This is an annual review of current portfolio positions. You can find a previous annual overviews here. This year I expanded more how I see US equities going into 2024, but let’s start with portfolio first.

Stocks Portfolio

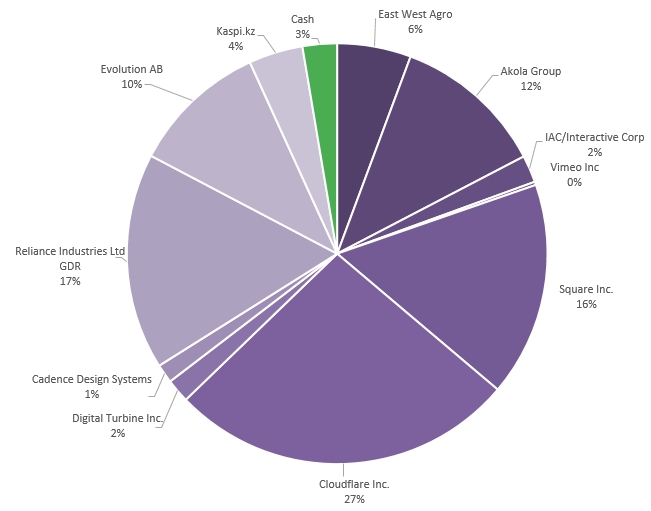

A positive year. Performance and comments on its flawed calculations – in the end. At the closing prices of 2023.12.31, the portfolio looks like this:

Tech names rallied into year end on lower yields expectations and fundamentals showing end of saving season. My companies are quite diverse, so are their stories in current environment. As usual, on each of these below.

East West Agro (Ticker: EWA1L)

Stock gained +4.35% in 2023. I had rebased cost basis (sold, bought within days) in 2021 for tax reasons and current CAGR is above +30%, however adjusted, taking original purchase date and cost, my position is (incl. dividends): +21.3% and +7.4% CAGR.

Funny enough, I’m still a shareholder due to failure at bank when I was submitting shares for sale through buyback. It was last buyback of 2023 and possibly 2024 given their ambitious capex for service center build out. Broker from bank phoned me and suggested to buy my shares for the same 17 Eur buyback was being executed, but I changed my mind and held on to shares.

Fantastic 2022 result (+20% revenue, +65% net profit) was reflected in high yield dividends and shares making rounds above 20 EUR. 2023 H1 looks stable, full 2023 likely within +/-10% of 2022 for revenue.

EWA1L Position Reduction in 2023 End

Primarily due to taxes, I’ve sold ~25% of my EWA position at average price ~16.9 locking above mentioned profit for this stake in last week of 2023.

Akola Group (Ticker: AKO1L)

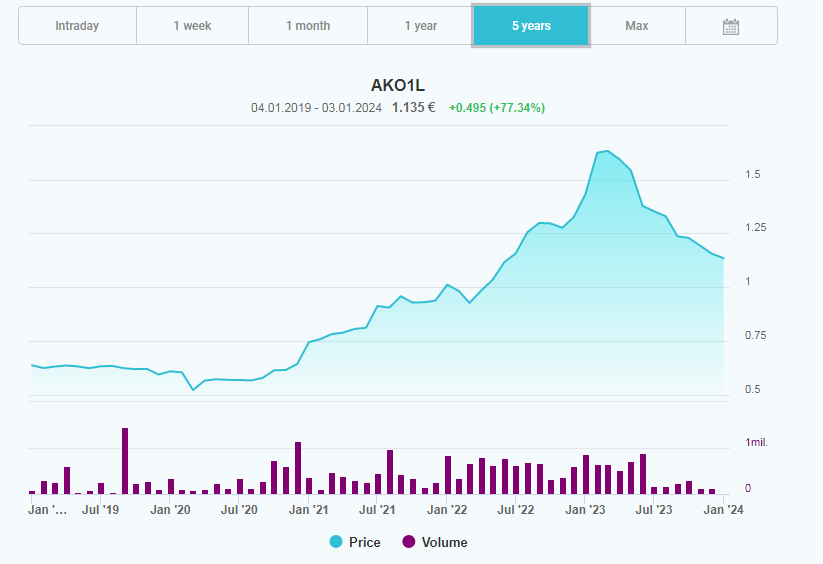

Group equities declined -15.3% in 2023. My position, incl. dividends currently stands at: +70.9% or +17.0% CAGR.

Group changed brand to more international name from Linas Agro Group (LNA1L) to Akola Group (AKO1L). Tradingview is lost, so nasadqomx chart instead.

Their 22/23 H1 was astronomically good. Market reflected in lifting stock to ATH. However cycle turned: cheap fertilizer from 2021 inventories ended, wheat prices crashed on not materialized famine scare (Black Sea blockade).

I like food products segment alot. Higher margin, bringing stability to group profitability. Works with clients to develop products. Perceived sale process – is from high demand side. Solid dry products portfolio share in EU markets and widened markets with acquisition from Auga Group (Auga brand to be changed within next ~6 months, for local shoppers reading). Lots of synergies still being discovered.

23/24 Q1 is “return to normal”. Nothing spectacular, but question remains whether AKO1L is undervalued. So I sketched out a simplified valuation to test it.

Akola Group Valuation

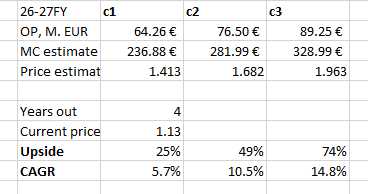

For their financial 22/23FY revenues were a little short of 2 Billion EUR. CEO Zubas in interview to vz.lt said they expect revenues of 3 Billion in 2027 (4 years out). Some assumptions:

- 1% annual stock dilution (very likely less in reality);

- 15% revenue target miss (2.55 Billion);

- no market reaction (theory vs Baltic inefficiencies) to Group’s higher margin business;

- management continues to be prudent about it’s working capital management (debt is not a problem as it was for years);

- using simplified and sensitive historic market cap / operating profit (MC/OP) ratio;

- not including dividend (~+2% annual, 20% of net profit policy).

Between 12/13 and 22/23 MC/OP average is 3.69. Share count in 26/27FY: 167,626,668. And then three cases (c1-3) for operating margin (OPM) for 26/27:

- c1 OPM = 2.52% (historic average);

- c2 OPM = 3% (stated in annual report, LT goal >=3%)

- c2 OPM = 3.5% considering economies of scale, learnings from acquisitions, conservative management.

And I get:

Saw the trading volumes? It’s incoming dividend season in Baltic market, AKO1L is of no interest to anyone right now. Have not yet acted on it, but I definitely want a larger position.

IAC Inc. (Ticker: IAC)

In 2023 stock: +18.8%. My position in deep red: -70.6% and -33.5% CAGR.

Finally Joey put IAC’s money where their mouth is and bought back some shares at both IAC and Angi layers in 2023. Dash Meredith, aside from advertising downturn, had another punch this year from generative AI and potential implications. Papa Smurf’s Diller face was seen in WSJ about publishers collaborating to fight for their rights against gen AI firms.

Joey at Angi’s helm says reorg internals is a priority before effort is made at building back up revenue growth. That’s the main anchor for Angi in my opinion. Investors can buy unprofitable growth if it’s … a growth.

Poor MGM got hit my cyber attack in 2023 H2. From shareholder letters, smaller bets like Vivian seem to be doing fine, but neither maturity nor IPO market is ready for their value realization. Hold.

Vimeo Inc. (Ticker: VMEO)

Spun off from IAC, cost = 0. Using easier mental accounting, let IAC position handle the cost (market adjustment down).

Zoomed in more, that others, otherwise recent moves are overshadowed by falling 200 MA distorting vertical axis scale.

Listened to most earnings calls since spin-off. Anjali is out, new CFO is solid and knows what investors want to see. They got their shit together, self-serve is decline, enterprise (primary focus) on the rise. However due to revenue share in self-serve for longest time revenues post covid were falling, driving down share price.

Last quarter was the first with sequential revenue growth. Initial market reaction was +20%. Again. Growth is what market wants to see in these companies. Watching.

Block Inc (Ticker: SQ)

Block closed year at +23.0%. While my weighted position performance is: -18.0% and CAGR of: -6.0%

Have not updated my numbers for a while, skimmed reports, listened to every earnings call. While everyone, including me are not happy with the price they paid for AfterPay (major dilution), contrary to others I saw end-user and seller base acquisition and ability to cross-sell into wider SQ ecosystem.

Jack must be furious how Twitter slipped from his vision for Twitter over the years and I believe he learned the lessons. He’s now streamlining Block and Square specifically.

I’ve highlighted CFO goals in 2022 review. Although the progress is slower than I’d had liked, but their are executing towards their defined rule of 40: top line growth + adj EBITDA (if not mistaken), keeping share count in tact. In last ER they also announced 1 Billion USD stock buyback. Consider it a stop on share count increase. Baby is going into maturity.

Organization grew tremendously throughout 3 years I’ve been a shareholder, Block acquired and built many more products in-house. There should be enough room for efficiencies and I know their business can churn nice cash flows. A sleeper segment of CashApp’s Bitcoin txs should also show strong renowned growth for Q1.

Cloudflare (Ticker: NET)

Cloudflare gained +84.2% in 2023. As for my weighted position it stands at: +10.8% and +3.4% CAGR.

Gaining intuition on this one. Cloudflare traded down to EV/NTM range I described in previous annual review (November tweet) after they first posted growth below 50%. If I remember correctly, throughout 2023 their multiple did not dip below 11. Investors know, so do I.

I didn’t like public attacks on ZScalar at all. Low class act, especially considering ZS grows faster for most quarters I have in recollection comparing the two. I suspect ZS sales org is stronger and they had made more inroads into federal purchases. Well, in last ~6-9 months, Prince is happy about the changes and efficiencies they see after swapping sales heads.

Product velocity from blog posts might have slowed a little, but that might be my busy-not-visiting-that-often bias. Tailwinds from AI craze. A step more powerful inference going away from end-device will obviously gonna be on the edge. Amazing foresight by Cloudflare building racks with reserved space for GPU’s, saving CAPEX now, leaving that sweet gross margin stable.

In last earnings call I heard slight optimistic note. Retention may be bottoming at ~115-116%. Sequential 100bps improvement. Cashflow, operating profitability now positive and expanding. Hold.

Digital Turbine (Ticker: APPS)

Digital Turbine declined -15.2% in 2023. This is heavy anchor on my portfolio as well. Current weighted position: -78.2%, or -45.2% CAGR.

Yeah, ouch. Dragging feet over multiple headwinds:

- advertising downturn;

- global smartphone sales;

- high debt after 21′ acquisitions to integrate vertically;

- below expectations Single Tap ramp up(?);

Recovery unstable, past quarter again showed sequential decline in revenue after growth quarter prior. Not what market wants to see. Market possibly put another discount on new device form factors (AR glasses, headsets).

I like the business. Listed tailwinds in last overview. If Digital Turbine was in fact a mistake, I’m having a hard time drawing conclusions from this one.

Cadence Design Systems (Ticker: CDNS)

Cadence Design Systems had another excellent year climbing +69.6%. In portfolio, CDNS position: +192.7% with +38.6% CAGR.

You may remember I sold majority of CDNS in 2023 due to personal reasons and I expected next sanctions package against China semis impact Cadence revenues. That did not materialize, and quality has its price. Lower yield expectations added fuel to the fire. Sad to see reduced position, this is a wonderful company.

Several days before new year, rumors on street spread about Ansys and Synopsis merger (Synopsis acquiring Ansys). There aren’t much major players in simulation. Interested if FTC approves it. I don’t expect neither short term, nor long term impact to CDNS if deal goes through. Moats in the sector are wide and deep.

Reliance Industries (GDR Ticker: RIGD)

Marginal +1.6% change YoY in market, but with big asterix. In portfolio, RIGD position incl. dividends stands at +17.4%, +5.1% CAGR.

Asterix is a spinoff of Jio Financial Services in 2023. I’ve written a thread on socials, won’t rehash why Reliance did that. Reliance Industries shares owners had received JIOFIN stock, while GDR owners like myself eventually received proceeds from JIOFIN sale as soon as it was listed (based on GDR issuers in London). Sale proceeds/dividend amounted to ~10% yield based on my original cost.

Last year I mentioned Reliance moves in somewhat orderly waves and in 2023 I may try to swing trade it. I did not have time for that, and JIOFIN spinoff messed with my mental model of what Reliance typical trading range should look like.

Again, some time passed since I last updated my key metrics by segment and I don’t have clean numbers. I do look at every segment report though. Jio, Reliance Retail thesis playing out nicely, though I would had expected for margin to expand more strongly with scale. Maybe that’s an optimization issue down the line…

Petrochemicals doing fine, especially with cheap Russian inputs. Indian government had put one-time solid tax to even out Reliance performance from this business line. As I mentioned before – I very much like their own gas extraction. They recently shared, that their K6 offshore field is nearing peak load and Reliance in general is supplying 30% of India’s natural gas (30% of extracted within India). Revenues, EBITDA scaling up nicely.

For context, most recent quarter consolidated EBITDA rose +30.2% YoY. And this ain’t no mom and pop corner shop, but a conglomerate.

Evolution AB (Ticker: EVO)

Evolution rose +18.4% in 2023. In portfolio, position stands at -23.8% or -10.3% CAGR.

I believe it was revenue growth below expectations for Q2 – what caused EVO to correct down from 1400 in mid 2023. EU consumer is frail in my opinion. RNG does not perform, management keeps iterating double digit growth but so far RNG segment does not budge. Recently China launched another probe into gaming. Evolution shareholders reacted as well, though this time casinos, gambling was not targeted.

Of recent exciting things I’ve seen: Crazy Time game show launched in US and of course everytime you look at new earnings release and see that absolute unit of an EBITDA margin.

Kaspi.kz (GDR Ticker: KSPI)

Kaspi.kz rose +28.7% in 2023. Including dividends KSPI position in portfolio: +10.0% or +10.8% CAGR.

Recently significantly increased my position in KSPI. Dipped toes in Kazakhstan waters in start of 2022. Water is fine and Kaspi registered with SEC for US listing. If that were to happen, valuation would likely change quite a bit.

For 9M of 2023, consolidated revenue: +53%, net income +50% (44.7% net profit margin). Relations with government are excellent. Tokayev’s (good guy) office stands behind Kaspi, views Kaspi as transparency driving force, expands government services offered within kaspi ecosystem. Rare symbiotic relationship, helping grow business moat.

While Kaspi may eventually penetrate Kazakh market, another tailwind shared with Reliance is growing purchasing power and usage frequency. Kaspi already has globally leading engagement for a SuperApp, right after China’s WeChat.

Profitable startup that grows considerably, pays great dividend and buys back shares (GDRs). What’s not to like?

Portfolio Return in 2023

Annual mantra: I don’t like this figure and I don’t really know how to calculate it correctly, because my portfolio “cash” is a liquid pool of personal finances as well and all it entails (larger purchases or savings). For instance if in given year I sell some position completely and spend proceeds outside of portfolio, comparing against prior year which included full position is not correct when comparing for annual “performance”.

Regardless of above comments, portfolio value change from 2022.12.31 to 2023.12.31 is +14.0% (-44% in 2022). Not owning NVDA, MSFT, of course I under performed S&P500 again, which gained +24.2% in 2023. Not owning MSFT in portfolio may look weird, considering I’ve written this, prior to hype around generative AI, but… family members do.

Markets Outlook Going into 2024

Bonds

Looking at US treasuries yields for 3 months, 2Y and 10Y – only 3M gained 100bps. Longer term yields barely moved YoY. What I read from that:

- Market did expect FED going so high with rates;

- LT yields priced cuts throughout whole 2023, and they are definitely closer to truth now than a year ago;

- Ongoing longest inversion (?) between 2Y/10Y reflects shit not hitting the fan yet.

I think majority of market participants are in disbelief economy could be driven out of abnormality with minimal damage.

Resilient Consumer

I kept seeing declining savings rate, credit card delinquences very slowly creeping up in 2023. Currently we have real wage growth adj. for inflation. Why would savings rate fall even further? Besides, seems everyone forgot positive savings rate is still … saving after all household expenses.

While delinquencies might talk about most frail demographic, but that may not necessarily be a fraction of population that tips the ship.

Oil

Somehow world rebalanced, or at least so it seems. Oil heads always talk about under capitalized sector, squeezing ESG idiocy, Saudis call on speculators, but price – manipulated or not – is my fact. The longer at ~70 USD WTI, the more I believe that’s true price.

Have you heard discoveries in Guyana, Israel, Turkey – Greece disputed waters. Seems everyone who thinks, surveys and new deposits keep popping up. OPEC power was clearly waned as 2023 showed.

So either we are having a supply glut, of mere market competition as everyone wants to strengthen their balance sheets by increasing extraction or there’s a real demand destruction. While reshoring, decreased demand from “cheap Chinese plastic” movement in ocean as I call it post covid supply chain waves, EU de-industrializing may definitely play a part, I’m more on the side of supply-led pricing battle.

If that is the case, energy crisis should not occur in next 6 months.

Fiscal & Unemployment

Have you seen the monstrosity of a buildout US is doing? “Inflation Reduction Act” has caused massive action. Shit loads of contractors, suppliers, transporters have work to do. Manufacturing is returning to US in a big way. Each of those cogs are moving, hiring, and economy keeps humming.

Government spending is not sustainable, of course – never was. I don’t calculate how this would playout on decade-scale. I read the thread in Q3 by professional FED watchers – they indicate gov financing problems in 2024 Q1-Q2 junction. By that time FED will have to invent new patches to fix a small problem by accidentally creating free money for JPM-scale players or just outright ease.

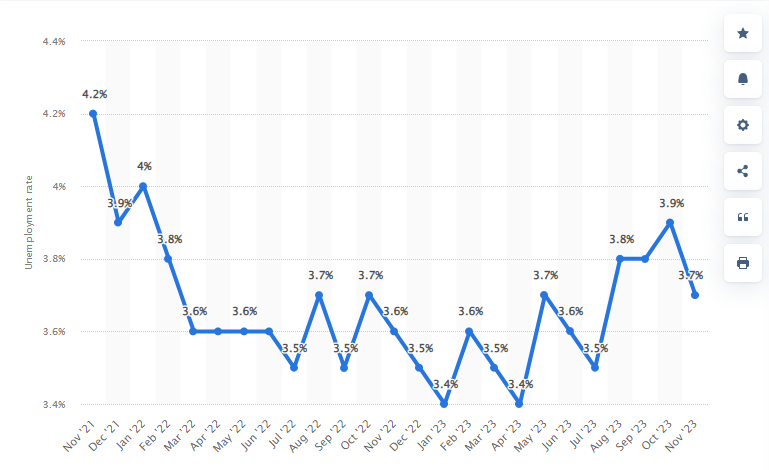

What about much watched unemplyment? Quite a few folks quit workforce into early retirement. All those new US factories will have to be filled with people. Uneconomical? Government will subsidize and make them economical. Recent report showed only slight decrease in new job openings. November’s 3.7% unemployment lower than 3.9% month prior.

I don’t know… People remember GFC. If unemployment rises, that’s game over (except for global financial cascade). That’s a vivid memory that scares, not the data.

US demographics is a huge tailwind going up to ~2035. Quite a bunch of population are in their most productive age. Check Ciovacco Capital research on that one.

Also, don’t forget – economy is being dressed for election.

Cuts

Concerning inflation I believe:

- inflation will not go above 4.5% without external shocks;

- inflation will not come down below 2.5% for quite a long time;

- utilizing globalization was cheaper than building your own, that, by definition must be more costly, excl. transportation.

I believe all the above to be true for at least full 2024. Which means, FED would still have positive rates if it cut 200bps tomorrow. (5.25 – 5.5 fed interest rate range vs last 3.1% inflation read).

Emerging markets, that lead hikes ~1.5 year ago, are already leading in cuts. FED does not want to look pussy, we get that and market is very patient. Bond yields prove that. My base case, that by 2024 H1 end, there’s at least one cut.

SPX valuation

I’ve heard quite a few earnings calls with “efficiency” in it. Higher productivity, less sleeping at the wheel. Cost of capital makes the head think. Gen AI still in exploratory mode, but will definitely increase productivity some time in the future

Huge pile of cash owners are parking their piles at market funds and rapidly compounding that. Of course that’s a privilege of companies with strong balance sheets (Magnificient 7 + Berkshire?). That’s free EPS right there.

I don’t hear these bullish points often…

Historically, expected return on SPX is abysmal (see John Hussman work), until you factor in soft landing, yield curve normalization and of course – cuts. I expect each dip to be bought and that secular bull market is in place. I think valuation normalization was done twice this decade already – covid and SVB banking crisis fears.

The problem and abnormality, in my opinion is shit loads of paper. There is simply is too much money. Parking money in strongest economy’s strongest companies does sound … prudent. And I’d imagine there’s quite a few sovereign wealth funds ignorant about cycles or valuation.

SPX could have prolonged negative quarters if anti competition forces break big tech businesses and profitability in some way, but that’s not a worry for H1.

Ignorance?

Does price follow narrative of narrative follows price? Both co-evolve as new data comes in. Currently that’s my outlook and I admit I have not used a lot of numbers to support my thinking, but I tracked sentiment up to the very end of 2023. While bull voices are not established yet and lack self-confidence against loud bear voices, I have found and mentioned above few blind spots in bears’ narrative.

For 20-30% correction, pretty terrible things have to show up, I doubt purely valuation correction thesis is supported if my assumption about funds waiting for a dip is correct.

And of course you should be mindful I was only focusing on US picture. Internationally my visibility is way more muddy, spotty and diverse.

Thank You for reading. Make 2024 count!

Leave A Reply