Lately I have these invisible skepticism glasses put on and I find it hard to be empathetic and see best in people. It might be a side effect of coding, now that I think about it. Debugging (overly analytical thinking)+ irregular meals (decrease in tolerance) is a bad combo going forward.

Lately I saw a burst of bullshit on my feed and commenting each one, would only infuriate a casual follower, so there’s an aggregate of things I see and think lately, if you dare.

Anyway, I wanted to warn, this, hopefully quick blog post will be unfiltered and not politically correct.

Russian Squeeze

Putin is making a passive statement this autumn with gas supply crunch in Europe. Today two other things came up the agro vertical ladder.

Inflation in Russia making proletariat unhappy with government and the last thing dictator wants is a bunch of protests. Older people are particularly worried, because they have witnessed food shortages in 90s. Inflation in Russia is currently running at 6.5%+ for August.

Gas price increase in Europe has stalled local production of fertilizers, because input costs make it uneconomical to produce. Even local Lithuanian manufacturer Achema (1/3 of national gas demand if I remember correctly) has raised concerns about stopping its factory. Putin’s pen stroke on fertilizer export limits would put next quarters of Linas Agro Group (LNA1L), East West Agro (EWA1L) in difficult position.

Another related thing:

Foreign policy is damaging demand in Europe for one of two main Russia’s products – gas. Fascinating moves, actually. Started following Phosagro. Jimmy Rogers has a stake by the way.

Venture Capital going Web3

Let’s get this out of the way: I have a beef with Venture capital. I think they are arrogant, rich daddy kids, making bets from their inheritance and when eventual unicorn pops, they run around telling same stories about their strategy and what they look for in founders.

Personally I have no idea why angel investing and venture capital exists. If stock exchanges dropped their fees and allowed flood gates to open for new founders, marketplace would make a natural selection without all the drama, bullshit and ego games.

Now probably most famous of all them a16z comes, dips their millions and then pushes some Dixon (unfollowed after I read the thread) dude comes around and pushes their centralized shitcoins they have finished building stakes in probably months ago.

Blockchains are computers. Ya, dude, go back to coursera. Blockchains are ledgers, type of database. And you might also want to take a better look at “decentralized“.

There’re very little touchpoints between crypto ethos and financial world. Chissy here rides that educational gap. For banker / wall street type, that has exposure to crypto through Grayscale since last year, this whole web3, NFT thing is on the same lines as metaverse and he will eat any bullshit Chis will feed him. Hopium is hell of a drug.

The thing is: fake it till you make it WORKS. Enough hype, capital creates external validation for developers, new things get built, founders with 20% pre-mine are rich as fuck, because they created their own money and their vapourware is being used!

Solana

There are very few fintwit people that are transitioning to DeFi. When that happens I follow where does their attention and curiosity lead. Two particular fellows wrote about Solana. TWO. Out of? About 3. So I had to know, how serious this thing is. Read the flashy website, both write-ups (one sponsored, obviously) listened to interview with Patrick. I mean I have tried, honestly.

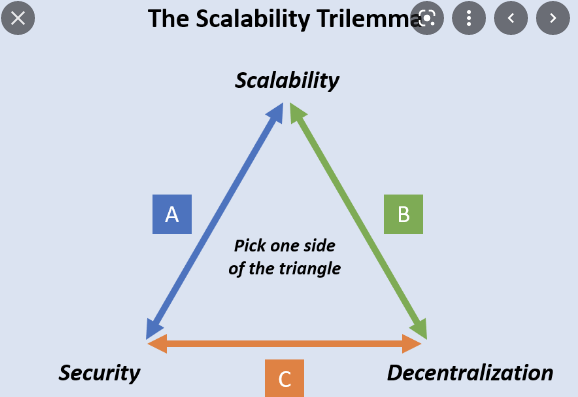

But damn, those kids are either malevolent and greedy or simply dumb. Instead of addressing pre-mine and decentralization (obvious flaw in Solana’s blockchain trilemma) dude skipped the whole beat and went “do we really need decentralization”?

And there’s an obvious answer: in your case: OBVIOUSLY NOT, and you could use mongoDB or PostgreSQL for your infinite scale ambitions, but that would’t make you ultra rich, would it?

This “decentralized” thing has a CEO Anatoly and given block generation speed, only few validating nodes will ultimately be operational. Development? Sheltered in Solana Labs. Very open source. Kind of Apple Store open source.

What a lot of people fail to realize, IMO, is the eventual showdown. Say a network gains enough power. If it has approchable node operators – it can be shut down, like my Liberty Reserve account. I get the speculative wave and founder’s will to make a fast exit, I just hate lies, man. Next.

Paypal Acquiring Pinterest

Fat Tail Capital looked where the truth lies. CEO compensation depends on revenue and FCF CAGR. And you guessed it, mostly financed by stock issuance. Dillusion with erode shareholder value, but what does hired management care? It achieves their compensation hurdles.

They probably even tipped Bloomberg to stop stock from sliding. No bloomberg, market is less likely to lie here.

Outstanding volume. Someone’s running to Square.

Fastly Digging a Hole

Welcome to 2021, Fastly, we have remote conferences now.

Or perhaps you wanted to postpone product releases and buy some time?

Also I would not pull a tiger’s mustache, because last time I checked, Cloudflare generates revenue from different products, while up until now, you pretty much had one – CDN. Cloudflare got angry? Could make a CDN pricing holiday and drive your revenue through the floor. Also, there’s little class dunking on others. Just be better. Irony, writing this, while I dunk. But I have made an intro for that.

While on this side…

Cloudflare Going for 100 P/S

What is happening here? 12 days climbing in a row on solid volume. ONE down day, TWO UP again.

Selling unprofitable , money burning business at 152USD and seeing this sure makes one feel like a retard. But how I interpret Cloudflare’s recent price action is the following:

Big boys have made some number crunching on reasonable probability of 4th cloud scale and moved their bets accordingly. Current Cloudflare shareholders instead of questioning current valuation should ask why Snowflake listed a year ago, had a bottom of ~90 P/S?

I think meta answers are the same. Implied future probabilities. Next

Trump Launching TRUTH Social Network

Good one. Brownie without THC in the brand contest.

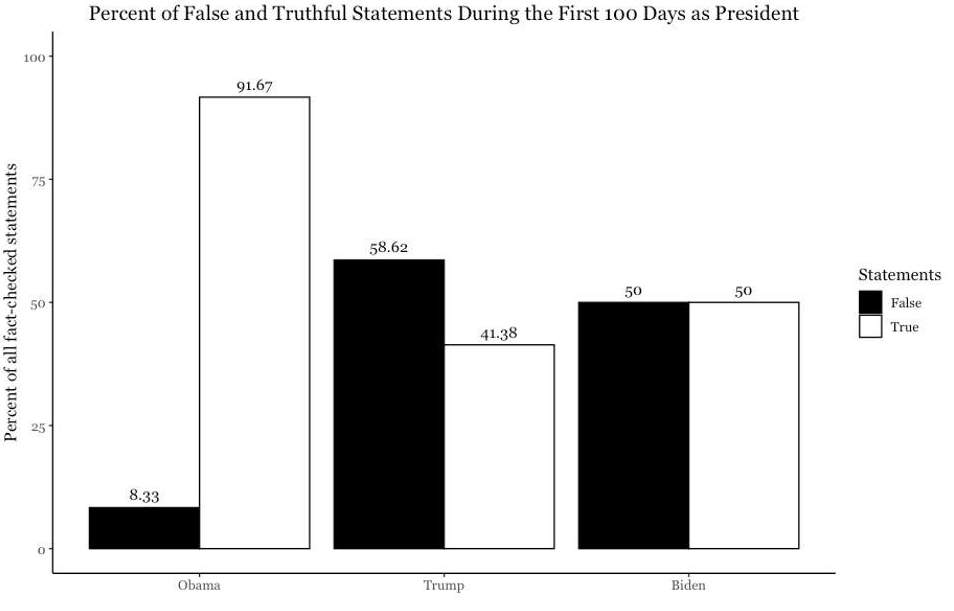

Ma home boy Georgy has something to say:

Enefit Money on The Table Untouched

Primary intuition was right. Today (yesterday at the late time of writing) was the first listing day for Estonian green energy producer. Retail participation was unheard 60 000 Estonians. IPO price 2.8, and plenty of liquidity today to sell at 3.4-3.5. +20% in two weeks – unrealized.

Why was I not in, having spent around 8-9 hours reading prospectus and calculating ratios in excel? Because I would have needed to use leverage, I did not see public enthusiasm and prospectus had serious risks, if pop were not to take place and I would have to sit on a stock for some time.

Two things bother me. I have let logic intercept intuition, which is an integral part of my investment process. Second the time burned for nothing without result. Burn some, gain some? Nop. Doesn’t work on time.

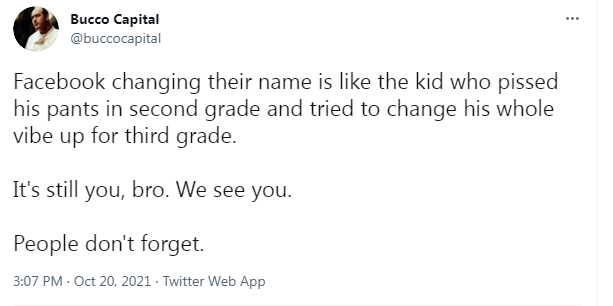

Facebook is a great cash generative business. And a fucked up company run by psychopath. I don’t have a problem Fintwit investor community hating Jack Dorsey for passing edit button, split CEO attention between two companies, stock performance or even failing to see a bigger picture of building an opensource protocol for communications.

What I do have a problem is a moral self-deceit, giving Mark Zuckerberg passes at every fucking step of the way, ignoring all the evidence pointing to the fact Mark is acting in malevolent ways. There’s nothing wrong with making money on gambling, cigarette, even coal companies. Just don’t lie to your self.

What’s my suggestion for new Facebook name? Analytica.

Amazon shareholders have a hard time explaining why Costco doing retail never attracted regulatory attention. In social media world, Reddit CEO never testified about contributing to erosion of democracy and spreading misinformation.

FED Risking Credibility

Congressmen, demented bitches, FED officials playing insiders game on the stock market is shit and giggles when people have record savings and are reasonably happy. But if you pulled that shit public in 2020, I doubt there would be a capitol to return to work in to.

The morality is not even on the platter to have a reasonable discussion. The credibility of FED institution and dollar is the real risk.

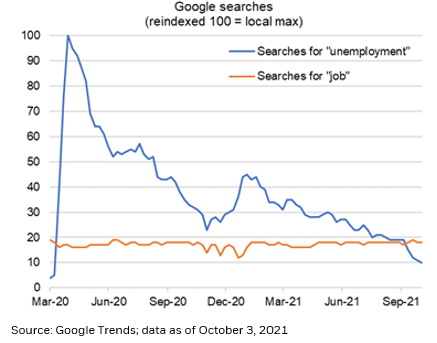

The people? Getting of the couch finally.

To close on a positive note: today my hairdresser shared two blossoms of CBD rich Jane, that was a pleasant surprise.

Let me know if you found this interesting. That’s a first-of-a-kind blog post. Had to vent somewhere. Have a better day!

2 Comments

Thx for the post, it was amazing.

Please write more stuff like this.

Appreciate the good word, Mr./Ms. G! These things (mundane business/ world news) pass quickly and writing is something I can’t do fast, unfortunately. So it makes sense to cover the topics, that have a lasting effect. I would consider doing more regular posts like this, but site is free and time is not.

Next piece will most likely be on how to stay ahead in information age, it should be very useful to the curious reader, so hope to see you here again!