This is an annual review of current portfolio positions. You can find a similar overview made last year here. Before 2022 H1 one might had thought 2021 tech rout was bad. Terror in investing math is an active can decline 10% daily ad infinitum.

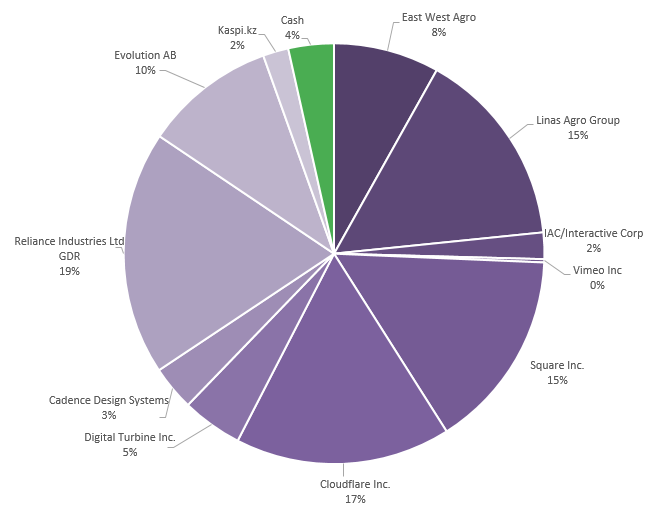

Current Stocks Portfolio

Having a heavy weight on tech dragged portfolio down, but to my surprise 4 out of 11 portfolio companies have reached ATH or are currently traiding at the tops. Gotta love that diversification…

At the closing prices of 2022.12.31, the portfolio looks like this:

Without further ado, let me briefly walk you through my thinking on each of these companies.

East West Agro (Ticker: EWA1L)

Position had a price rebase in 2020 where I fixed to cost at the bottom. I initially opened a position in 2018.01. Currently incl. dividends, it’s +23.7% or +5.9% CAGR from original (2018) cost. In 2022 EWA1L stock gained +20.1%.

Things are developing super slow in EWA stock. Agro equipment sector has a huge inertia. To years of decent crop yields (weather conditions), ultra high prices for 2022 and suppressed farmer investments for 3 years up to 2021 – EWA’s business is booming.

Their stock buybacks are erratic and can’t be relied upon. Selling on open market costs a serious spread. Besides, it still trades at 6.3 EV/EBITDA (2022 H1 TTM) with double digit growth and raised guidance for 2022.

Patiently waiting for new buybacks, 2022 results. Kremlin’s war heightened worries for grain / energy / fertilizer, but going into year end everything seems suspiciously stable.

While writing this post, announcement dropped:

Market of new tractors, dedicated for professional farming in 2022 grew 15%, EWA market share was 18,3% (2021 – 17,5%). In 2022 EWA customers registered 171 units of Massey Ferguson tractors, 21% more than in 2021

Linas Agro Group (Ticker: LNA1L)

Current position performance in portfolio: +97.4% or CAGR of +40.7% (incl dividends). During 2022 LNA1L stock appreciated +41.1%. Note: recent tax-purposed move, which increased overall position cost.

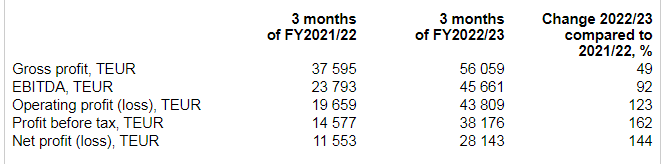

In last year review I sketched a 1.2-1.3 EUR target price post KG integration. Appetite grows while eating as they say. Linas Agro rode commodity cycle of 2022 really well. 22-23 Q1 was another banger quarter, ~doubling EBITDA.

Everyone understands results are “one-off”. My materializing contrarian view: normalized results what combined group can earn in stable market conditions are considerably higher than what market expects of LNA.

No current plans to exit LNA1L. Besides it serves as an important diversification role.

IAC Inc. (Ticker: IAC)

Entering a world of pain.

Reminder: from initial purchase VMEO was spun off. Original IAC position performance is: -74.2% or -49.3% CAGR. During 2022 IAC stock lost -66.6%.

As of 2022 Q3 10-Q and 2022 end price half of market cap is cash and cash equivalents with over a billion left to employ. Sensitive to anti startup growing macro. Dotdash + Meredith story was really compelling before marketing dollars went poof. Hate Angi, love MGM stake with ample buybacks. Even if Levin (now as CEO of Angi too) makes correct capital allocation decisions this year, shareholder payback may be at least 2 years away.

A price of being a part-time investor. Let’s see where Levin drives my trust over next years, stuck anyways.

P.S. JPM has IAC as their best value pick for 2023 (H/T SleepCap).

Vimeo Inc. (Ticker: VMEO)

Spun off, cost = 0. Using easier mental accounting, let IAC position handle the cost (market adjustment down).

I don’t specialize in special situations and my ideas of Vimeo being a takeover target were a self-delusion.

I have previously suggested Anjali Sud, VMEO better start working on AI tooling ASAP before company is rendered irrelevant. I think we are 2-4 years away from decent quality video generation. Noisy prototypes are already here.

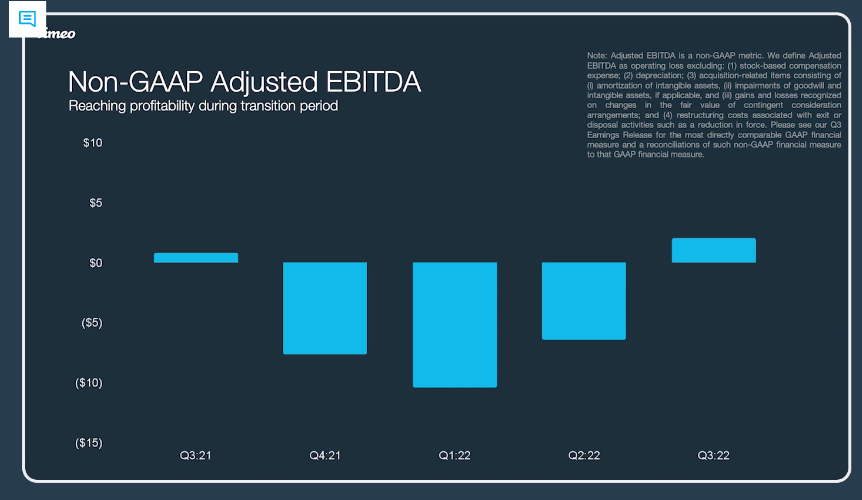

On a positive side, they changed CFO to Gillian Munson in the end of summer. She has a strong emphasis on profitability (like everyone else), and actually can deliver on it (unlike everyone else).

Non GAAP adjusted EBITDA is peak 2021, but it’s a direction I’m interested in. In 2022-2023 they are reorienting business to serve large businesses away from historically long relationship with creators. Love and hate some aspects of this move.

They struggle to grow in this harsh environment. I considered an exit at 4.5 USD at one point, but on absolute basis position is negligible so might as well have it as a tracker to follow business closer.

Block Inc (Ticker: SQ)

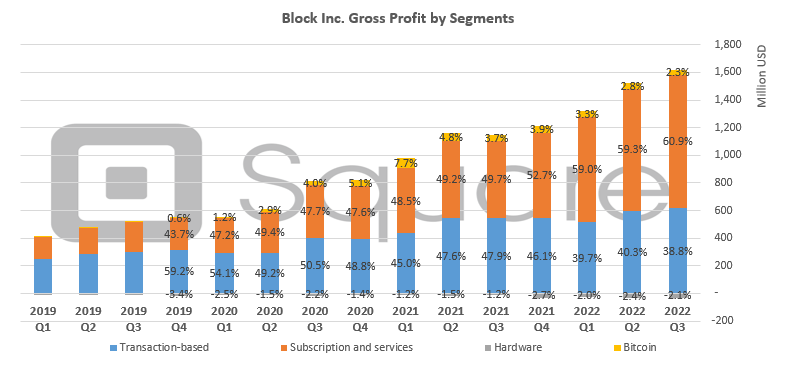

In portfolio, Block has a return of -30.0% or CAGR of -14.2%. Block has fallen -61.0% during 2022.

Another self-correcting act. Don’t have numbers for growth adjusted for Afterpay acquisition. As mentioned in previous annual portfolio review, paid price was excessive, but at least paid in like-wise expensive SQ stock.

Investor day in 2022, though spanning more than 5 hours, did not give any new relevant datapoints for me. Interestingly in last earnings call CFO emphasized main capex / opex is already done (given this env) and they will turn the dials on profitability in 23′. Interested so see how street will value SQ once real profitability is visible.

Cloudflare (Ticker: NET)

As a portfolio position Cloudflare has a drag of -37.4% or CAGR of -21.2%. During 2022 Cloudflare has declined –65.6%. (Note: my initial cost was in 40s, but fixed ~100% profit for taxes in 2020).

Market gave Cloudflare excess premium due to rapid TAM expansion and most importantly – stable growth rate in excess of 50% every quarter. In 2022 Q3 growth dipped below 50% and deservingly so, NET got re-rated on lower multiple (12.1 as of 2022-12-30).

Other than non-sassy macro, company keeps humming. Nothing else to add.

Digital Turbine (Ticker: APPS)

Digital Turbine, after multiple adds is at a loss of -49.8% or CAGR of -38.0%. During 2022 APPS declined -75.0%.

Profitability and FCF does not always help. When marketing dollars are pulled, they are pulled across the board. During 2022 they transitioned their accounting in two ways: report on updated segments to reflect new acquired business activities and net revenue reporting.

However I look at this company I see multiple tailwinds:

- privacy legislation hurts big (ad-)techs. Device firmware level is mentioned nowhere;

- anti-monopoly legislation – opens up phones and ultimately expands TAM;

- other devices (e.g. TV’s?) – expand TAM;

- Past Google “threat” is neutralized by official partnerships and regulators breathing in GOOG neck;

- network effects across the board. Carriers, devices, footprint, larger advertisers, higher margins.

One of weighing factor past year in increased interest environment is a debt post-acquisitions, however they are reducing it as much as their cash flow allows. Another – obvious one – contracting revenue YoY as of last Q3 quarter.

Position I have added on to most in 2022. Looking forward to the other side of recession and proliferation of single tap in coming years.

Cadence Design Systems (Ticker: CDNS)

CDNS position in portfolio is profitable at +78.8% gain or +28.7% CAGR. In 2022 Cadence, after hitting an odd ATH, contracted for the year -13.8%.

So semiland in the end of 2022 heated quite a bit. Biden export ban of leading edge nodes so far did not include tooling (SNPS, CDNS), but both stocks declined ~10%+ in short span of days surrounding export ban rumors and announcement.

The reason I highlight this event is because such things impair the terminal multiple and increase a probability of China business loss (mentioned this last year).

Operationally Cadence is flying. Ukraine war? Immune. Energy prices? Immune Inflation? Immune. They even admit that on earnings calls. They beat their Q3 key metrics and raised guidance for full year. Rolling 3yr revenue CAGR above 15%. Massive tailwind of everyone reshoring semis.

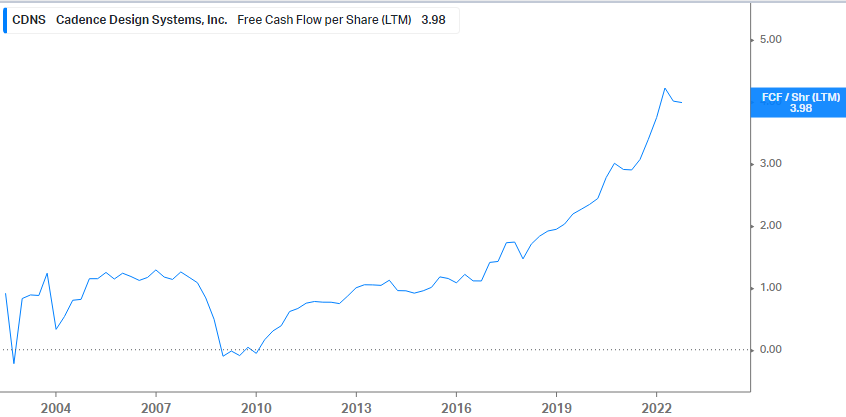

As the adage goes “FCF per share is the truth”

Most FCF goes to share repurchases.

ML designing chips is at the front. Both SNPS and CDNS offer these products and management is very optimistic about this trend and potential value capture. On flip side, I recently read Nvidia blog post where they slapped their compute capabilities at chip design and outperformed “current tools”. Tooling takes time and medium term I doubt there is risk for duopoly moats.

Reliance Industries (Ticker: RIGD)

Reliance Industries to date has contributed with +12.6% gain or modest +5.5% CAGR return. Over 2022 stock has declined -3.8%.

This is for London listen GDR. Notably, when looking at Reliance Industries stock listed on Bombay Stock Exchange, 2022 return is: +7.6%. Diversification cuts both ways. Indian rupee, as most currencies in 2022 depreciated against the dollar, hence the under performance.

Everything rolls according to original thesis – that’s a pleasure for investor. I have reviewed quarterly results on multiple occasions, won’t repeat my self too much. Jio and Reliance Retail both growing revenue, EBITDA at 20%+ rates.

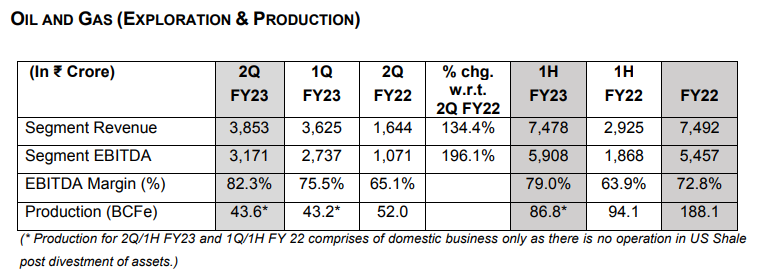

I would like to draw attention to gas though.

From last quarterly report:

Production from MJ field is expected to commence by end of the year. With the incremental production from MJ field, KGD6 block is expected to contribute around 30% of India’s gas production.

Yes, thanks to Reliance I have exposure to E&P. 8% of consolidated EBITDA as of calendar Q3 and ramping up.

What I have observed through 2022 looking at RIGD GDR price is Indian market is less developed. Which means there’s less (none?) automatic trading and less price noise. Price moves are directional and .. easier to predict?

In 2023 you may see me selling a portion of my Reliance position at what I perceive as local peaks in an attempt to re-enter lower. Other than that – sleep well stock.

Evolution AB (Ticker: EVO)

Evolution position (including dividend) is at -34.6% loss, or -24.6% CAGR. In 2022 Evolution declined -18.4%.

2022 Q3 revenues up 37.1% YoY. However I suspect market priced lower (decline?) organic growth excluding acquisitions (don’t have numbers). Evolution, although being B2B is despite sensitive to consumer non-discretionary (gambling, duh) revenue. For the whole year consumers were hammered with double digit inflation across the globe, but still holding up strong.

EVO stock bottomed IMO, when this became evident. Besides, company itself became value stock in GARP (Growth at reasonable price strategy) context. Evolution’s management has my trust and continues to be an industry innovator and leader by a wide margin.

US market (post regulation state by state) will ultimately be a next leg of growth and long term thesis is not impacted.

Decision to enter EVO so far has a bitter taste due to the fact it was funded by partial LNA1L exit. In my defense my primary goal was to construct a portfolio of the companies I deem of quality and do (buy / sell) as little as possible. This decision (as some others reviewed above) achieved my goals, but may look messy in QT environment.

Kaspi.kz (Ticker: KSPI)

Including two dividend payments in 2022 KSPI in portfolio is still at -3.3% loss, or -3.5% CAGR. In 2022 Kaspi.kz declined -38.4%.

Dodged Kazakhstan’s unrest of 2022 January bullet, caught another – Russian war in Ukraine and FX impact on KZT. After wild swings into both directions, KZT lost 7% against dollar – could have been worse.

Already modest multiple for Kaspi.kz contracted further in 2022. Luckily Lomtadze having solid stake (23.42%) in the company, understands how cheap it is and issued a buyback program. Again – a common theme of this annual review – healthy, growing double digits business with ample cash flows suffering a cautionary investor sentiment and run for safe regions/assets.

Capital allocation in short for 9 months of 2022:

- OCF: 605 707 Million KZT

- Buybacks: 36 344 Million KZT (shares outstanding barely moved -0.3% YoY)

- Dividends: 95 787 Million KZT (second distribution falls into Q4 and is excluded)

30%+ growth on top / bottom lines and as you can see – conservative capital allocation. Decent market growth prospects, excellent CEO, monopoly super app position, great economics, healthy cash flows and some optionality – perfect exotic taste to portfolio.

Portfolio Return in 2022

Annual mantra: I don’t like this figure and I don’t really know how to calculate it correctly, because my portfolio “cash” is a liquid pool of personal finances as well and all it entails (larger purchases or savings).

Regardless of above comments, portfolio value change since 2021 Q4 to 2022.12.31 is -44.0% (+59% in 2020, +7.6% in 2021). That’s the second year in a row of me underperforming S&P500, which declined -19.4% in 2022.

Higher beta still hurting and I expect another drown year for higher growth names. As I briefly elaborated in Evolution section. my aim in restructuring portfolio in 2020-2021 was to create mental space and reduce portfolio turnover. Although a noble goal, this resulted entering companies at rich valuations in some cases, result of which is being sawed for second year in a row.

But who counts monopoly money?

Personal Note

You may have noticed in 2022 I was less active on Twitter / Facebook and certainly – by the number of blog posts here. Another quality leak – I occasionally dipped my toes into subjects less deep than I would have otherwise wanted.

In 2022 I took coding most seriously since I started coding as a hobby since I quit my last work. I’m now approaching first cloud deployment. Needless to say, this continues to take enormous amount of money and mental power.

Thank you for reading! Make your 2023 great! See you around.

Leave A Reply