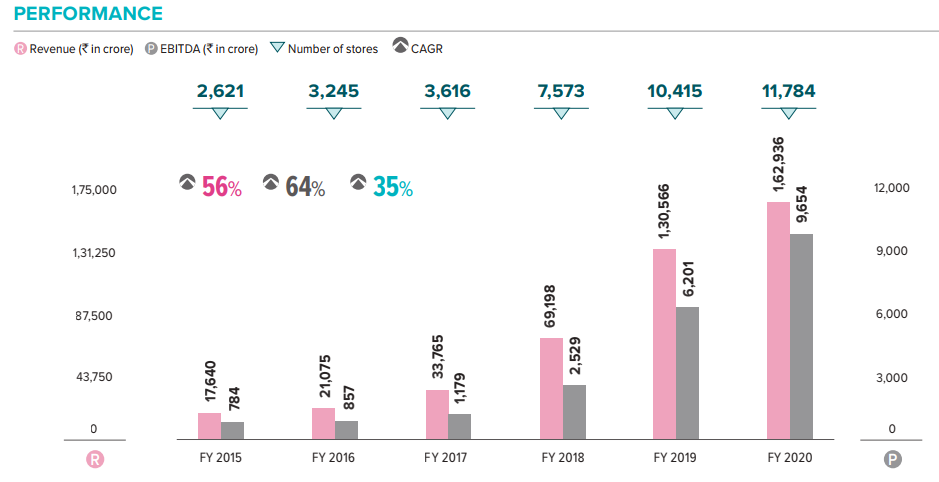

Reliance Retail is another honey pot for western capital. Reliance is aiming to become default choice of growing Indian purchasing power – Amazon of India. Performance from referenced FY19-20 Annual Report (also for other segments).

In FY2020 Revenues were 24.5 Billion USD. What’s the target market?

India’s retail market is estimated at US$822 billion in FY 2019-20 and is expected to grow at a CAGR of 10% over next 5 years to reach US$1,315 billion by FY 2024-25. The penetration of organised retail market is estimated at 11% in FY 2018-19 and is expected to grow to 17% by FY 2024-25E. The organised retail market is estimated at US$89 billion in FY 2018-19 and is expected to grow at a CAGR of 21% over next 5 years to reach US$230 billion by FY 2024-25E

Few sticking points concerning Retail Arm:

- Fashion & Style – most profitable categories – suffered during COVID.

- Partnerships with farmers and local kiranas (refer to AGM video) – integrated moves – “playing nice”.

- 70% online orders with JioMarkt delivered within 6 hours – Wow?

- Partner of choice. Primary partner for international brands entering India.

Digital Services (Jio Platforms)

Reliance digital baby aims to become digital gateway to most digital services in India. Think of Tencent of India. Payments, entertainment, gaming, ecommerce, advertising , tele-health, news, e-learning, music , video streaming. Expanding vertically and horizontally.

Jio’s Performance:

Sticking points:

There are three telecommunications companies in India. Reliance has lower maintenance cost advantage and expanding market share. Mechanics of market share and rivals – in the references. Disadvantages: Reliance does not offer 2G/3G connectivity, which is still a huge chunk of Indian population. Issue is being addressed with partnerships with Google, Microsoft. Aim is to create affordable, yet powerful Indian market tailed smartphone and transition country to 4G+ technologies.

India is 2nd largest smartphone market after China with ~450M unique users.

Petrochemicals / Refining / Oil Segments

That’s a legacy – cash generating machine. For years Reliance has been funding investments from cash flows made in these segments. Overall – low prices of oil, decreased demand for fuels and industrial feedstock during pandemic has significantly slowed these sectors in end of Q4 / Q1.

E&P (Oil & Gas)

Oil & Gas exposure gladly is relatively small. Some bets in US Shale with local partners. Main focus on gas. By mid FY21 R-Cluster Field should be commissioned. Scale?

The R-Cluster fields which will come onstream first, will have a peak production of 12.9 MMSCMD, about 10% of India’s current gas production. The combined production from the three fields will ramp up to 30 MMSCMD in 2023 when all the fields are onstream.

Targeting to meet around 30% of natural gas domestic demand.

India’s gas consumption is expected to triple by 2030 from 9% to 15% (in used fuels mix) with strong demand from industrials and emerging city gas distribution sector.

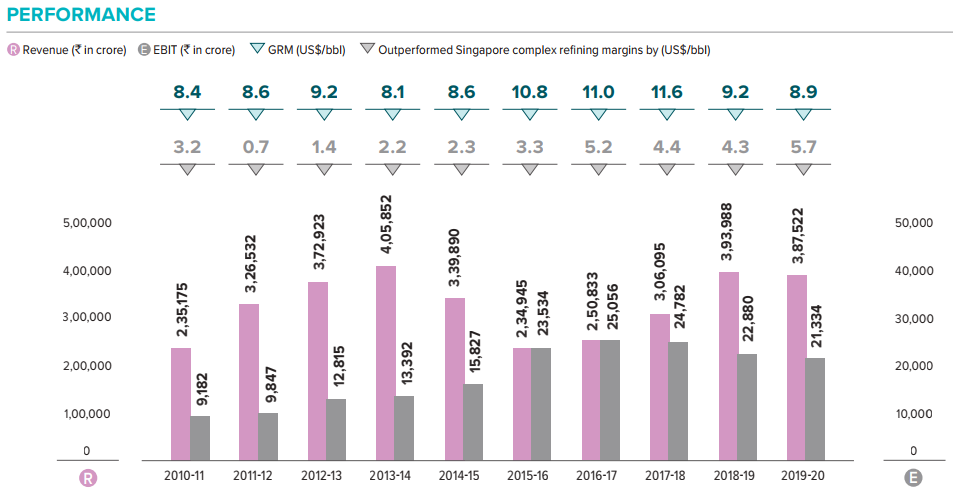

Refining and Marketing & Petrochemicals

Weird mix, I was surprised by “Marketing”. Anyway, Reliance operates one of largest retail gas station networks across India. Stations network grows with development of infrastructure.

As a side note, India has the strongest aviation market growth in the world. Refining branch supplies aviation fuels to meet this growing need. Naturally pandemic has slowed the sector.

For Refining, story is a bit lagging.

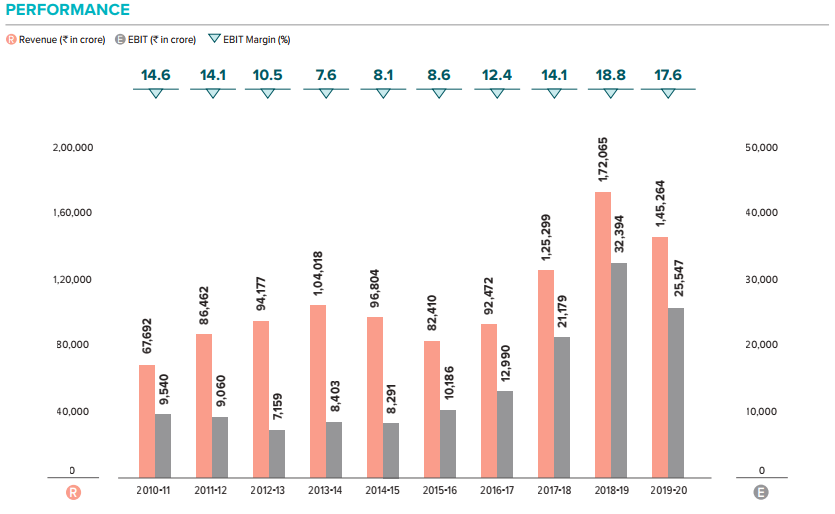

Financial performance for Petrochemicals has been trending higher.

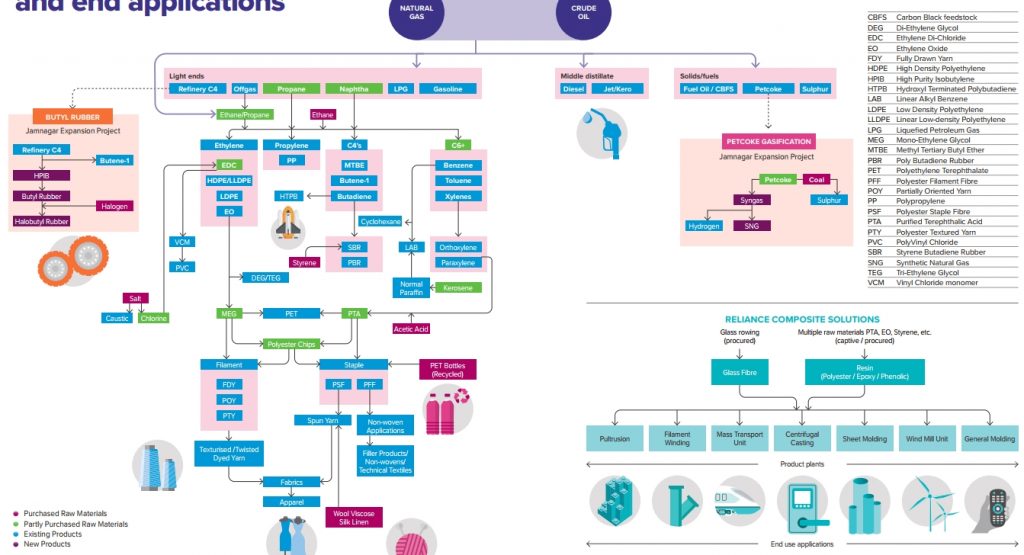

To be honest, I can not by heart distinguish their two main cash machines “Refining” and “Petrochemicals”. At the end of the day, it imports oil and makes shit loads of end consumer and raw materials used in all sorts of industries.

Here are some ideas (click image to view enlarged in new tab):

Let’s talk business.

Reliance Industries CEO Profile

From my learnings, Mr. Mukesh Ambani is an excellent capital allocator, successful business man, highly influential. He has deep respect for his father and his eventual (another encouragement to go through references) establishment in Reliance Industries succession is the best thing that happened to this company.

He reads a lot and has familiarity with technologies in blockchain, edge computing, AR/VR. Mukesh tries to surround himself with young people, which help him stay “fresh” and understand what consumers are coming into market.

Ambani has a good grasp on where world is going and positions his moves early on. Jio, Retail arms are two proofs of that. Carbon Neutrality goals, investments into R&D, Accumulation of Intellectual Property.

Through Reliance Industries history ties with government have been close and relationship between the two is very healthy.

India’s PM Narendra Modi has launched initiative Digital India in 2015. Program aims to connect all Indians to internet (including rural areas). Reliance plays into this very nicely. For the rest, check references (I promise, last push, but articles are that good).

Research & Development Angle

Annual Report has 21 points (screenshot below only lists 5) in different fields where some technology is used or is being developed. Page is visible in the corner if you want to dig in. It spans in biology, agriculture, industrials, smart cities, nanotechnology etc… Some of it seems common sense efficiencies, others pleasantly raises eyebrows.

One of Reliance’s visions is to build an IP (Intellectual Property) portfolio to provide a long-term competitive advantage.

Governance & RIL Foundation

Bershire’s Hathaway’s shareholder meetings would look bald in comparison. When RIL IPO’ed in 1973 it did so in a giant campaign to amass retail investors. From the old days, Reliance has a large share of retail investors and has been retail friendly. It has made a lot of millionaires.

Reliance stock has been compounding 30.4% since IPO (Annual report data).

Reliance has huge efforts in charity, which is led by Mukesh Ambani’s wife Nita, importance of which as very visible during COVID outbreak.

India in Macro Perspective

Approaching 1.4 billion population and likely overtake that of China is a huge market. Technologically speaking, India is lagging behind China ~5-10 years and we all know what happened there, right?

Strengthening middle class, increasing purchasing power, living standards (growing ARPU in Jio Platforms is a great proof of this trend).

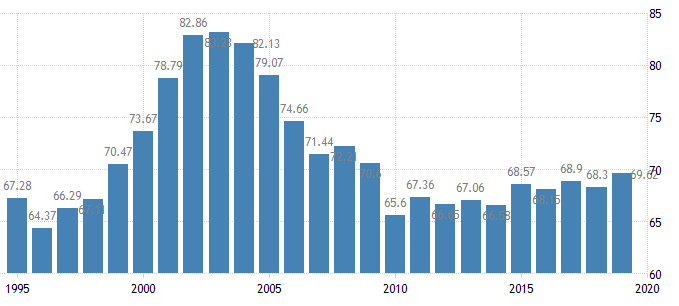

Indian finances are more prudent than US. Debt to GDP is expected to hit nearly 90% in 2020. That’s India Government Debt to GDP below.

Inflation at 7-8%.

Ever noticed currently a lot of Big Tech CEO’s are not native American? Population breeds talent. Think of growing technological development power India has…

Geopolitics and Public Image

Very briefly, ’cause it’s been all over the news. China and US relations are getting colder. What about India?

India has banned Tiktok before US, even had it’s military conflicts in disputed Himalayan areas. Investments from China also froze. Indian ties with US or west, for that matter has gotten warmer. Whole culture from colonial times is more investor and governance friendly, compared to China.

Modi has had his fair share of criticism over ethnic cleansing and aversion to muslims, but general Indian public seems to support Narenda Modi. What concerns Ambani, from time to time people rise up, but having this scale does not come easy.

Reliance Industries Valuation

After record (Billion USD / time) minority stake sales, Reliance is now debt free. Reliance still holds majority stakes in both companies and I don’t expect to loose it’s grip on Retail or Jio in the future.

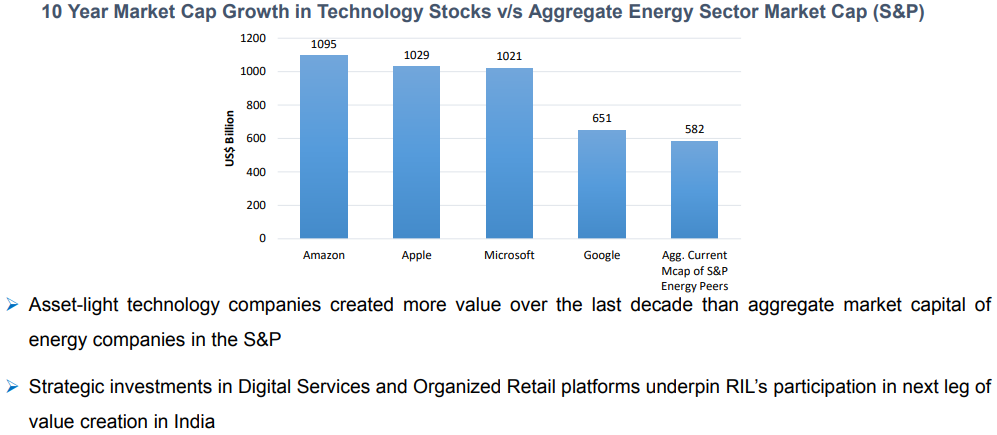

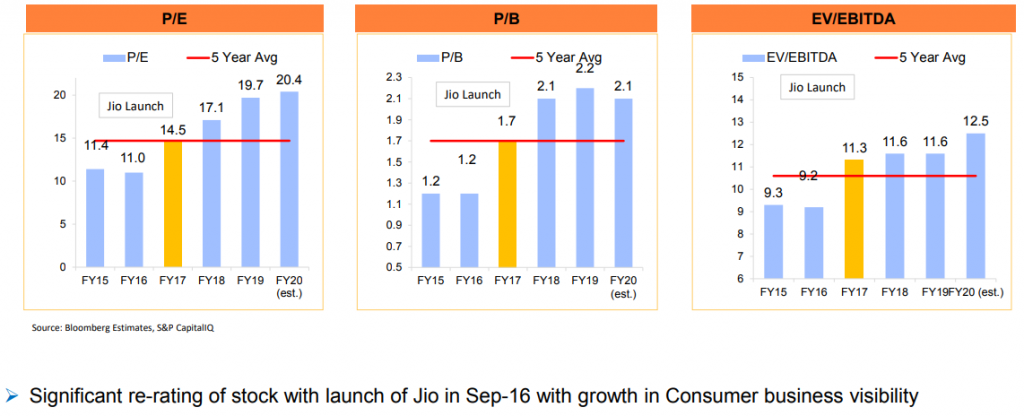

Two slides from Q1 presentation. One underlying what Reliance is modelling, other, the other focuses on how market reacts to business transformation.

Pitfalls in Reliance Way

I don’t think Jio Platforms, nor Reliance Retail moats can be disrupted by a large player. I got an impression that foreign players like Facebook/ Amazon have been facing regulatory hurdles to play however they please and that was exactly the playbook cast by Reliance and government relationship.

Tata Group is not a direct competitor in Jio’s way too. Criticism arises from “Home grown” mentality in Reliance, under which everything had to be acquired or built inside controlled subsidiaries.

Reliance has already lost fights in several consumer apps. Example “Jio Chat” could not stand a fight against Facebook’s WhatsApp. Partnerships will bring western know-how and participation in large plays, but there’s a worry company will get disrupted by very vibrant Indian startup ecosystem.

Here’s where Investor mentality must shine through. By backing startups, Reliance could become the Tencent of India. I don’t yet have a firm opinion whether Reliance is playing this.

Bottom line

Investing in India is a no brainer. Country housing ~1/5 world’s population is leapfrogging technologically and will be the next purchasing power on global arena. In my humble opinion Reliance Industries has the largest exposure to this natural and enormous Indian opportunity.

Reliance is the gatekeeper for foreign capital, breeding companies itself and hopefully developing an ecosystem of domestic startups. Serious money managers will knock on Ambani’s door first.

Loaded gun for stock is foreign listing opportunity.

If my ramblings on Reliance investment thesis feel like a children’s fairy tale, you could be a simple person and follow one of the best businessmen and investors, who already piled in Reliance arms. I bet they did their homework more seriously.

If it’s not obvious yet, I have formed a position in Reliance Industries, which is my first position in Asia. Details relating to instrument of choice to European citizen, position sizing will come with another blog post. Thanks for reading!

Leave A Reply