Putting Aside Personal Life

Like any other investor I was looking for a dip in the market to enter some forever-expensive software companies (won’t expand today). As Corona Virus (COVID) pandemic in China escalated, I put nearly all my personal and professional (programmer wannabe) time into the newsflow, markets and analysis of several interesting firms I mentioned in last post.

And I hate it. The only reason I kept alert for 2 months now is to employ capital into opportunities opening each day.

Corona Virus Spread

COVID origins

ZeroHedge (one of the most popular investor website) twitter account was suspended after sharing an article which suggested COVID was China lab-designed bioweapon. About a month ago, China’s foreign affairs ministry spokesman blamed US. army of transferring virus to China.

Theories, theories, theories… However China’s problematic and unhygienic “wet markets” is the primary cause. Vox review on wet markets and food supply history in China:

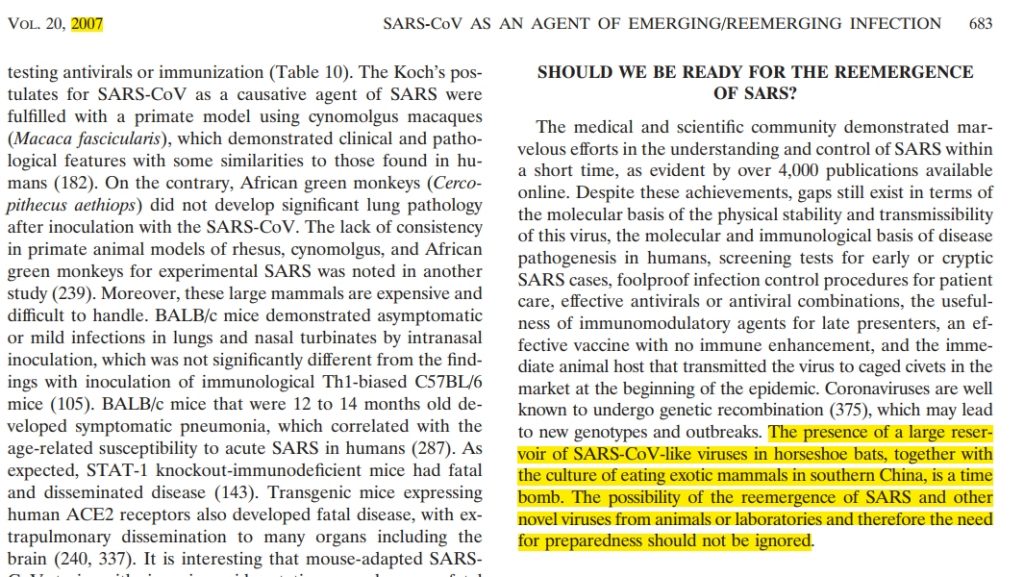

And Hong-Kong University scientists have been warning about this 13 years ago. Study from US National Library of Medicine

Out of Hand… Where?

I’m a fairly young dude, all the other pandemics like Ebola, SARS, Zika, which all happened in the last 20 years have passed with minimal distress in global arena. All the other pandemics did not even spread across the globe.

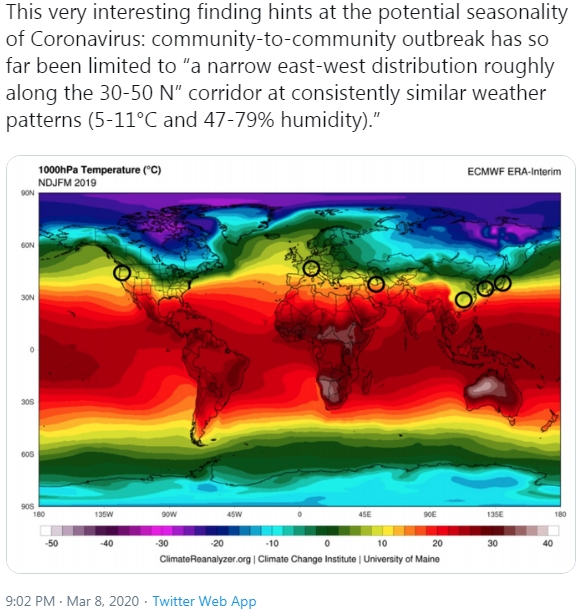

Russia is China’s neighbor in a BIG WAY, and unlike its southern neighbors has not raised attention, then I see this:

In Europe, for almost a week, REPORTED virus spread was highly localized in Italy, which again suggested it could be contained reasonably well in the global context.

Geopolitics

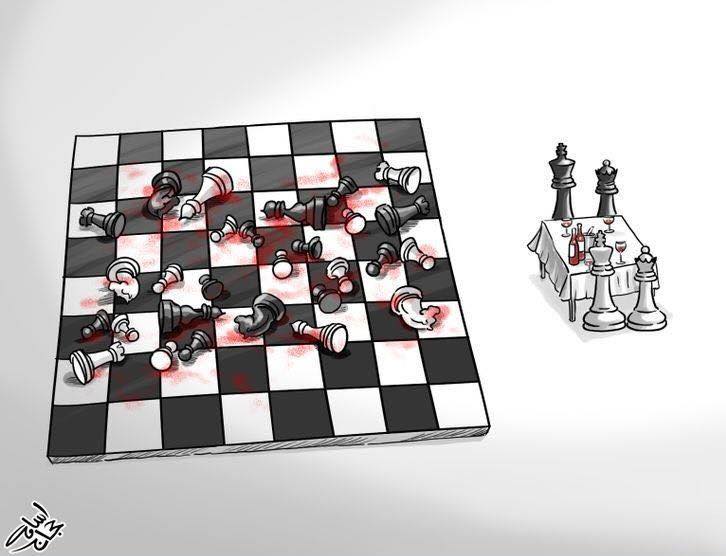

Russian – Turkey Chess

Syria is an unfortunate victim of regional powers making indirect passes at each other.

Syrian rebel forces supported by Russia shot down Turkey aircraft with 30 soldiers.

Days later Turkey bombarded Syrian forces. Naturally, people literally fleeing fire from the sky, have pushed towards Europe through Turkey; meanwhile, Turkey have been blackmailing European Union on financial support in refuge crisis handling. Erdogan, pissed at Europe’s ignorant position has opened its borders for refugees to fee to Europe.

Exactly what opportunistic Russia wanted. Greece border was under siege by refugees and other illegal immigrants. I briefly spoke about it in short tweet thread:

Besides, Russia in parallel runs an informational war against EU.

Everything boils down to Energy, as always…

Energy Interests

Russia supplies around a third of Europe’s energy demand. That’s the reason heads in Brussels can not wag a finger at Russia’s geopolitical moves (Ukraine, Syria).

Shale oil has changed global power dynamics dramatically. I wrote about dynamics between NATO, Europe and Russia here.

Saudi Arabia – Russia Oil War

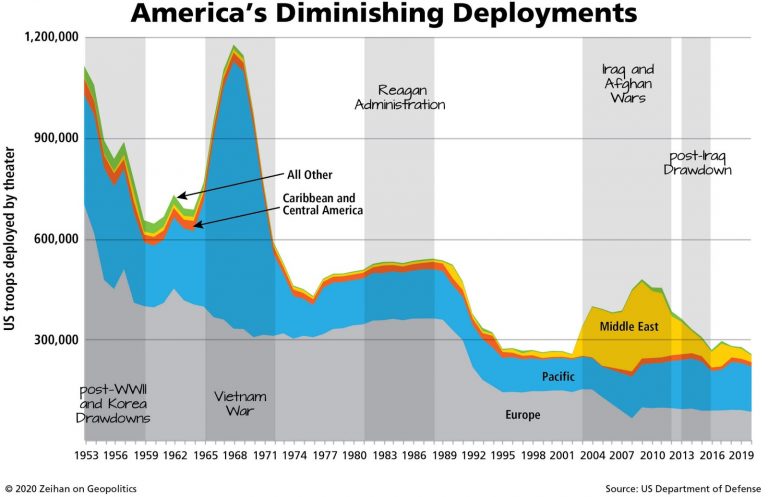

United States have been steadily reducing its military deployments around the globe for years, and shale revolution at the beginning of last decade was the primary reason.

Iran is the only rebel in town, who US could not get on its knees. Iranian supported groups are a threat to Saudis. I won’t pretend I know the nuances of the region, but the fact is, Saudi Arabia is not happy about decreased protection, and in my view, conflict with Russia in OPEC+ meeting was just a cover-up to get back at US, primarily – Shale Oil Industry.

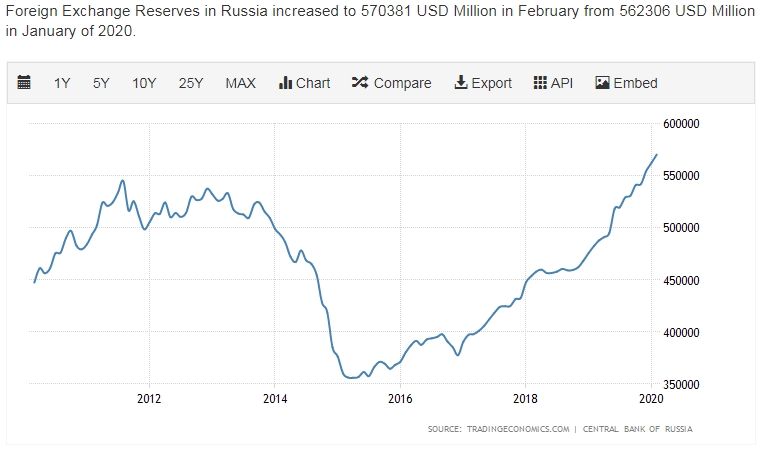

Again, Russia hurts, but it doesn’t matter until US hurts more. One f|_|ck€d-up mentality if you ask me, but that’s what Russia is… Putin has hiked social benefits, to pump Russian spirits. This would entail high burden on budget, but now is party offset with gold, foreign currency reserves … and cheaper ruble.

USD/RUB Rate at Ukraine Conflict levels:

As oil price has been smashed by both sides: lower China’s, and global demand (do you drive the car these days)? And overwhelming supply by Saudis. WTI Oil is currently at 23.4 USD or -62% in this year. Transportation, storage costs. Experts are pretty confident it will go even lower.

Economy

China’s Play

World has outsourced production to insane levels. Remember this tweet? Very well illustrative.

The China Factory stops – world stops. Somewhat. Reversion of globalization to nationalism has been a recent trend. Trump election, refugee crisis in Europe few years ago, trade war between US – China, forthcoming trade war between US and EU, are now Corona…

Apple was the first major company to announce impaired Q1 guidance; Market ignored. Microsoft followed. Even local players such as HansaMatrix have warned about component shortages in the market.

Liquidity

When Corona proved itself to be NOT “just a flu”. Markets begun its journey down; corporate bond yields spread (difference as compared to Treasures) have skyrocketed. Treasuty yields have plunged as investors ran for safer assets. FED as of not provides up to 1T (yup, trillion dollars) of REPO operations each working day, drastically cut rates and restarted QE.

What a clusterf|_|ck. Gold down, Bitcoin down, all run for liquidity or cover margin calls.

Systemic Problems

Let me remind you, REPO operations have started right after yield spikes on Treasuries on September 16, 2019. Under the hood, where billions are exchanged between money market funds and major banks, hedge funds. This does not happen normally. FED stepped in and FED balance sheet continued its way onto new record levels.

If you are confused about REPO term, as I was, there’s a 5 min tutorial. There are people that understand what’s going on (note the date):

I never got around to write an intended sequel to my criticism of the current monetary system. But the brief summary would be: if you care about your family, you have to own a portion of bitcoin. This insane money supply will eventually get ugly. When that day comes, hard assets will be shining.

Corporate Life of SBC, Buybacks

If you haven’t seen Inside Job or The Big Short, well… you should. US government ties with corporate interests are shocking to outsider, but that’s a side effect of free markets and capitalism. You can either scream or adapt.

What I noticed going through SEC Fillings of several companies, was a “Stock based compensation” section. Which is stock option rewards usually for executive-level employees. This inflates shares outstanding.

Furthermore, companies use low-interest environment to take on debt and spend it on horizontal expansion (acquisitions) and share buybacks. Buybacks reduce shares outstanding making look profits per share better, granting executives even more bonuses.

This is incentivized by the government. Income tax on dividends is higher than capital gains.

Only few companies spend their free cash flow on R&D. You will most likely used to find them at 40+ Price to Earnings ratio levels.

Boeing bailout

2008 Global Financial Crisis (GFC) set the stage for how things are dealt with in corporate America. Tax payer will pay to bailout and restructure what’s left of once solid-business after greedy CEO’s are done with it.

In latest press conference Trump was explicitly supportive of bailout ideas. Naturally. Boeing is a huge military contractor. But public is very unsettled by the bailouts echoing from GFC.

Looking Ahead

Corona Developments

Corona Virus in US on a steady rise. One good thing in recent days, was the ramp-up of testing capacity. However I fear the “flatten the curve” stuff won’t do in US and hospitals will be overwhelmed. If this scenario rolls, the market won’t find floor soon.

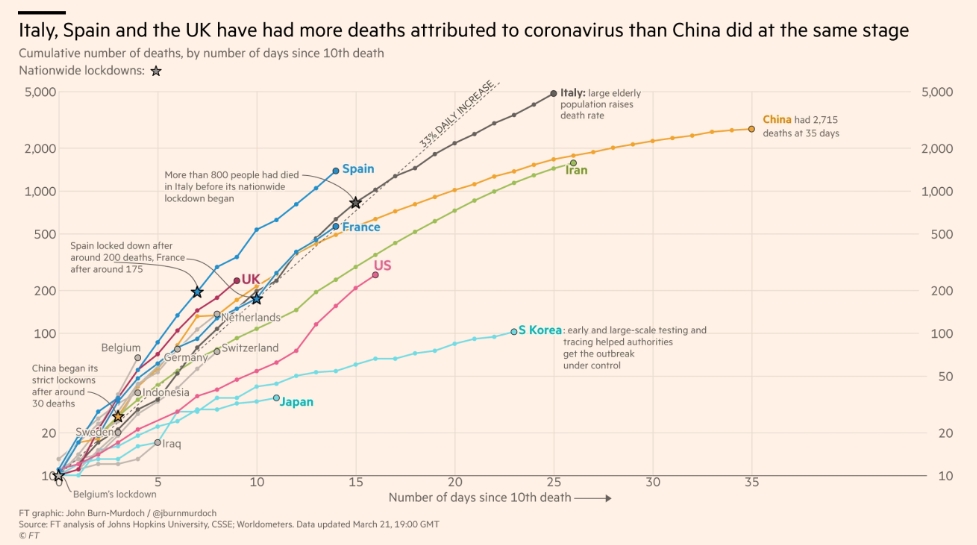

Highly organized countries either through culture (Japan, S. Korea) or authoritarianism (China) have battled Corona quite successfully. Except things like this pop up, that indicate potential horrors in China (bonus reminder).

The western world is softer. Early appropriate measures have been taken in few countries. This is and will bite hard in the upcoming weeks. Iran, Italy, Spain, France, US seem most fragile today. India, Russia – too silent. Why..?

Macro Economy

China is ramping up its daily activities, but the rest of the world is lagging behind significantly.

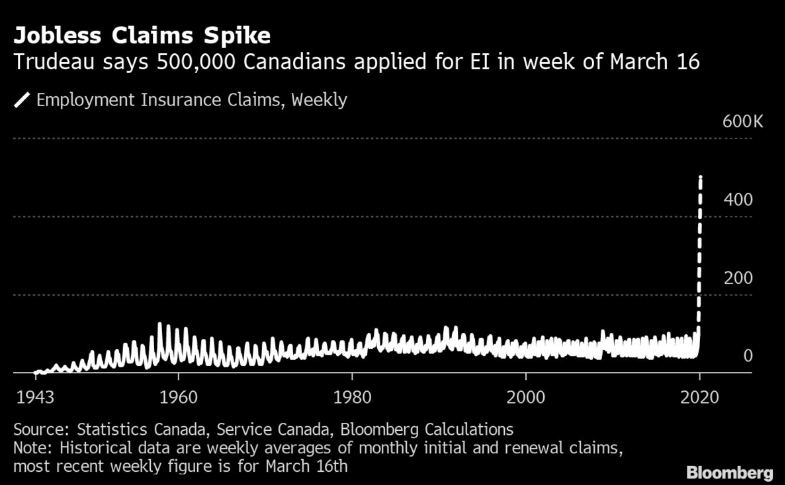

Canada’s jobless claims spike:

US numbers are due next week, if I’m not mistaken. Goldman Sachs projects up to 2 million jobless claims.

It’s safe to say, Q1, Q2 will bear negative GDP. I’m not sure all businesses will be eligible for government support. I’m not sure all business deserve financial aid. There’s been discussions about zombie companies, that only exist due to debt refinancing. Not all bankruptcies are bad. All bailouts are.

It’s hard to put a world-halt effect on the economy, but stock market is beginning to count that in.

Universal Basic Income

Hail to modern-monetary theory. Extraordinary times call for extraordinary measures. Hong-Kong started its UBI stimulus a month ago. US wants to proceed with distributions until April.

This is not a tax relief, which has been applied before in Bush administration, but direct payment to bank accounts

Proposal: Relief bill that includes direct cash payments of up to $1,200 per person whose income is less than 75 000 USD/year.

People earning over that amount would see their payments reduced by $5 for each $100 in income over that amount. The benefit completely phases out for individuals earning over $99,000

NPR

I would not be surprised to see this replicated in European Union.

What is the value of something you get for free?

Riding the Volatility

Last time I have been trading was around 11 years ago. This week I have opened an account and started playing around with this crazy volatility. I won’t go into details of psychology and my personal experience with this week, because it would be another post.

What I will do, is provide my technical analysis on SP500 index (hop to other paragraph if you have no idea what’s that):

Weekly chart of S&P500 from GFC with Fibonacci Retracement levels:

Here’s the zoomed version on daily:

There’s was temporary support at both levels. 3 days spent at 23.6; 5 days including Friday spent breaking 38.2 level support.

Friday’s trading session candle closed almost full-body below, which indicates further downward trend development. Nearest support according to Fibonacci levels around 2030, which should not be hard to eradicate 200 points in a week.

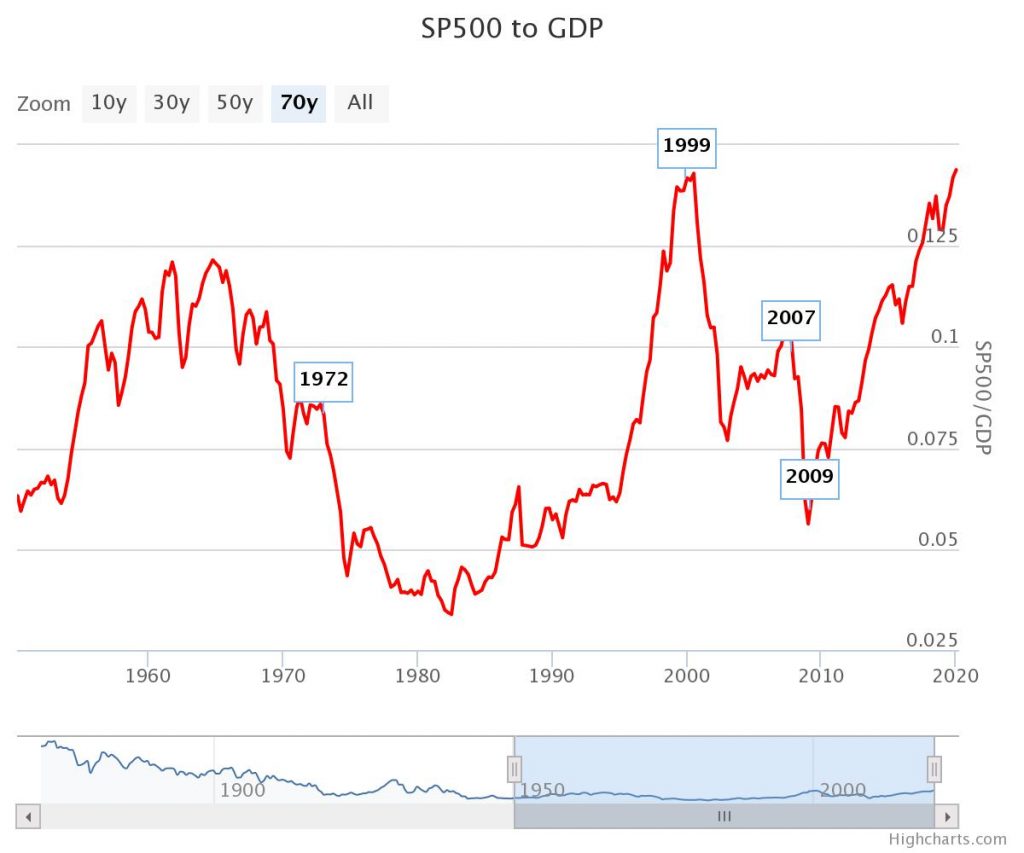

As of today, S&P500 lost 33.2% from its peak 3398 in Feb 20, 2020. CAPE ratio for S&P500 currently stands at 21.8. Considering forward profits, ratio is still way too high in my worldview.

In relation to latest (!) GDP figures:

I’m on short side for the most part in my trades. I consider this not a bet against humanity, but a bet on required system cleanup.

Closing Remarks & Materials

I have no idea what is up with this new decade, but tensions are on every corner…

I encourage you to watch last Friday’s Jim Bianco (Bianco Research) webinar, which will illuminate some of market dysfunctions currently at play:

And one more article, I found pretty comprehensive and recommend you check out on market fragility exposed.

Stay safe, let’s kill virus and the bubble.

Leave A Reply