A Wild week in the markets. S&P500 closed with -11.49% dive on Corona Virus fears. Baltic Exchange Benchmark Index OMXBBGI index lost -8.21% as first virus cases have been detected in Estonia and Lithuania.

Notably, Friday’s trading session was on turnaround sentiment:

Sale of Apranga Group

It was the race with time, with this trade. Price chart for the reference:

- Italy confirmed its first Corona Virus cases on January 31;

- Apranga was scheduled and reported its Q4 figures on February 27;

- First virus case in Lithuania officially confirmed 27-28 February night (?);

- If virus spread develops, we have empty stores and empty bottom line for Apgranga;

- Faggots in Apranga gave investors 2 minutes to skim through report before trading session started, not a good sign.

Apranga Group Q4 results

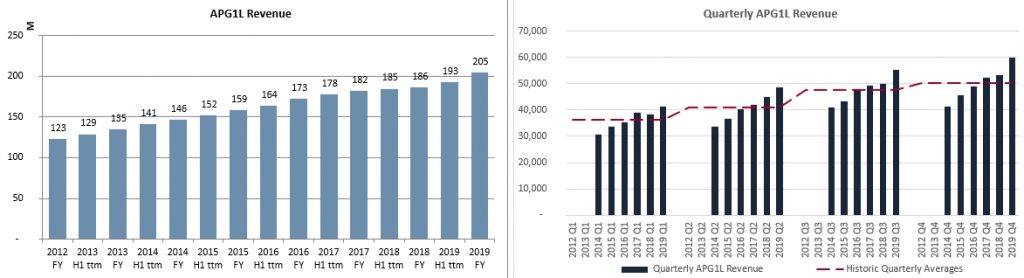

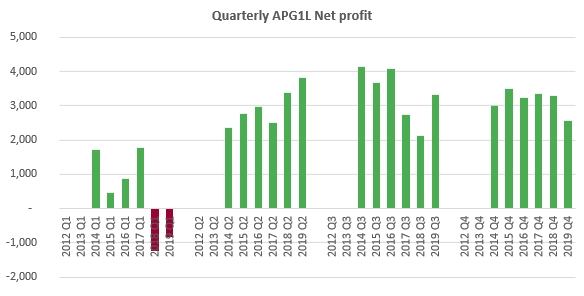

Apranga Group revenues for 2019 FY were 205 Million EUR, up 10.1% YoY. Net profit up +17% to 8 873 k€ from 7 565 kiloEuros in 2018. Or talking in charts:

2019 – 2020 years are somewhat transformative for the company. Group opens and reconstructs a lot of stores as it said many times. What disappointed was Q4 earnings, that dropped -22% YoY.

Apranga Position

I never liked the retail sector and I was looking for ways out of this position for quite a long time. Q4 earnings disappointment and growing concerns over CoV spread in Baltics isn’t the best shake I’m willing to take, so minutes after session started I sold my position in 2.06-2.04 range.

Including dividend, APG1L position was closed at +0.96% or +0.68% CAGR. There were clearly a better change to fix a position at 2.20 price level, however neither I, nor other investors I suspect have anticipated dropping profits (even prior to virus outbreak, Riga Akropolis launch).

And Madara Cosmetics..?

You might be wondering why Madara Cosmetics is kept untouched in portfolio:

- Poor liquidity;

- Stronger exposure to e-commerce;

- Growth story;

- Longer play on company acquisition to be realized in X years.

Fixing Kauno Energija profits

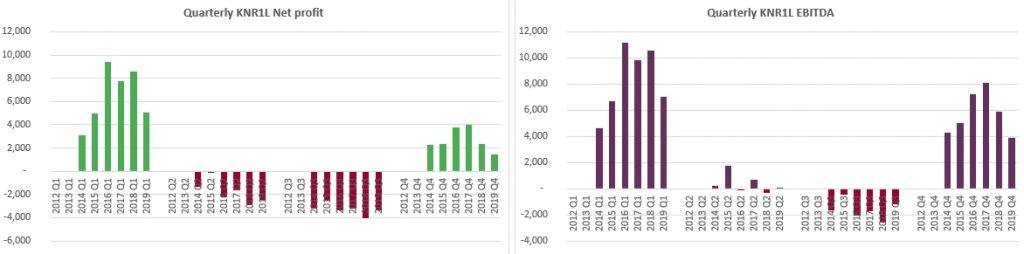

Decreasing Revenues and Profits

With increasing average temperature and reduced energy demand from centralized heating, Kauno Energija has been losing its revenues and profits for several years now. Kauno Energija collects its profit for the year in Q1 and Q4. Here’s what quarterly earnings look like:

Cash reserves

What for long supported my apologetic view on droping profits was a cash reserve (33.7% of market capitalization in 2019 H1 report, at today’s price), but that all went to CAPEX as of Q4 report release.

The remainder is 5.8% Cash/Market Cap and Free Cash Flow for the year is… negative, so no good prospects for dividends either.

Kauno Energija Position

As I have written in portfolio overview, Kauno Energija is pretty old, counting 4th year in portfolio. When I evaluated recent report, I looked at 10k units on ASK column at 0.99, which was a clear indication, the stock won’t be priced above Euro anytime soon.

Kauno Energija position finished its show in portfolio with +49.8% total return, or +15.5% CAGR.

Stocks to watch

After the mentioned sales, there’s some room for improvisation in the face of CoV sale. I monitor situation closely, but calling bottoms is cursed activity, anyway, stocks on my radar are:

- Tallink (insider support at current and lower levels), expansion plans, occasional bump of payouts via share capital reduction increasing annual return to ~10%. With risks, naturally;

- Silvano Fashion Group. Been a long time since I dug deeper into reports of this company, to be honest, but EUR/RUB is keeping strong, CoV might impair activities badly, but historic return via dividends had been very strong. Occasional supplemental returns via share capital reduction too, there is some share premium left (sneaky admirable tactic)

- K2LT – recession proof fundamentals, poor liquidity, competitors to start a year from now, new revenue stream introduction this year;

- Grigeo Group would be interesting again in 0.8 range;

- Vilniaus Baldai – decreasing raw material prices, fixed contracts with IKEA, on a way to deliver another strong quarter. If market pushes price again to local lows, I might take some.

- Inter RAO Lietuva. Written extensively about it. Market bashed the price brutally. 100k EUR worth insiders sale at 20+ zl level also discouraged market participants.

Going outside of region:

- Orpea – recession-proof business model growing 8-15% annually; Price too high

- TSLA – anticipating poor Q1 result and overall, auto-market sales are plummeting, but a must-have stock for next decade;

- MSFT – have to dig in a little more, but double-digit growing IT giant, that is NOT under the regulatory radar;

- Stone Co – Brazil Payment Processor, doubles revenue every two years. Expensive as fuck, ignored this week’s downturn.

- Activision Blizzard – if CoV and Market deepens;

- Ansys – Enginnering Software Compounder, Perfect Balance Sheet, standard (out of space) valuations.

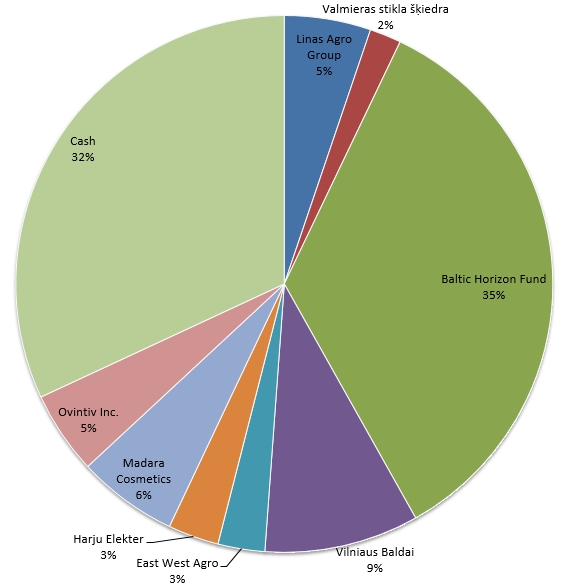

Updated Portfolio

After the sales, updated portfolio structure at Friday’s prices:

This is not a financial advice. Read my poorly written disclaimer.

Leave A Reply