Future is already here, it’s just not equally distributed – William Gibson

This is a long due analysis of my learning about Jack Dorsey’s second listed company Square Inc (NYSE: SQ). After almost a year in watch list, currently I have accumulated 30% portfolio position in Square, so bear that in mind, while I’ll try to reason my way through this investment thesis.

History of Square Inc.

Jim McKelvey first hired Jack Dorsey when he was 15 years old (1991), to be an engineering intern for his first tech company Mira. The two really liked working together and it was nearly 20 years later, that the two would start one of the most mission driven companies – Square Inc.

Accepting credit cards

Jim pivoted away from engineering into arts – he blew glass works. There was this one glass work that he despised himself and the ~2500 USD sale was blown, because he could not accept a credit card the buyer had. He approached Jack and the two set out a month to learn everything there’s to know about credit cards and try to come up with solution to accept them as payment method.

We saw what the credit card industry actually did to St. Lois and families in St. Lois and we didn’t like the credit card industry in many ways. We didn’t think it was fair, but we recognized the buyers were using them all the time. – Jack Dorsey

In a “hackaton-like” month guys came up with cassette tape reader that you could plug in to microphone jack of an iPhone; they swiped the credit card and the damn thing worked!

Asking better questions

They knew a woman – local flower stand owner and for three days in a row they asked her if she would like to start accepting credit cards. The woman have tried that route in the past and was irritated by proposal.

Some of the answers the guys got:

- It’s too complicated;

- I’m not credit-worthy by banks;

- Fees are too high;

- Go away, you want the flowers or no?

The next day guys just watched her work and sure enough a guy wanted to pay with credit card, and the woman said: “no, sorry, only cash, there’s an ATM just around the corner”

They waited 5, 10, 30 minutes, buyer never returned. They once again approached a flower stand owner and asked: do you want to make a sale?

By asking “how can we help small businesses grow” instead of pure credit card acceptance problem, company has widely expanded their target addressable market. I’ll return to this later.

How Square compares to Legacy Banking?

Basically banks operate on 0 trust and have a lot of compliance hoops to partner with small business.

Square on the other hand has inverted this paradigm and by default trusts and invites all by default, but watches closely for misbehaviors.

Bridging Square and Twitter Values

In case you did not know, Jack Dorsey is the co-founder of both these companies: Twitter and Square and they do share a lot of underlying values and meta challenges.

Twitter started with 140 character limit per tweet. This decision was both technical and conceptual. Let’s look at conceptual side.

Constraint inspires creativity – Jack Dorsey

By limiting the size, people might be more on the moment, more genuine. The intention was to make experience live and human, sense of inter-connectivity.

A good example would be: I the red brush was given to man and he was told: there’s a huge canvas that takes entire wall, go make a mark, paint that canvas. Natural reaction is to get stifled and overwhelmed. Huge canvas – great responsibility. You want to do the right thing.

However if the wall-sized canvas were to be replaced with a business card, and man is asked with the same task of making a mark, he usually won’t get in his head of what the mark might look or mean. And this goes to the core of Twitter beliefs:

Everything you write, everything you tweet is of value to someone. […] It’s all up to who receives and interprets a message

In another interview Jack gave this example:

It doesn’t matter who and where you are. Ideas still count at Twitter and this human element is highly preserved and valued.

What does Square really represent?

“Square up”, “Fair and Square” – heard of these, right? Just like like in Twitter, Jack wants to simplify and level the playing field to everyone. Twitter gave equal opportunity in communication, Square does the same to commerce.

Banking

Accepting a credit card payments: merchant has to comply with FICO (Fait Isaac Corporation Credit-worthiness score) (!), even though it wants to accept, not spend money. Merchants loose somewhere between 1.69% to 7% depending on the card being using in transaction.

Getting a loan: banks don’t make money on 6000 USD loans. Piles of forms and loan request acceptance (or not) period of 6-12 months. Often small businesses turn to their families instead.

Covid recession in 2020 has showed this difference in SQ and traditional banking approaches very clearly. Touched on this in Square’s Q2 results recap in Twitter thread:

Personal banking: un-intuitive, inflexible, limited scope of services, higher prices due to capex operating bank branches, system inefficiencies.

In general banking industry has not changed much from 30 years ago. Square, among other competitors (will look into that later) are addressing all of these problems.

Side note: Unlike other fintech “bank-killers” Square names banks as partners.

We don’t need to become a bank to save the trip to the bank.

How Square Leverages Machine Learning & Data Analytics

What is commerce? Simple activity of exchange between buyer and seller. It has nothing to do with payment device (Credit/debit card, cash, barter, digital currencies). What’s important is accounting for that transaction. Because if you can account for it, you can learn from it and you can grow. – Jack Dorsey

I won’t go into details of machine learning. Quick basic principles primer is an excellent video by 3Blue1Brown. In few words: that’s a pattern recognition solution on top of data stack. The higher the stack, the more precise are solutions. And today it’s everywhere. Let’s look at some examples.

Going back to the right question, Square’s proposal to grow small business now encompasses offerings on inventory, full menu or products, sales, analytics, payroll, e-commerce software solutions. Say a business has all their business in the hands of Square.

Why am I getting all these sales at 3:40 PM? What if I stay open an hour more? Turns out the business grows 20%.

Square is addressing the answers based on business analytics from data it routes through, even before business owners ask the question “how can I grow my business”.

Streaming Finance

Accounting as we know it today is extremely slow. Payments are held at various parties, usually banks, sometimes for months. Sections in financial reports like deferred revenues, accounts receivable are a testament to the speed differences between payments and business environment.

Andreas talk goes way further than the scope of Square’s activities, but I want to encourage readers’ imagination into the world of streaming money.

Square takes a step into this world and will likely show some surprises into the future with it’s Square Crypto investments and innovations. More on this in later sections.

Square Capital: Annual Reports vs Real Time Cash Flows

Say a restaurant wants to grow and needs a loan to expand it’s serviceable area. As noted above, banks are not friendly in this regard, besides, they are watching at minimum quarter old EBITDA data, what about Square?

Square needs few weeks of observing the business during it’s normal daily operations, before it can come up with with better loan proposal, that if agreed, is deposited the next day.

Think about it. Square has a granular understanding of how business is doing at every hour, live. Which tables are usually occupied at certain hour of the day, average spend per client, inventory levels. This is great, but here’s the kicker:

Square can benchmark and learn how restaurant is doing in comparison to same street, district, city, or even state. And remember, the more data points (businesses on board, time in service) the better and more accurate is business risk evaluation. When that gets laser-accurate, all you have to do is decide your margin.

That’s the same reason people don’t get market pricing on Tesla. Think of car insurance and telemetry data it can observe and learn from.

Square’s Business Model

Square currently has two major ecosystems: Seller and Cash App. There’s quite good CNBC video on Square’s operations from 2019 October:

Empowering Business Owners

Tools should get out of the way, so people could focus on what matters most – their business – Jack Dorsey

We have already touched on a lot of aspects of what Square does in its seller ecosystem. To sum up:

- Square Capital – provides loans to SME’s;

- Aligned incentives with fixed fee on transaction (Square in incentivized to help their sellers grow);

- Hardware (terminal, card readers, registers, contactless solutions, stand) sales;

- Software solutions (payroll, team management, inventory, sales, business analytics insights, virtual terminal, loyalty and marketing, e-shop builder)

- Developer Platform (in-person payments, online/mobile payments, e-commerce)

Overall Square offers more than 30 distinct products and services aimed at helping merchants grow their business.

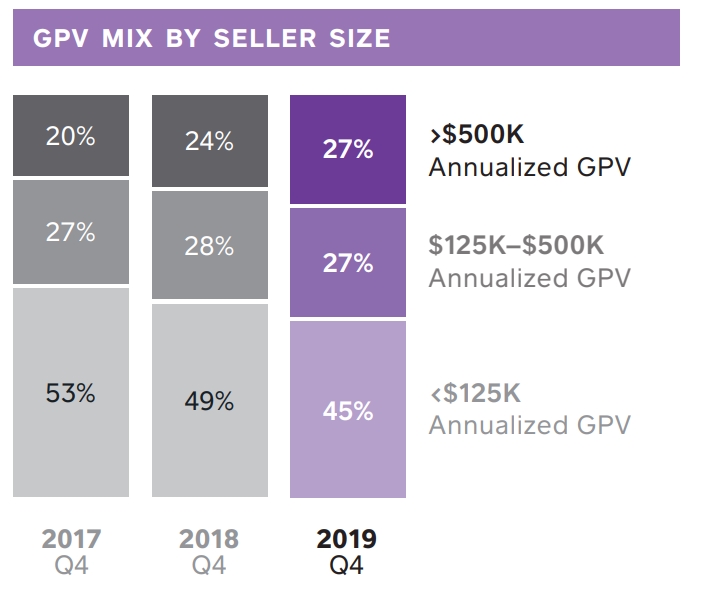

One thing worth noting is that, Square is increasingly on-boarding larger businesses. Which in turn generates more money for Square. In the end of 2014, sellers generating over 500K USD gross processed volume stood at 9%, while at the end of 2019 larger sellers were already at 27% from total processed volume.

Payments

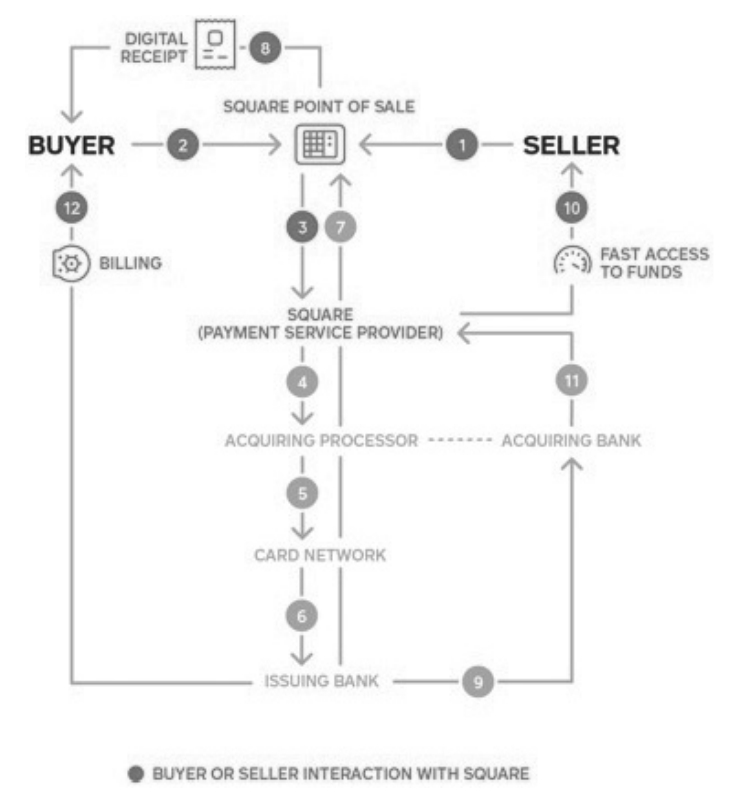

Basically, Square acts as a payment aggregator. The more scale Square has, the more money it can move at maximum efficiency – meaning – inside its ecosystem -changing internal database entries of who owns what at any given time. As for the settlements outside of the SQ’s ecosystem things get complicated.

Some terms:

- Payment Service Provider (PSP) – that’s Square, which also acts as Merchant of Record;

- Acquiring Processor – back-end technology provider. Technological bridge between card networks and the issuing bank;

- Acquiring Bank – bank associated with acquiring processor, maintains relationship with card networks;

- Card Networks – Visa, MasterCard – providers of network infrastructure flow from acquiring processor to issuing bank;

- Issuing Bank – bank that issues the buyer’s payment card.

Behind Square’s Payment

- Once the buyer is ready to make a purchase, the seller initiates the transaction using the Square Point of Sale and presents the buyer with the amount owed.

- For in-person transactions, the buyer pays by swiping or dipping their payment card, or by tapping an NFC-enabled payment card or mobile device on a Square Reader, Square Stand, Square Register or Square Terminal, as applicable, which captures the buyer’s payment information. For card not present transactions the seller can either use the customer’s card on file or the card information may be keyed in manually by either the buyer or seller. Such card not present transactions may be initiated using the Square Point of Sale app, Square Invoices, Square Virtual Terminal, or the seller’s eCommerce website.

- Square initiates the transaction, acting as the PSP.

- Square passes the transaction information to the acquiring processor. Square pays a fixed per transaction fee to the acquiring processor.

- The acquiring processor routes the transaction to the relevant card network affiliated with the buyer’s card (e.g., American Express, Mastercard, or Visa). Square pays a variety of card network fees, which includes card service assessments of roughly 0.10% to 0.15% of the transaction amount.

- The card network then routes the transaction to the issuing bank, which authorizes or declines the buyer’s payment card transaction.

- The issuing bank sends a notification back through the card network to the acquiring processor and the Square Point of Sale to inform the seller that the transaction has been authorized or declined.

- If authorized, the Square Point of Sale may send a digital receipt for the transaction on behalf of the seller to the buyer. The digital receipt enables a persistent communication channel that further allows the buyer to provide feedback to the seller.

- Upon settlement, the issuing bank disburses funds to the acquiring bank through the card network for the final transaction amount. The issuing bank is reimbursed an interchange or merchant discount fee as both a

percentage of the amount of the transaction and a fixed fee per transaction, which together average between 1.5% to 2.0% (this is COGS on transactions revenue) of the transaction amount. However, this percentage varies significantly based on the buyer’s card type, the transaction type, and the transaction size. - Square transfers funds to the seller’s bank account, less applicable fees as charged by Square. Square provides sellers with fast access to funds, typically disbursing funds within a business day after the date of the transaction. Deposits use Automated Clearing House (ACH) transfers, or leverage the same day Instant Deposit service for an additional transaction fee.

- The funds are settled from the acquiring bank to Square, typically in one to two business days after the date of the transaction.

- At the end of each monthly billing cycle, the issuing bank provides a statement to the buyer including all applicable monthly charges. The statement includes a reference to Square as the merchant of record on the billing statement as a prefix to the seller name (denoted as SQ).

No wonder financial system is so closed.

Maturing Gem: Cash App

According to figures from the Federal Reserve, some 22 percent of U.S. households, representing about 55 million adults, were considered unbanked or underbanked in 2018. – Bloomberg

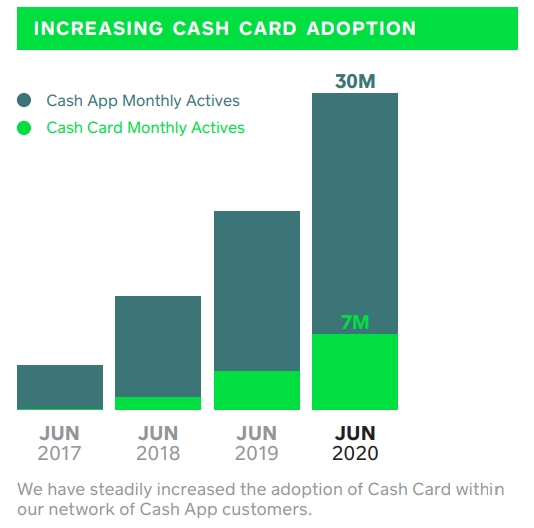

After gaining traction in commerce, Square started addressing another painful area: financial services accessibility to everyone. Cash App was released in 2013, and today still enjoys growing adoption.

Cash App offers:

- P2P Payments (sending, receiving, tipping using $cashtag, phone number or scanned QR code);

- Banking – ability to receive paycheck, tax returns and other direct deposits up to two days early;

- Cash Card + Boost – free debit card tied to Cash App. Paying this card – results in rewards (boosts), which are used as discounts at various partner places;

- Investing – fractional investing in stocks and Bitcoin.

Notes from 2020 Q2 shareholder letter:

“In the second quarter, we saw an increase in the number of products customers adopted within their first month after activation, including Cash Card, direct deposit, Boost, and bitcoin investing. Cash App customers who use multiple products have had a higher lifetime value: In the second quarter, Cash App customers who used two or more products generated 2x to 3x as much revenue as compared to customers who only use peer-to-peer payments.”

Network Effects

Covid Pandemic has propelled Cash App adoption astronomically. At the end of 2020 Q2 there were around 30 million Cash App monthly active users.

That is, around 9% of US population is using Cash App.

Classical definition of network effect is: value of the network increases with each new network user.

When 4 friends go out and share a tab for the evening and three of them already use Cash App day-to-day, the fourth friend is compelled to start using due to peer pressure and social conformity. Numerous of other examples could be painted, and each new user is indeed more valuable to the rest of the network.

Personal Cash Flows

Again I want to reiterate the importance of this data. When (Already?) / If Cash App becomes the default banking solution for people, Square sees all the inflows and outflows that are not cash based (and we all know we are on a long way to cashless societies across the globe).

Same story as with Square Capital, Square eventually will provide unmatched in industry offers (lower rates) for personal loans and even mortgages.

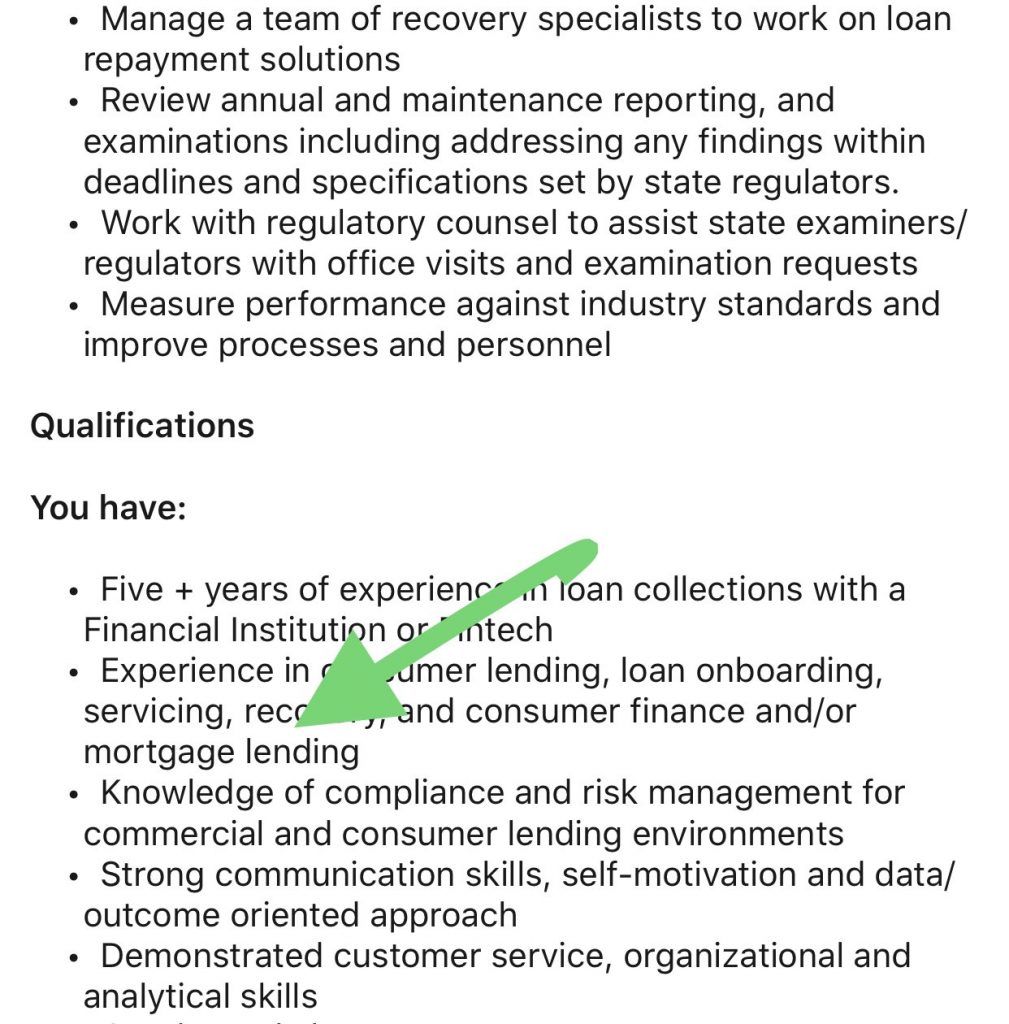

Sean Emory at AvoryCo has pointed Square had a job opening for Loan Operations Manager this summer:

Live risk profiling is the thing I would have expected from social networks in collaboration with financial institutions 5 years ago, but here we are today, and Square is pushing the envelope.

Stellar Marketing

Quickly I want to acknowledge something. Honestly, I have never witnessed such a creative marketing. Nowhere. Anywhere. Ever. These people are creative geniuses.

Each Friday Cash App hosts a giveaway event on Twitter, where people share their Cash App handles for a chance to receive money.

Engagement on these events is staggering. Often it hits Twitter Trending sidebar. Giveaway campaign is very clever, calculated. It increases engagement, fan base, adoption and ultimately life time value of users.

This is quite a nice write-up by money.com on the Cash App’s weekly event.

Teams’ creative visuals is not all, Cash App even pushed into gaming and started distributing money there!

Cash App Gaining Cultural Significance

Empathy: Cash App, due to its simplicity of sending and receiving payments has been widely adopted for people in need. Single moms asking for help to cover healthcare bills and similar stories get social momentum and shows wonderful application of accessible finance Square was able to deliver.

Charitable Causes and Celebrity Giveaways: I had no idea who the chick was, evidently that’s a huge star. And yep, #CashApp and #WAPParty was trending… For scale, her most popular youtube music video has 1.2 Billion views at the time of writing.

Music: There is a growing number of artists referring to Cash App in their lyrics or even track title. That represents a big generational change in the world of hip-hop, which, due to technological changes and other factors, has arguably had more impact on global culture than rock and roll and jazz did in the 20th century. Example below…

Do not forget we are talking about generational products. What seems alien to 50 year-olds is a must-have for freshly baked teenagers. Cash App managed to build all of this in less than a decade.

Sales & Profits

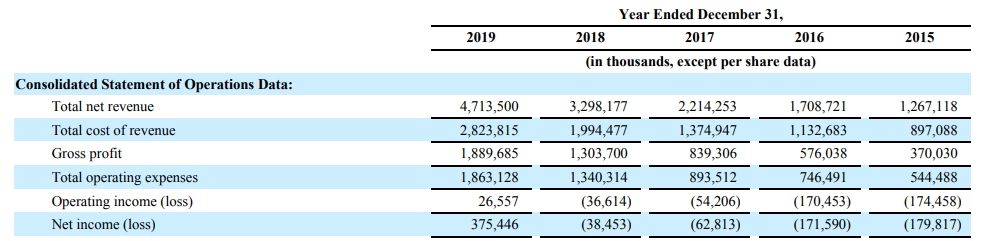

Square’s revenues have a “boring”, typical growth story. From 2019 10-K Annual Report:

Square doubles its revenue each two years.

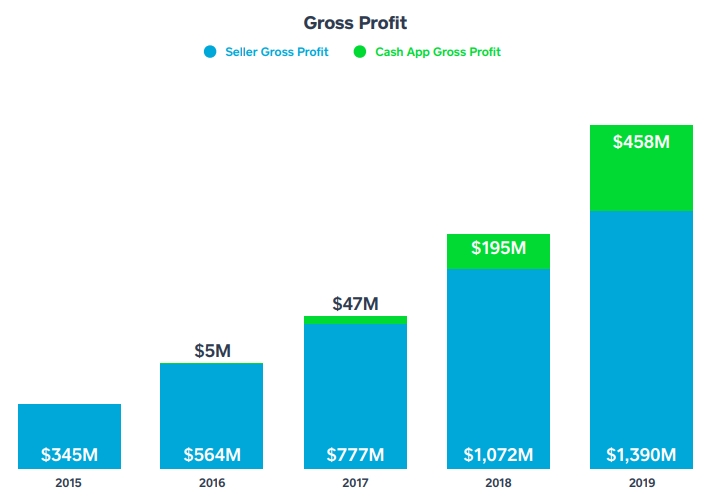

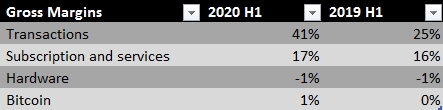

For gross profit I’ll use slide from 2020 March presentation.

That’s around 40% CAGR in gross profit growth.

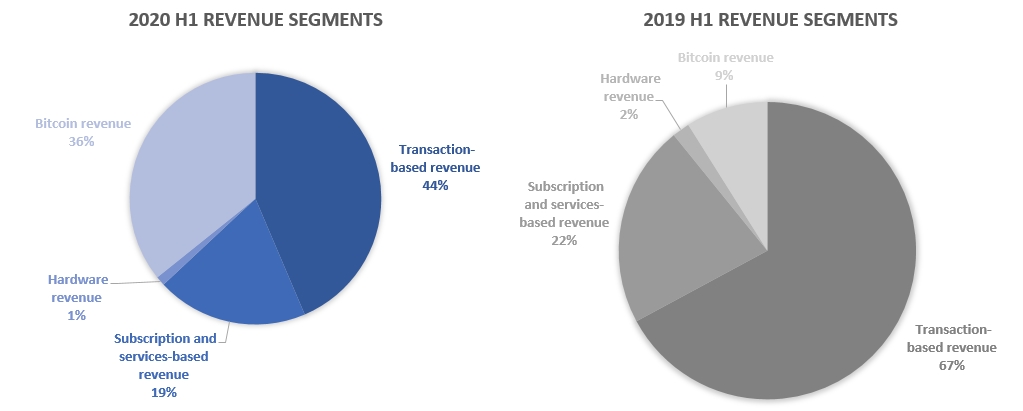

Now for most recent figures, let’s look at segment revenues and their respective profitability.

2020 recession shed a light and global awareness on global central banking response, and people are increasingly adopting Bitcoin as a hedge against systemic risks. In 2020 H1 revenue mix Bitcoin sales accounted for astonishing 36% and respective 620% YoY growth. Square is literally contributing its part in delivering Bitcoin to masses.

How profitable are these segments? Transactions are the most lucrative business, and has been hurt during 2020 Q2 lockdowns naturally. For reference, full 2019 transaction gross margin was 60% (2018 – 70%).

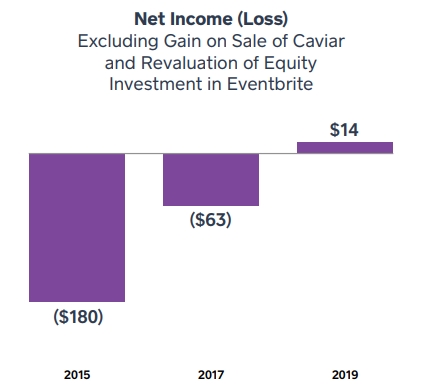

Net profit side: nothing spectacular so far. As of 2020 H1 trailing 12 month net profit is again under water.

Global Operations

Square currently operates in USA, Canada, Japan, UK. Company does not disclose revenues by geographies.

In 2020 June Square acquired Spanish P2P payments app Verse, which is an obvious entry to European market.

Square has communicated that it does not intend to push elbows into saturated and functioning markets were payment problems are already somewhat solved (China – AliPay, WeChat; India – Jio Platforms). Square is interested in entering markets with obvious pain points for both sellers and individuals.

Another note: it takes a lot of time getting required local permissions, deals with local issuing banks. Jack has noted Bitcoin could clear a lot of these nationalist boundaries.

Side note: Jack Dorsey spent half 2019 year in Africa.

Founder Profile: Jack Dorsey

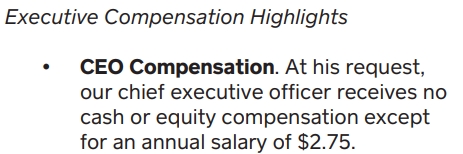

Jack is truly an inspiring and mission driven figure. Since we are landing here from financial side, let’s look at Square CEO compensation:

Like Elon, Jack is not incentivized by money. During Covid pandemic he has pledged 1 Billion Dollars to various charities in Square stock, which at the time of writing is now worth around 2.8 Billion USD.

Whole thing is as direct and straight forward as it can be. Every donation is public and a simple google spreadsheet.

Jack is active meditator and has also went through Vipassana retreat. The foundational values he planted in Twitter and Square extend to spiritual and societal consciousness levels. That’s truly admirable, and may serve shareholders on product quality being delivered, because products were designed for its users, not for profit.

Jack Dorsey is an engineer, builder, maker, dropout, humble idealist and … hacker. In early career Jack Dorsey, for his second job broke into DMS – Largest Dispatch company in US, exposing vulnerabilities and presenting his own crafted dispatch system written in C to company CEO.

Jack was once asked whether he sees himself as business man or an artist. He answered something along the lines of:

“I would like to think of an artist, but that is something that should be valued by others, based on work”

Mantra: “Do whatever it takes to make it work“

As an old school hacker, Jack is a huge supporter of Bitcoin. This is what his Twitter profile look like:

I encourage everyone, regardless investor or not, listen to at least one long form interview with Jack. Out of several I went through, I recommend this one, filled with positive vibes from UK.

Competition

Make no mistake, global payments market honey pot attracts a lot of hornets. Even prior to listing, when choosing investors Square’s executives have been warning VC’s of a wild ride ahead, so investors would keep cool-heads when major developments would unravel.

Seller Ecosystem Competitors

- On merchant side Square was able to fend off attacks from Amazon as explained by Jim McKelvey in this interview in the early days. Adyen – Netherlands fintech is a growing payments company with global operations;

- Shopify, Big Commerce, Wix are direct competitors when it comes to e-commerce building; it’s not yet visible, but soon enough Facebook will join that band;

- Stripe, which should IPO eventually provides a payment gateway to application developers and competes with developer tools offered by Square;

- It’s almost a given, that giants like Apple, Facebook is/ will be in payments too.

One note from Square on Apple Pay competition with payments in messaging:

We have observed, people like single purpose apps.

Personal Banking Services Front

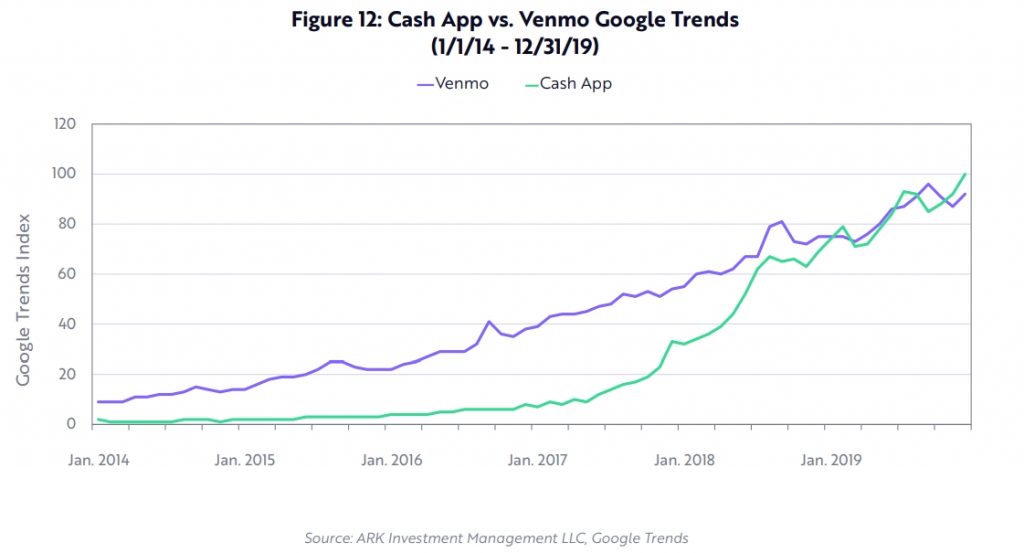

Of all Revolut’s and N26’s fintechs out there, Paypal’s Venmo stands as a direct and most serious competitor. Paypal market offering (Venmo app) has been released 2009 and had significant head start (CashApp released 2013).

Considering the Paypal’s massive user base, potential to squish Square seemed reasonably high. The fight between two rival personal finance apps would take a lot of effort to cover and I doubt I would make a better job than Maximilian Friedrich from Ark Invest team. To learn more about Venmo vs Cash App competition I encourage to read his paper.

In 2019 April PayPal revealed Venmo had 40M users. Cash App as of 2020 Q2 had 30M. But momentum is on Cash Apps side.

Square’s Edges

No, it’s not linear (geometrical pun intended). In another interview Jack was asked to differentiate Square’s offerings and he was prepared with 4 points:

- Focus on speed. Fastest approach to funds for people.

- Cohesion. You have all the tools that serve the most critical needs in one app.

- Elegant.

“Putting a register on my counter makes me feel proud. Validates my business. I’m in business now.” – Square’s sellers

4. Self-serve. Merchant does not need Square’s help to get started.

Cards in SQ’s sleeves

Square Crypto

If Internet is a worlds’ nation, Bitcoin is its’ money.

Square has an initiative Square Crypto, which pushes the envelope on next generation payment technologies. It actively contributes to Bitcoin and Lightning Network protocol development, supports no-namers, that help bring future into today.

Damn this community is beautiful…

Square has patented real-time fiat-to-crypto payment. In an admirable move to foster innovation in crypto ecosystem, SQ recently launched Cryptocurrency Open Patent Alliance (COPA).

To settle a payment, Square is charged up to 2% on the outside legacy systems. Payments on Lightning Network can scale at nearly 0 cost. More on Lightning Network applications as retail payment system in this wonderful article.

I can only speculate what applications are brewing in Square’s CTO’s head, but I am excited about the direction. Whatever Square does, scale, that it gains everyday will help push any game changing or improving updates in the future.

Square’s Growth Trajectories

There are at least three stages of growth for Square, and currently we are mainly in the first phase. They don’t have to be sequential.

- Horizontal growth – that’s network growth for two ecosystems. On-boarding of new sellers and consumers in large fragmented landscape. Also creating new products within each ecosystem to expand Target Addressable Market (TAM);

- Within each ecosystem optimizing cross-selling opportunities deepening relationship with customers;

- Bringing these ecosystems together to close a self reinforcing flywheel.

Seller & Consumer Ecosystems Flywheel

Square is in unique position among competitors to be on both sides of the counter. Recent launch of payroll to Cash App is one clear example of fostering this relationship.

Why should people wait for their paycheck? – Square rightfully asked.

Because businesses still run payroll on a fixed schedule, employees are paid days or weeks after they’ve worked. We created On-Demand Pay for employees so they can access their earnings when they need them, as soon as their shift has ended. For employers, it can take up to four days for payroll funds to move from their bank account to their team. With Instant Payments, employers can now fund their payroll instantly, getting money to their team faster – Caroline Hollis, GM of Square Payroll

In the future, I wouldn’t be surprised to see ability to invest in your local farmer’s expansion, if he used Square Capital for his growth ambitions. All the necessary risk profiling is in Square’s hands as talked before. On consumer end – increased engagement, return on spare cash in Cash App and sense of community.

Boost programs for investors in local bakery? Limits are drawn only by creativity.

Recapping Square Inc. (SQ) Thesis

I won’t go into details of purchases, which I usually did under such long-form articles. These are archived in my social media posts.

Some highlights:

- Square has a strong moral foundation, excellent product quality and delivery, alien-class marketing and an enormous size addressable market worldwide.

- Competition in payments space is fierce and will be growing. A decade of experience in the market positions Square if not dominate the space, at least take a sizable share of finally evolving banking industry.

- Cultural footprint the Cash App has already achieved can not and will not be negated in the future. Brand has been strongly established and with changing generations trend will continue.

- Square Crypto endeavors might drastically cut network costs in the coming world of digital ledgers. In the case of systemic credit risks, Square is among the most prepared public companies to aid its sellers and users worldwide (just a calculated intuition);

- “Early days” according to CFO Amrita; huge opportunities in: gaining scale, cross-selling in-between Square’s ecosystems and creating new products that bridge gap between sellers and consumers.

Leave A Reply