This is an annual review of current portfolio positions. You can find a similar overview made last year here. High growth side of portfolio has suffered a normalizing environment of valuations and I suspect it will take another year or so, for fundamentals to fully grow into these superior business models. Counter-balancing that, traditional businesses have performed well.

Current Stocks Portfolio

My overarching principle for the longest time has been to minimize actions around portfolio freeing time to build competencies and follow my curiosity. Up until 2019-2020 juncture, I was not feeling comfortable with leaving any of Nasdaq Baltic positions for a prolonged period of time. However, most current portfolio businesses have one commonality of long runways, which makes the task way easier.

If you follow the social posts on Facebook or Twitter, where I post any changes (sell / buy) to portfolio, you may have noticed 2021 has been way less active than 2020 was. My aim going forward is to further increase the quality of businesses owned and minimize unnecessary interruptions to compounding.

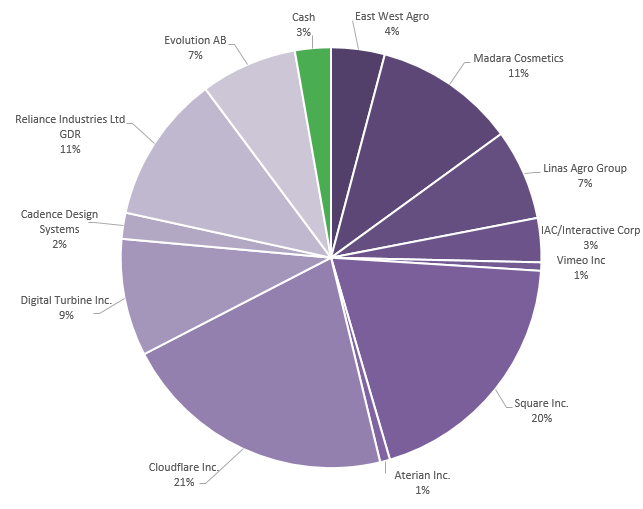

At the closing prices of 2022.01.07, the portfolio looks like this:

Let’s spin the wheel of fortune (or mayhem in some cases).

East West Agro (Ticker: EWA1L)

Position had a price rebase last year, due to change in brokerage (sell on one side, buy the same on the other). I initially opened a position in 2018.01. Currently it’s +9.32% or +2.25% CAGR from original (2018) cost. In 2021 EWA1L stock doubled: +106.15%.

One of those positions I want to get out off, but not at a price market currently rates it. on 2021 H1 TTM financials it’s 3.7 EV/EBITDA with significant FCF yield, deleveraged. In 2021 company resumed its dividend payouts and if economic momentum persists, price should follow.

Headwinds for 2022: Energy -> fertilizer prices -> lower farmer budget -> slower EWA1L revenue growth. We will see how things actually play out.

Madara Cosmetics (Ticker: MDARA)

Similarly to EWA1L, but from a higher base, current position performance is: +196.2% or +120.6% CAGR (even higher considering original cost). In 2021 Madara Costmetics stock has gained +38%.

In 2021 Madara has finally got the attention it deserved. Management maintained guidance of 27M turnover for year 2023 and financial momentum isn’t slowing down.

At 28 EUR and above I modeled discounted dividend model and it proved my intuitions – a low IRR going forward. If you, like me, have a framework that not selling something is equivalent to buying it everyday, then Madara position becomes a problem. And I have tormented myself for around a week, whether I should close or at least allocate some capital from Madara to, well I can say you now – Linas Agro, but decided against it due to several reasons:

- Madara has a way easier and margin-wise superior business model, therefore it deserves an elevated valuation;

- I would have to track and hunt down Madara valuation at more attractive level, because I want in;

- excess taxable profits for 2021.

2022 may be quite flattish for Madara stock as revenue catches up with 2021 H1 price momentum.

Linas Agro Group (Ticker: LNA1L)

I re-entered Linas Agro Group stock on KG acquisition news. Current position performance in portfolio: +59.8% or CAGR of +52.7%. During 2021 LNA1L stock appreciated +37.4%.

Not a performance you would have historically expected from Linas Agro. Having been a shareholder of LNA1L for most of my adult shareholder life I would name change in CFO a critical moment in unlocking Linas Agro real value.

Where public investors have failed looking at Linas Agro in my opinion, was anchoring on the past. Taken ~10 years average of EBITDA vs Market Cap and a realistic lower bound of guided consolidated EBITDA, I’m arriving at target price of 1.2-1.3 EUR. When Linas Agro Group eventually lands there, I’ll have a headache of what to do next, until then, easy hold.

During the year, I have reallocated 2/3 LNA1L position to Evolution, which so far has been a capital destructive move.

IAC/Interactive Corp. & Vimeo Inc. (Tickers: IAC / VMEO)

During 2021 Vimeo has been spun out as separate stock (ticker: VMEO) and “unconglomerate conglomerate” has seen it value drop an adjustment for VMEO loss in SOTP (sum of the parts). For performance evaluation, adding VMEO value back to original IAC position performance is: -14.8% or -14.6% CAGR. During 2021 IAC stock gained +1.2% adjusted for VMEO spin off.

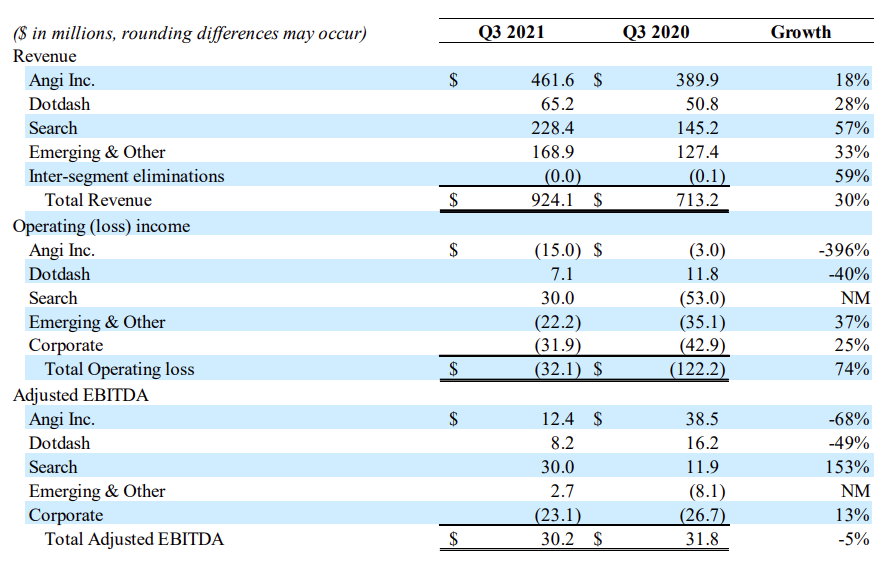

IAC

There are things to like and things not to. The SOTP story is compelling, but a lost of investors are taking a bet on Angi finally making economic sense. I won’t say I understand Angi. That’s the part I don’t like. In a pitch to Bill Ackman one student team shared a real story of service provider, that lost around 200$ to Angi’s platform. There’re a lot of moving parts to the story, but from birds’ eye view aggregating plumbers, electricians etc onto a service platform seems a Syzyphus job.

Angi makes up aroud half IAC’s revenue pond. Execs are continuously re-interating, they see value in here and their track record of building businesses gives some needed confidence in Angi’s story.

The other parts are much more exciting. MGM’s focus on e-casino, superb covid entry, Meredith acquisition and aggregating quality content, all emerging bets, continued momentum in Search, not to mention 500M+ left in cash after Meredith deal.

VMEO

I still think Vimeo will eventually be acquired by something like ServiceNow, SalesForce or Microsoft – prominent B2B software shops. IAC exit of Vimeo was trully a touch of a genius in timing and I probably should have got the hints management put out before (I believe SaaS market excesses were highlighted in IAC Q1 letter). VMEO was punished from two sides:

- deceleration in revenue growth (guided previously, and tough comparable numbers from 2020). Reacceleration should come in comming quarters with more sales motion, if we listened to CEO Anjali Sud in IAC Q1 webinar.

- Market multiples compressing on pricing yield hikes.

Until it got acquired, however long it took, I was also reasoning my position tax-wise. IAC position goes negative and not taxable. VMEO profits unrealized until major corporate action (still think it’s acquisition). Until then it’s a long runaway business, which I let sit and grow. Match Group spin-off had more steam and business had a deeper moat. But I can’t time travel, so learning about the Diller team along the way.

Block Inc (Former Square) (Ticker: SQ)

Square has rebranded to Block past year. In portfolio, it has a return of +45.7% or CAGR of +25.4%. Block has fallen -20.6% during 2021.

Not long ago I have shared my thoughts about what’s happening with fintech in a Twitter thread:

So not too much to add. In the meantime valuations have normalized across the board, so that added additional pressure too. Notably, a bunch of wallstreet types also have a beef with Jack’s views on Bitcoin.

On Q3 runrate gross profit, Block currently trades at 14.5 GP/EV or 64.5 EV/ adj. EBITDA

Excluding Bitcoin, revenue for 2021 9M grew +56% YoY from 3.5B to 5.5 Billion USD. That’s still astonishing rate of growth at that scale.

CBDC will likely hurt these businesses, but also eliminate a lot of competition.

One thing I did not particularly like is Afterpay acquisition at the top, which comes at dilution cost. There’s a definie element of hype around BNPL.

Aterian (Ticker: ATER)

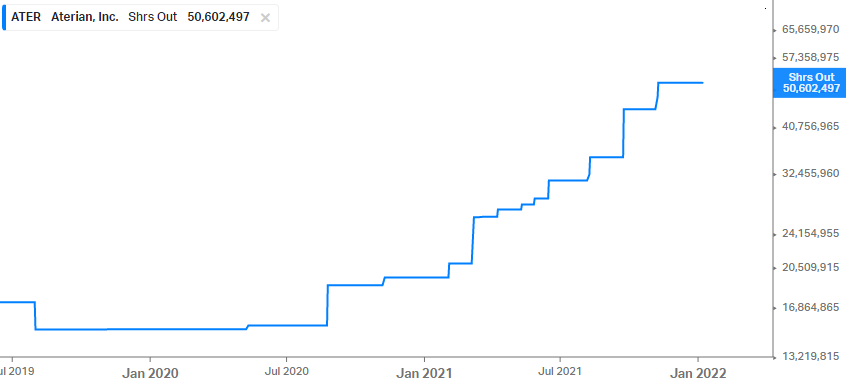

Aterian, (formely Mohawk Group under ticker: MWK) up date has destructed value, performance in portfolio: -79% and very similar CAGR (entered a year ago at similar time). During 2021 stock fell -77.6%.

My first thought when thinking about this position is “jews fucked me”. Business made sense until story has been under pressure on multiple fronts:

Buy small 3rd party sellers on Amazon / Target / Walmart / whatever platforms and give them exit at 4-6 EBITDA’s with future performance earn-outs. The higher Aterian market cap, the more it can leverage to accelerate growth. Then came a short report by Culper Research. I read it. And one thing I suspect was actually in operation is a shadow’y promotion tactics in Facebook groups and over-promise, under-deliver of their “AI” platform.

Then came a shipping crisis and the Chinese stuff suddenly hit COGS heavily. Compound that with leverage and we have a market, that sees through it all. The worst part IMO is a permanent damage on per share basis. Due to difficulties satisfying debt covenants, there were significant share dilution with convertable bonds.

And looking back, it’s not so evident when the story broke so bad, that what puzzles me. And if you don’t own Maersk for at least a year, I don’t think it’s evident for you either.

As of today, shipping crisis is slowly easing. Baltic Dry index is off 60% from peak printed in the end of October. Amazon own logistics is another realistic hope to ease ATER’s problems. Main concern I have it whether Aterian portfolio products can sustainably hold top positions.

Aterian has also been a toy of short squeezers in September. I had a temptation to close a position then, but seemed, like shipping crisis was about to peak soon (proved to be true, at least in Baltic Dry Index terms).

Pretty sure I’ll have to close eventually at a loss, but I want to see how ATER does post-shipping crisis first.

Cloudflare (Ticker: NET)

Fallen Angel that will visit peaks eventually again, to date has a return of +38.7% or CAGR of +36%. During 2021 Cloudflare has appreciated +43.4%.

While East are closing internet, West are finally figuring out a modern solution to cybersecurity which is zero trust. Micromanage, observe and evaluate every request. On top of that, Cloudflare has the biggest reach, thus building a moat of future edge networks. It’s ambition to be cloud-vendor agnostic and be the fabric, that connects these networks is really a serious ambition dollar-wise.

No matter how you slice and dice Cloudflare, it comes out as one of future cloud leaders. I see little contradicting evidence to break this view. Most importantly, they seem to be culturally very strong, which attracts exceptional talent.

In a random 2021 evening outburst I wrote:

Selling unprofitable , money burning business at 152USD and seeing this sure makes one feel like a retard. But how I interpret Cloudflare’s recent price action is the following:

Well, market nature always brings the balance and today I could repurchase shares I sold ~30% cheaper, but current anti-SaaS winds and 50+P/S still give me hope I could see NET 80-100 range. If not, well, I’ll wait. Stake is solid in size regardless and as you can see, I don’t have much cash on hand.

Digital Turbine (Ticker: APPS)

Digital Turbine so far has returned a weighted return of +54.6% or CAGR of +34.6%. During 2021 APPS returned +16.6%.

I have added to my APPS position 3 times in second half of 2021. Slowly it becomes a high conviction stock for me, I was not so sure when I entered it first in 2020. Execution, team and tech stack are all impressive. Main threat from Google got supressed recently with official partnership. Patented Single Tap technology lincencing will likely boost margins and itself become a billion-dollar business line at some point.

I feel comfortable in both valuation, position size, and especially – execution. 2021 stock performance was hindered by absorbing 3 acquisitions, increased leverage. But business itself just keeps on getting stronger and bigger. With size, comes negotiating power, margins and additional partnerships further entrenching moat in this lucrative mobile advertising market.

Cadence Design Systems (Ticker: CDNS)

CDNS has so far contributed with solid +73.4% gain or +52.2% CAGR. In 2021 Cadence shareholders enjoyed +37.3% appreciation.

I first bought Cadence as a tracker position to learn about semiconductor space and gain exposure to near-indestructible FCF. I won’t get into how wonderful CDNS is. Stock speaks for itself. High margins, high FCF generation, strong MOAT and high barriers to entry. Duopoly with Synapsis, unreasonable switching costs and overall increase in semiconductor sector CAPEX. What’s not to like?

Few things that bother me:

- Buybacks seem almost autopilot. Without regard for valuation. As I shareholder I would rather see higher buybacks on moments like what we are seeing now, but share count has decreased -1.5% YoY;

- More aggresive China’s tone towards Taiwan could shake up semi market in a big way. Cadence revenue share in China as of 2021 Q3 was 13% (17% 2020). Not tragic, but still significant. Other Asia, which may include Taiwan, however: 18%

- FCF yield has contracted significantly in 2021.

Position I would liquidate when aggregating capital for new position, but won’t touch unnecessarily.

Reliance Industries (Ticker: RIGD)

Reliance Industries to date has contributed with +13.6% gain or +11% CAGR return. Over 2021 stock has returned +17.3%.

Poor India has been hit hard with Delta variant during 2021. Stock has suffered accordingly. However in the second half of the year, momentum has been starting to build. Global shortages have been also a tailwind for manufacturing units of Reliance.

Jio subscriber growth has significantly slowed, but that does not kill my enthusiasm in a young country with increasing purchasing power. Ambani’s latest move into solar and particularly how he moves is what I really appreciate as an investor. Jio segment EBITDA grew +16% last quarter.

Amazon is angry and litigating about misfortunes in India. All the while Reliance Retail is becoming a defacto Amazon of India growing EBITDA +45% in last quarter.

Having exposure to India also fuels my interest in regional geopolitics, love the position beyond the numbers. One of those positions I’m not planning to move for a long time.

Evolution (Ticker: EVO)

My homework for Evolution took a little too long this year. Since buying, Evolution made a -21% loss, or -37% CAGR, but in whole 2021 has given shareholders a solid +57.6% return.

I recently saw a neat meme for EVO, that really captures the spirit of this stock:

In all seriousness, Evolution ranks among the strongest businesses I have come across in my investing career. A book example of economies of scale with each passing quarter. In 2021 Q3 Evolution clocked 69.9% EBITDA margin. That’s astronomical cash conversion at top line growing 97% for last quarter YoY.

Management is top notch, paranoid of preserving market leadership. Market is huge and in transition to digital form. Being a supplier, attaches growth levers to end casino’s growth while also organically expanding to capture new markets.

Of course these high margins attract attention. There was a high profile public attack recently, also I don’t think tax authorities will let EVO keep 70% of revenues down the road. But what I think is important is preserving a leader position is ever-increasing digital casino market.

I’m grateful for my colleague, who helped me develop first DCF model (EVO model).

Portfolio Return in 2021 & Closing Words

As I mentioned last year, I don’t like this figure and I don’t really know how to calculate it correctly, because my portfolio “cash” is a liquid pool of personal finances as well and this year I had high capex associated with renovation.

Regardless of above comments, portfolio value change since 2020 Q4 till today (conservative, given recent high growth stocks sell-off) is +7.6% (+59% in 2020). In 2021 I have underperformed S&P500, which returned 26.61% due to ongoing rotation to value.

In closing, I would reiterate, what I said last year. Let’s give this “higher weight in high growth stocks” strategy more time to show its true colors.

Leave A Reply