Another low-structure collection of recent thoughts about our seemingly ever complex world. This is supposed to be a stream of consciousness, despite staring at the title for minutes.

Calling the shots

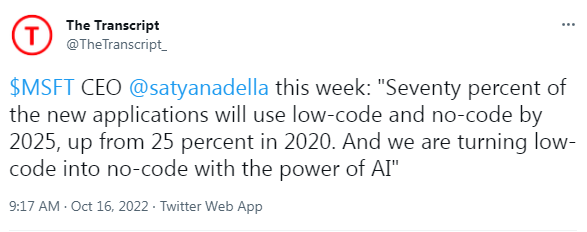

Calling macro shots as a Generalist – is a dangerous endeavor. Last time I did, I called for FED pivot. We didn’t get it. Instead, FED officials were more outspoken about risk of overdoing hikes, coupled with falling commodities and that was enough to set +18% counter trend rally. Then CPI came out and you could throw it all out the window.

In Lithuanian Facebook there are several public economists, that essentially summarize the market news for past days, chew it, put it on platter and maintain the “economist” public image. You be my judge when I say: that’s journalist, not an economist.

I would rather put out some image of the future, regardless of its precision in manifestation and learn in public that be afraid of ridicule. So your next question is..

What’s next

Two written pieces have been a breath of fresh air in last months with a thing in common: in ever shorter time span world, these were discussing perspective of 5-10+ years.

- Zoltan Pozsar: “War and Industrial Policy” (2022 August) [pdf]

- Interview with Russell Napier “We Will See the Return of Capital Investment on a Massive Scale” (few days ago) [pdf in case link dies out].

I can’t really put a hole in their arguments and to some extent I adopt this vision of structural inflation. I have mentioned de-globalization before in this blog. Recent fractures (will touch on later) – are scary by the magnitude and speed it’s happening. What in means for a folk in western ground? Slower, costlier.

From studying (especially Bitcoin) economics years ago I realized a simple axiom:

people have savings, governments have debt. Inflation eases debt. Therefore incentives are in place to destroy your savings.

Simple, innit? The two giants above have way more professional and historical background, therefore I could not yet be so articulate, but here’s the one public proof I hold this true:

European Double Speak

I’ve been making fun of Lagarde all year. Especially when Lithuanian inflation got to 20% YoY and ECB rates were still negative at the time. Fighting inflation they say. 2 hikes (125 bps cumulative). I get the point, don’t get me wrong. I just don’t like being told lies, and I feel responsible for pointing out the lies. Anyway.

Slowly, the rates are picking up. I’m thinking maybe it’s time to kill some zombies, bring back prudent capital allocation, clean up the system, boost productivity, but I read [2 above]:

Just to give you some statistics on bank loans to corporates within the European Union since February 2020: Out of all the new loans in Germany, 40% are guaranteed by the government. In France, it’s 70% of all new loans, and in Italy it’s over 100%, because they migrate old maturing credit to new, government-guaranteed schemes. Just recently, Germany has come up with a huge new guarantee scheme to cover the effects of the energy crisis. This is the new normal. For the government, credit guarantees are like the magic money tree: the closest thing to free money. They don’t have to issue more government debt, they don’t need to raise taxes, they just issue credit guarantees to the commercial banks.

and loving criminal ECB mother kills the hope.

So given unprecedented scale of leverage and immense interconnectedness I inclined to live by 70s prolonged inflation playbook, which I’m sure we will get plenty educated in coming years.

Psychology of Narrative

I had a dream for sometime to log my thoughts about upcoming quarter, set some price targets. At the end of 2022 Q3 I actually did it. Fun exercise. A thought visited, when I laid out “my future” that are somewhat consensus at the moment: can I ever dissociate from market narrative?

Between data and narrative – I pick narrative as a main driver of sentiment and therefore market momentum. I don’t model economy and don’t track PMI’s, macro indicators to independently gauge economy health, because data not applied is dead data.

On the other hand my portfolio is fairly diversified (intentionally so) so I’m not too worried about falling victim to narrative. This year I had contrarian views at some point, but this topic I’ll keep a closer eye on…

MBS donates 400M to Ukraine

Saudi Arabia going against their OPEC+ buddy Putin does seem odd at first, doesn’t it? However when Biden got upset about OPEC cutting production by 2 M bpd, he ordered a review of Saudi relationship and at the top of the list is arms sales… Not too keen of Saudi’s enemies (aside from Iran) nowadays, but they always liked new and pricey Lockheed toys.

Then 400M in humanitarian aid (not to mention they profited probably the most, even BUYING Russian oil this year).

Aramco achieved a record quarterly and half-year net income of $48.4 billion in the second quarter and $87.9 billion in the first half of 2022

Somebody, Explain Israel, Please

Speaking of middle east. Watched this odd documentary from Al Jazeera on racism and antisemitism inside UK’s Labour Party. If you follow me for some time, you may have noticed, I may comment on odd things, barely related to issue at hand. This is one of those cases.

It’s UK internal politics. They have their struggles, like everybody else. However under the umbrella of antisemitism, Palestinians are being shoved out of politics for no apparent reason and structures are emerged to normalize Israel’s atrocities in Gaza strip. Here’s my tangent.

- Israel is top player among worlds’ intelligences;

- Israel combat training and style is among the deadliest in the world;

- Israel has a vibrant tech space, startup scene, strong internet businesses;

- Israel is a known dealer of zero day exploits and surveillance tech. [if you need recent example];

- Israel is occasionally bombed and target of terrorist attacks;

- Isreal is small, was historically plenty fucked and yet inflicts bombings, shootings of Palestinians;

- AND CAN GET AWAY FROM IT IN THE WEST.

Only idea: west needs their intel / surveillance deep tech and is able to compromise on public image of Israel in western screens. As past years have clearly showed, I invite everyone to examine their media bubbles and instead of pointing finger at Ivan, ask themselves: how am I brainwashed?

Deep Fakes

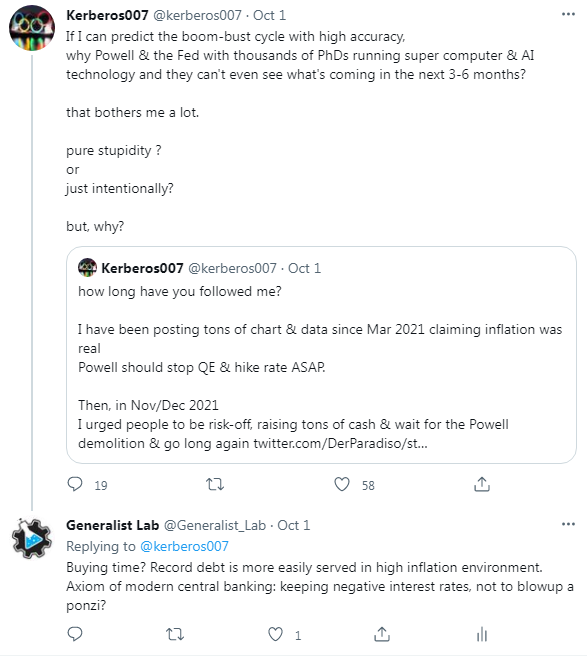

Shared a Microsoft CTO paper on deep fakes not long ago. 2 risks were highlighted. (1) voice + video fake (imagine your mum getting a VIDEO call from you, mimicking your facial expressions, tone, and asking for help). No later than two weeks later saw it in the wild:

The (2), however went on to paint a far scarier future. Imagine an adversarial state, which pushes some narrative and suddenly by censoring present affairs simultaneously has the ability to manufacture proof of the past that never happened. Frame opposition, create fake past discussions online. I mean dude… The Bayesian thinking of probabilities will come in handy outside of investing too.

The Closed OpenAI

Older readers may remember I wrote about OpenAI as part of wider Microsoft investment thesis. Only recently I publicly bashed OpenAI philosophy:

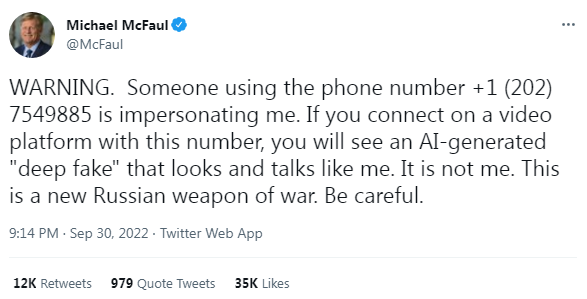

And even more recently I learned they released Whisper model out in the open. So maybe they are likely course-correcting and Microsoft is leaving a longer leash. That’s great news. Microsoft’s CEO repeatedly calls on growth of no-code development. I’m certain OpenAI is crucial building block here.

Tech Stocks

Given the opening discussion, what’s my thinking on GAAP non-profit SaaS? It’s too late to cut loses, that’s for starters. Hidden options in CPI down / FED picot or FED breaking world / FED stopping. Sunken decade? In the past I would have said yes, but I still recognize incredible rate of changes taking place.

I like tough environment. I can sustain multiple compression and allow winners playing out.

SQ vs Paypal? Did you see Paypal “mistakenly” trying to control speech, fining and closing accounts?

Cloudflare vs Zscaler? Did you see Zscaler director departing?

If the thesis was right, my growth side of portfolio will eventually grow into their valuation. Current environment prolongs that foreplay. It’s better with foreplay…

Energy

It’s temping to speak about Russia and the war, but fuck that little guy on high heels.

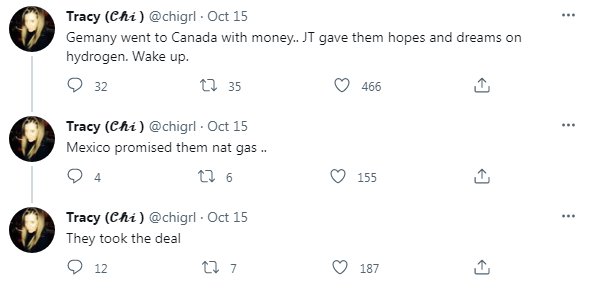

Europe although sometimes comically is past peak energy crisis for now.

Physical market is tight and I don’t know whether it’s financial engineering or SPR or genuine demand destruction (thanks for your pain Xi), or more rains -> more hydro in Scandinavia or all the mentioned, but intuition tells me we won’t be around 80 USD WTI next year (aim higher).

In the serious and opinion-shaping twitter public sphere I hear nuclear. Never capex of nuclear. Only zero carbon free energy nuclear. Blow past the likely Russian financed green activists against nuclear in Europe.

Would capitalist capital not shift to nuclear if it was cost-efficient by now? Just some details I’m missing in ALL nuclear related talks.

No Limit Friendship

Promise not to expand, I promise. Just one little note, barely discussed anywhere. Putin’s energy blackmail, logical inconsistencies in public communication, involvement in indisputable war crimes…

It’s been a MASTERCLASS for China. You can get CCP lovers all you like, but the world is business and business requires trust and reliability. North Korea is more reliable partner for China at this point than Ivan. Russia is a useful fool and tool.

Sooner or later I expect a dagger in Russia’s back one way or another (decades, not tomorrow). Before Xi – Putin meetup, Xi dropped by at Kazakhstan to solidify commitment of sovereignty (read support in case KZ vs Russia) and energy cooperation (read China diversifies Russia / Middle East supply).

Notably, China dodged sanctions bullets so far by abstaining in UN votes on annexations etc.. So there definitely are limits to the “friendship”.

Biden Makes Semis’ Cycle even Sadder

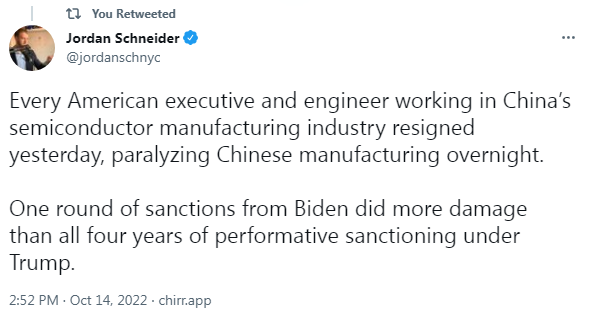

Intel is in deep hole regardless, AMD is first outspoken about PC demand destruction, NVidia had pain on that too AND got bitten for being leader in Biden export sanctions. In past days, US has really stepped up it’s aggression: leave China jobs or drop US passport.

I have this cynical joke: “US manufacturing PMI ex-defense does not exist”. So as I commented today in tweet: I imagine US calculates, it can’t allow China to ever to realistically threaten US’ military supremacy. And if you, like me, growing up thought of US as a world cop, bringing democracy and soling humanitarian issues across the world, this step may be the last drop to vaporize the dream.

I think US calculates it would rather invite China (be it with Iran + Russia) to war now, than when their missiles are supersonic, self-course correcting in miliseconds based on aerodynamics n’ stuff.

China has too much homework to invade Taiwan in near future. However when that happens, I would write off TSM Taiwan assets. And I still hold this view, everyone is reshoring chip manufacturing capabilities to decrease reliance on island.

Ending Words

Enough for today. If it’s not obvious – cover image was ML-generated (first time for a this blog). I bet economists say it everyday, but this is truly a unique and ever complex world. Hopefully we can get out of the maze more wise, healthy, prosperous and most importantly – alive.

I’ll leave you with a riddle:

Was never hacked, avg heart rate of 1 beat per 10 minutes and is predictable decades into the future.

Thanks for reading!

2 Comments

I enjoyed this post. Trying to predict the future is no easy task. Though I would try to write clearer conclusions for some points as I couldn’t always understand them fully.

Thanks for reading! Yea, writing does indeed force one to clarify thoughts. I would love to write more, but this year is exceptionally heavy on coding, and learning there. Can barely keep up with wearing investor hat with all it entails.