This could have easily been a twitter thread, but don’t want this blog to become a ghost town completely. Furthermore: both companies mentioned in title had/have a deep negative impact on portfolio, which I think is worth discussing for my own sake first. Secondly, market is having a menstrual cycle and I believe a lot of investors are questioning themselves, so reading failures of others does elevate some suffering, which is always nice, huh? So let’s get onto it.

Aterian (Ticker: ATER) Exit

So last week I finally got around to listen to Q1 earnings call and they guided for second quarter in a row of contracting revenues. This was supposed to be a growth story – thesis broken. Since I started writing publicly, this is the second time I’m taking a massive loss to the books (first being Ovintiv, former Encana Corporation – correct thesis, wrong pre-covid timing).

This week I sold at 3.03 USD, at avg loss of -82.9% or -72% CAGR. So natural questions arise, what went wrong.

Aterian Story 2021-

On fundamental level business makes sense, and there are more 3P seller aggregators, most notable in size of which is Thrasio. Buy family-scale businesses dirt cheap, add enterprise-level data, inventory, advertising and know-how management, acquire and scale their cash flows in dominant positions of niche marketplace categories.

Aterian was riding a virtuous cycle, where financing deals got cheaper the bigger they got, so they were doing deals at unsustainable leverage. Then came the short report.

I read it and most concerning part for me was Aterian was using dark marketing tactics to game Amazon review system to secure their category listing positions.

Then CEO started crying of short seller attacks – another red flag.

Macro Headwinds

On top of these, Americans got wild with their tendies and in the second half of 2021 supply chains were breaking down, with unprecedented costs to get containers from China to LA ports. Just when things started to normalize in beginning of 2022, consumer got punched in the face with rising prices. Demand for plastic from China will persist to deteriorate for some time.

And sure if that wasn’t enough, China locked down again.

Briefly on Financials

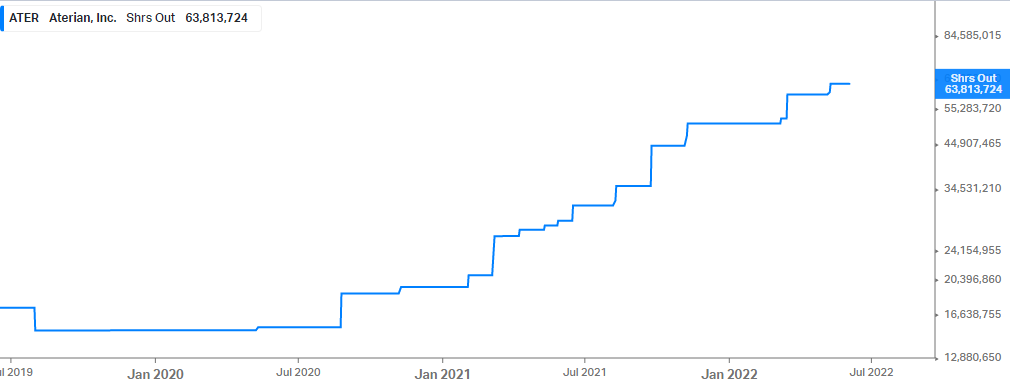

While they brought down leverage and are currently in negative net debt, which means there’s no immediate danger of liquidity, they are currently churning negative EBITDA. Price for deleveraging balance sheet is a rough x3 dilution.

Becoming a Meme

Huge short interest attracts short squeezers and the last two waves with increased volume are exactly those.

Never would I have imagined my portfolio stock joining the likes of GME or AMC, but here we are. Buying another lesson.

Operational Failures

In a mild excuse for management, yesterday I learned another 3P aggregator (probably Thrasio) cancelled its plans for IPO and fired their CEO. It all seems clear in retrospect. However obvious management mistakes at Aterian:

- growth at any cost;

- fraudulent marketing scheme;

- misleading investors;

- not attacking recurring purchase item categories sooner.

Personal failure

I repeat myself: business makes sense on fundamental level. That’s the primary reason I took 2 years to finally take the pain and realize this management may not be the one building a company I imagined being a solid, ethical seller aggregator.

Dependence on supply chains, geopolitics (trade tariffs) and now additionally – demand for cheap plastic destruction prolongs thesis realization beyond reasonable levels.

Until recently when consumer got crushed, most of issues surrounding ATER in my opinion had solutions within 6 months at most (we did get to see cheaper shipping eventually, right?). This is no longer the case.

Now let’s get onto another developing story where little bucks from Aterian sale found shelter.

Digital Turbine

I may be wearing pink glasses too, but I think Digital Turbine assets and tech stack enable them to capture leading position in growing market of mobile ad-tech. Mobile is dominant consumer platform and Digital Turbine offerings are immune to regulation, IDFA worries challenging established marketing budget pools (Google and Facebook). Two macro tailwinds against recessionary vibes and contraction of marketing dollars in general. More on that later.

Position

Next day after earnings release (-20% dive) I could not resist, added 10% to position at 20.86 USD and lowered my cost basis to 37.9 USD. Chart for reference:

This was an impulsive buy with mental accounting bias: dividing cash on hand into serious and “disposable”. Explanation: I don’t know when pivot is coming, but I think it’s coming and I’m not going to buy on green days. More on that in macro commentary below.

Sentiment in Marketing Area

You may be rightfully pointing out: “hey, I saw that chart before; I know where this is going”. Investor sentiment is also crumbling with some calling next quarters thesis make or break time. If Aterian had clear red flags along the way, Digital Turbine is silence is this regard. I think investors are over-complicating the story and underestimating how switfly marketing dollars can be pulled. For me: this is expected and normal, since there’s no visible signs of poor management execution.

This is the reason you have diversification in portfolio.

Earnings

Two weeks or so before recent FY22 and FYQ4 earnings release they announced they will be restating their revenue to report net revenues (after paying OEMs). Aside from bots dumping on ~50% revenue miss YoY, that’s not the reason stock stayed at ~20 USD the next day.

That was the guidance: flat-ish revenue and adj. EBITDA QoQ – not something you expect from growth stock.

But they are profitable and have a proven record of operational leverage. From same report:

Fiscal fourth quarter of 2022 revenue totaled $184.1 million, representing a 94% increase year-over-year on an as-reported basis and a 19% increase year-over-year as compared to the comparable pro forma figure for the fiscal fourth quarter of 2021

Non-GAAP adjusted EBITDA2 for the fiscal fourth quarter of 2022 was $50.4 million, representing an increase of 124% as compared to Non-GAAP adjusted EBITDA2 of $22.5 million in the fiscal fourth quarter of 2021

Please note the acquisitions. Revenue for FY Q4 actually grew 19% YoY in deteriorating target market environment. Single Tap licencing is about to start in next quarter – will be interesting to hear the numbers on this emerging segment.

Weighing Down Aspects

Three things:

- Large acquisitions to build in-house vertical ad-stack have expanded balance sheet with 500M debt;

- business segments got restated to reflect newly acquired companies makes it fuzzier to compare on longer history span;

- macro marketing dollar contraction.

If this ship sinks for whatever reason, I’m not touching <50B US market caps ever again, lol.

Current Portfolio

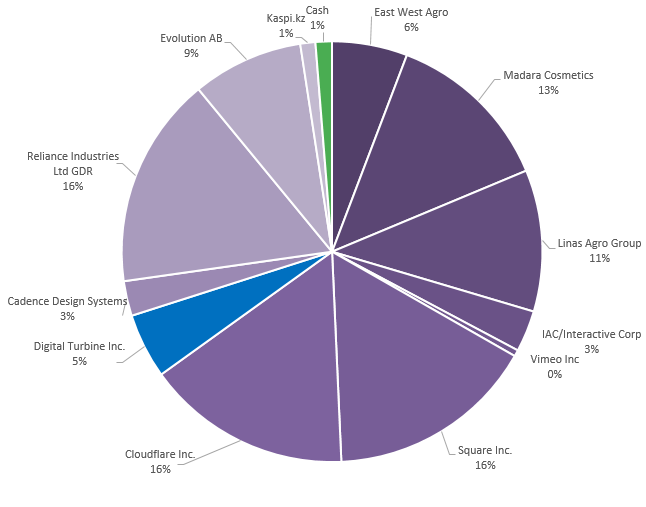

While I do have some restructuring plans for portfolio, I don’t want to share those now. Besides it will depend on developments in the markets. Current portfolio at the time of writing:

Macro Esoterics

State of Affairs

I say we are headed straight into recession and news from companies are affirming the path. Announcements include:

- hiring freezes;

- guidance cancellation;

- layoffs.

On the ground we we have consumer going into debt, shrinking savings, purchasing power.

Oil drillers refusing to put capex on questionable demand and shift in incentives. Saudis seem to sleep with Putin and Biden is about to beg in Kingdom if they could pump more.

Inflation factually peaked in February, but FED is pressured about still significant YoY numbers, which will get down in coming months. Housing, auto sales are reacted rapidly already. Lunatics at ECB are afraid to blowup Pandora’s box – Southern Europe’s debt bubble and are really happy inflation is eating their debt obligations.

What’s next

Gloom picture, huh? I’m an engineer, not a macro economist. I have no idea why you would even read this to be honest, but here we go.

US inflation numbers will return below <5% YoY due to two primary factors:

- fresh YoY comparison base;

- demand destruction;

Pressure on FED eases and after shortest tightening cycle in history (?), we are back to basics: balance sheet expansion and stimulus (no stimmies this time, sorry). This pivot would make the market rally.

Housing in EU still has some time.

Middle of June has a confluence of events (H/T to JSCCapital):

- 6/10- CPI

- 6/15- QT kickoff w/ $15B UST run-off & FOMC

- 6/17- $3.2T option expiry

- 6/17- Corporate buybacks enter blackout (GS est $1.0T in ’22 executions or ~$5B/day).

And I would be VERY surprised if FB, GOOG, APPL, NVDA, SNOW didn’t tank on Q2 results. First three have some weight on index and I do expect a further 10%~ slide in SPX.

Oil – fate in the hands of few big boys. With irresponsibly large implications on … everything. If the pain game between Russia and US/EU persists – the above game plan is out of the window and stagflationary depression could stay with us for longer.

Don’t worry though, life is too short.

Leave A Reply