Similarly to Reliance Industries write-up, I’ll try to abstain myself from going too deep. I think what Kaspi.kz is today is a testament of superb execution by management and continuous entrenchment of moat.

I want to thank Better Nest for compiling a list of material on kaspi.kz, if your interest throughout the post is maintained I suggest you go there to learn more. Today my goal is to:

- brush over what Kaspi.kz is;

- shareholders with focus on CEO profile;

- key business aspects;

- valuation (no DCF needed, ratios and growth rates will suffice);

- potential upsides;

- risks and climate post Kazakh crisis;

- technical details: instrument, position, disclaimer;

- recommended further reading.

In Short: What is Kaspi.kz?

Roots

Businessman Vyacheaslav Kim co-founded and ran Electronics Network of stores in 1993. Enterprenuers at the time were buying banks, so in 2002 he bought one too: Bank Kaspiyskiy. Logic behind it being to provide leases for electronics buyers.

In parallel Mikheil Lomtadze, current CEO, was growing his competencies all around and landed a job and finally a partnership at investment fund Baring Vostok. Kim wanting to transform Kaspiyskiy sought expertise and capital. Two guys connected well, shook hands, exchanged Kaspi ownership, and decided to pivot traditional bank to a technology company, shifting focus from business customers to retail clients. Lomtadze joined company in 2007, which marks the transformation of the bank. In 2008 name was changed to Kaspi bank.

Kaspi.kz Today

CEO Mikheil Lomtadze likes to refer to Kaspi.kz as customer relations technology company, which puts emphasis on customer satisfaction (famous Bezos attribute) – key aspect of a successful B2C company. However, for investors, the notion of SuperApp is probably more clear. Tenscent’s Wechat started with chat, Kaspi.kz started with a customer finance app and grew from there.

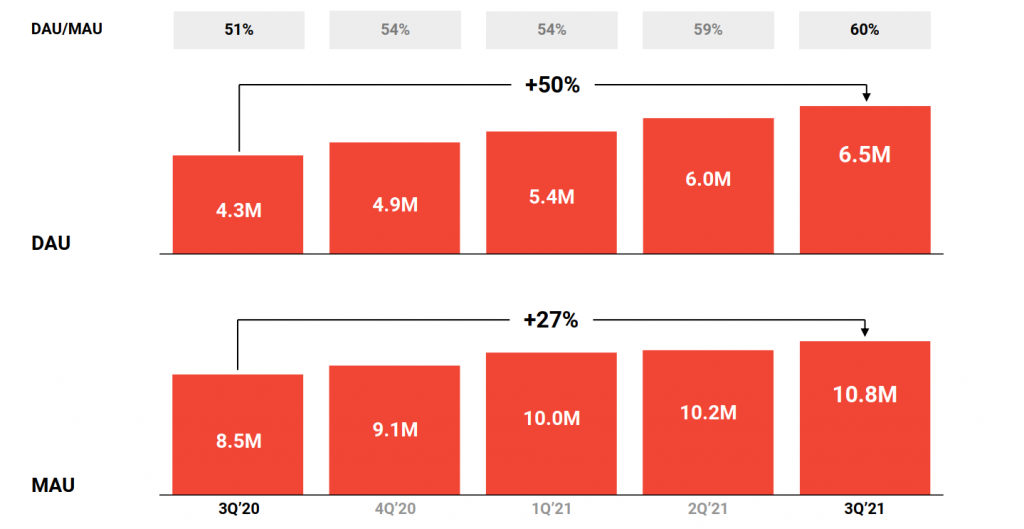

Today Kaspi.kz has 3 main business lines (Payments, Marketplace and transformed legacy – fintech), but more importantly – has become a de facto leader in Kazakhstan’s digital transformation. As of 2021 Q3 57% of Kazakhs use the app monthly (+27% YoY growth), of which 60% are daily users:

Shareholders

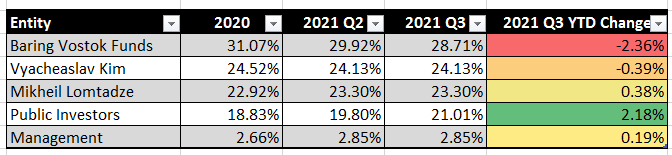

2021 Q3 report currently gives the latest data into Kaspi.kz ownership:

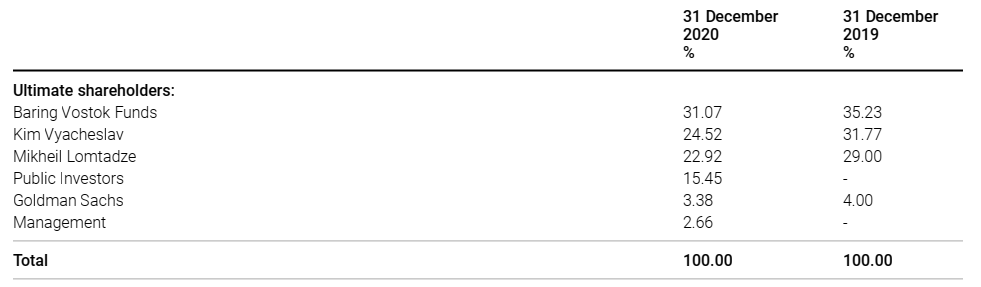

However, in 2020 audited annual report, Goldman Sachs ears are poking out too:

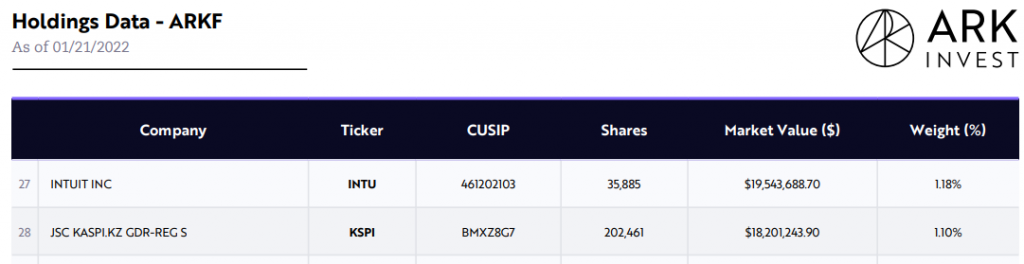

Another notable investor – Ark Funds also has a 18M stake at the time of writing:

I’ll return to this section when we talk about risks, but foreign institutional participation is welcome.

CEO Profile: Mikheil Lomtadze

Mikheil is originally Georgian. Came from a difficult background and was pushed hard by his parents. Education came before entertainment in the household, so he was always busy.

Discovered his talent for sales and networking early while selling fish with his father.

In school, he questioned authority, got into fights (you see the build, right?), and eventually learned that nothing is impossible, through perseverance.

He graduated from Georgia’s European School of Management and MBA from Harvard Business School later on.

In interviews, two aspects always show up:

- emphasis on people you surround your self with (duh);

- intelectual humility.

I can’t say I know the people of the region. I’ve only been to Georgia once. But I would argue, central Asia should share at least some similarities with CEE region. People are direct. Either honesty or dishonesty shines through, unlike someone French.

All Mikheil’s significant wealth is in Kaspi.kz and he sees other personal investments as a distraction. I shared another nugget from the interview recently:

His competitive make-or-break mentality, I believe is an engine behind Kaspi’s execution success so far. He’s currently 46 years old and I could not hear any hint of him stepping down.

In his early career, Mikheil recalls “we were a bank, but people still hated us” (not a direct quote). His aspiration has always been to create a product, that people love and from a certain time NPS (net promoter score) became one of KPIs.

People working in Kaspi.kz

Kaspi has an employee ranking system. If you rank at the bottom three times in a row – you are fired. I haven’t read any glassdoor like reviews from former employees and I may disagree with the policy, but numbers are cranking so the system must be working.

As per 2020 audited report, there were 9000+ employees, 1200 of which in data science, IT and product development. Average employment term: 4 years (average age: 30)

Two notes here:

- modern fintechs have a problem with UX. Problem? You are frusted talking to a bot and waiting for a human. I suspect significant amount of cheaper (in comparison to west) local workforce is customer support.

- Most senior management members are old-timers from Vostok – Kaspi transformation times.

Kaspi’s Business Model

As mentioned above, Kaspi.kz classifies it’s business in three major lines within the same app, so let’s touch on each of them.

Payments

Kaspi.kz took Kazakhstan’s cash-rich ecosystem by storm. From 2020 report, kicking Visa and Mastercard in the teeth:

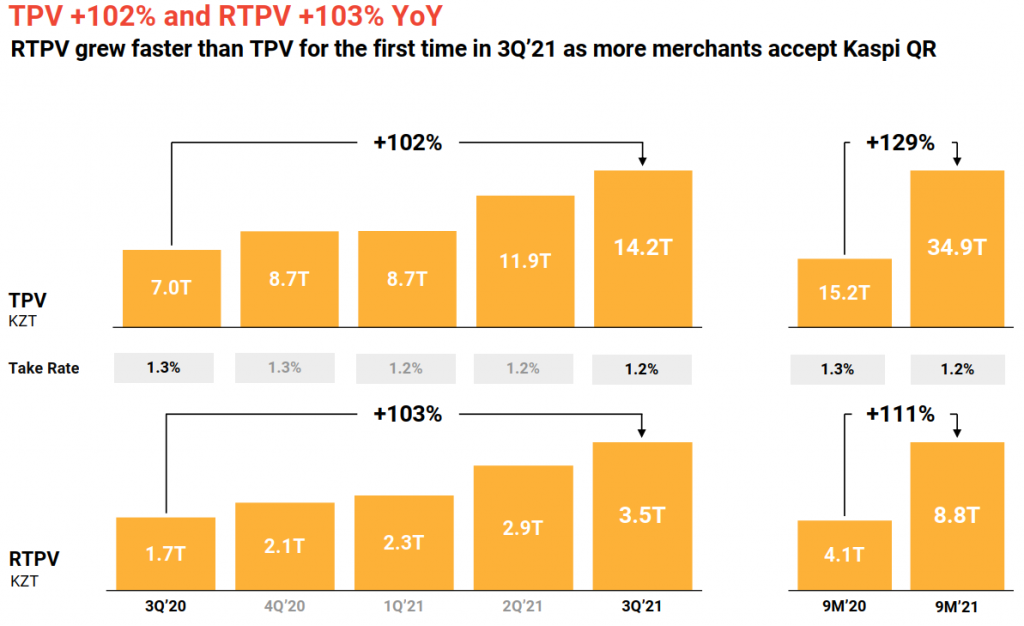

Kaspi.kz Payments Platform is the largest driving force behind Kazakhstan’s transformation from cash to cashless and digital transactions. Based on NBK data, our TPV corresponded to a market share of 69% in 2020 for total cashless and digital transactions (card payments, P2P payments, internet and mobile payments) effected in Kazakhstan, up from 65% in 2019

Payments functionality is the most important factor to acquire new customers into Kaspi.kz ecosystem. As you can see, there’s also a wide range of government-related services. One webinar on youtube also suggested there could be voting (as much as it matters in KZ) through the app. But more on government – later.

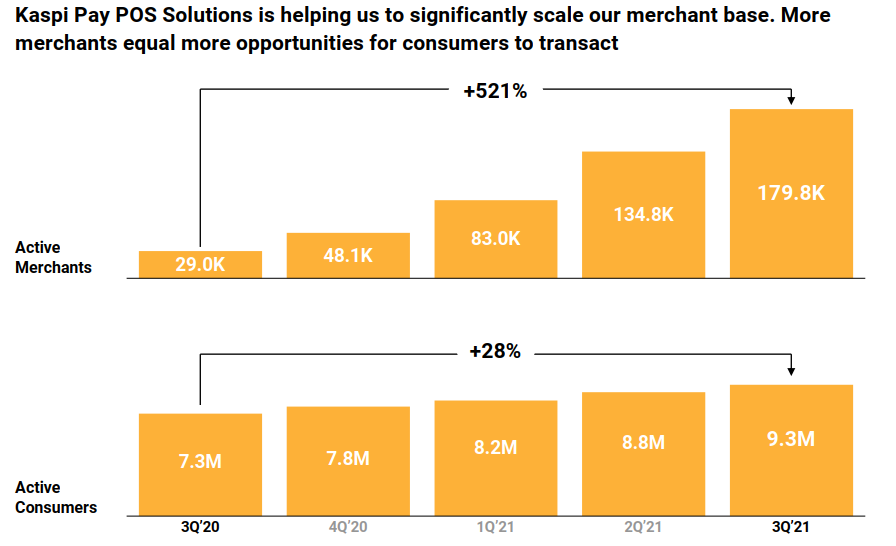

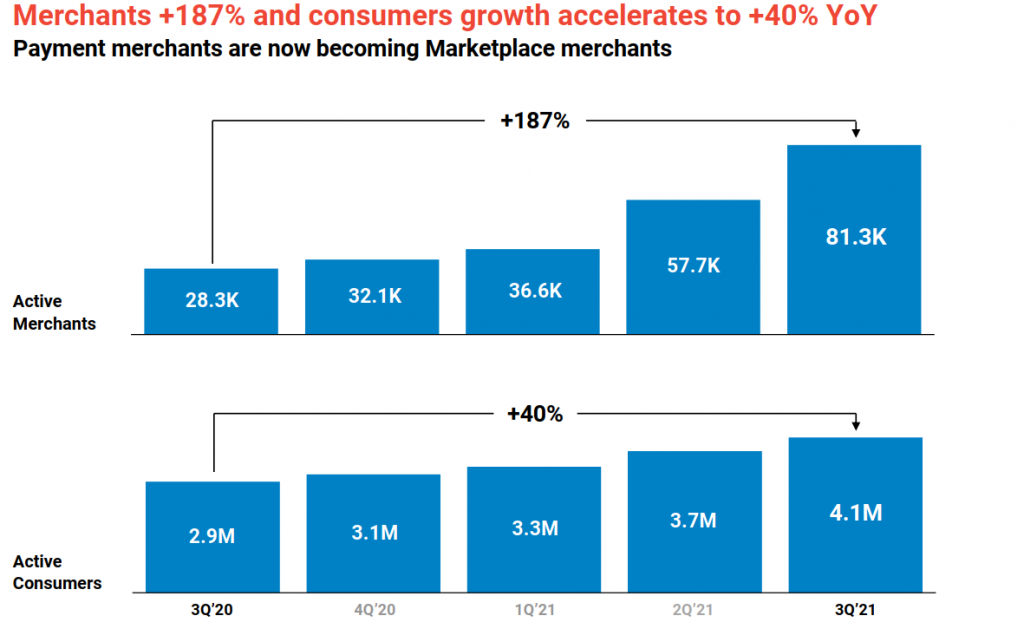

Merchants naturally have a lower base and show significant growth over consumers. From 2021 Q3 earnings deck:

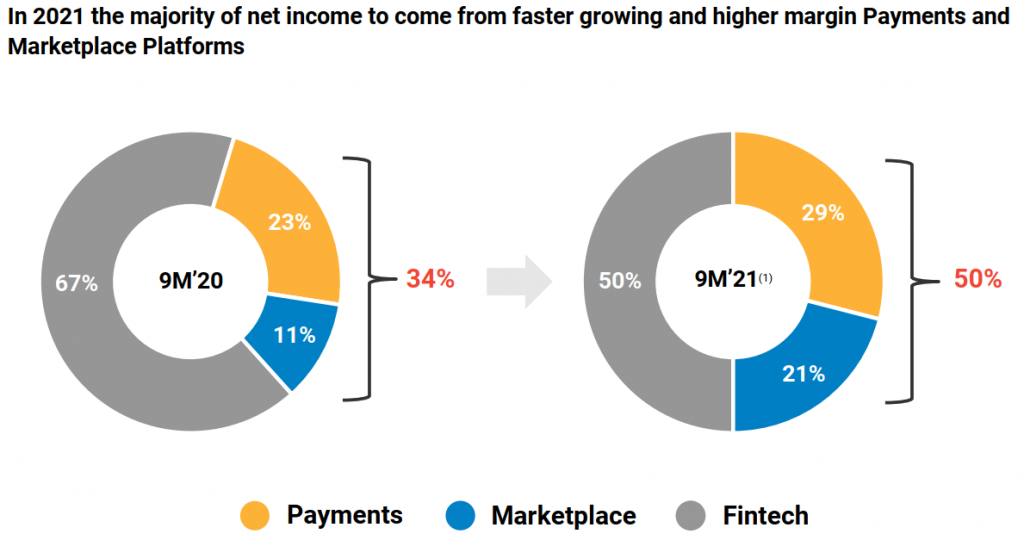

Payments and marketplace businesses are gaining share in overall revenue 50% up from 34% a year ago:

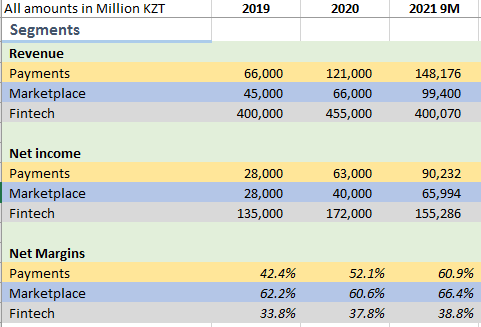

Speaking of margin… It’s a thing of beauty. For 2021 9M net profit margin was 60.9% and has increased almost +1800 bps from 2019. Network effects at play. More merchants – higher RTPV (revenue generating total payment volume) with a marginal incremental cost:

Marketplace

Within the same app a “Amazon” opens up. Difference is: there’s no first party. Kaspi.kz stays lean and only mediates between merchants and customers.

And it’s growing tremendously well too.

New merchants bring new merchandise, which grows consumer selection, deepening the moat in e-commerce, making Kaspi the default choice for consumers. The flywheel dynamics are the same across all marketplaces, so nothing new here. And Kaspi is a dominant player in a country.

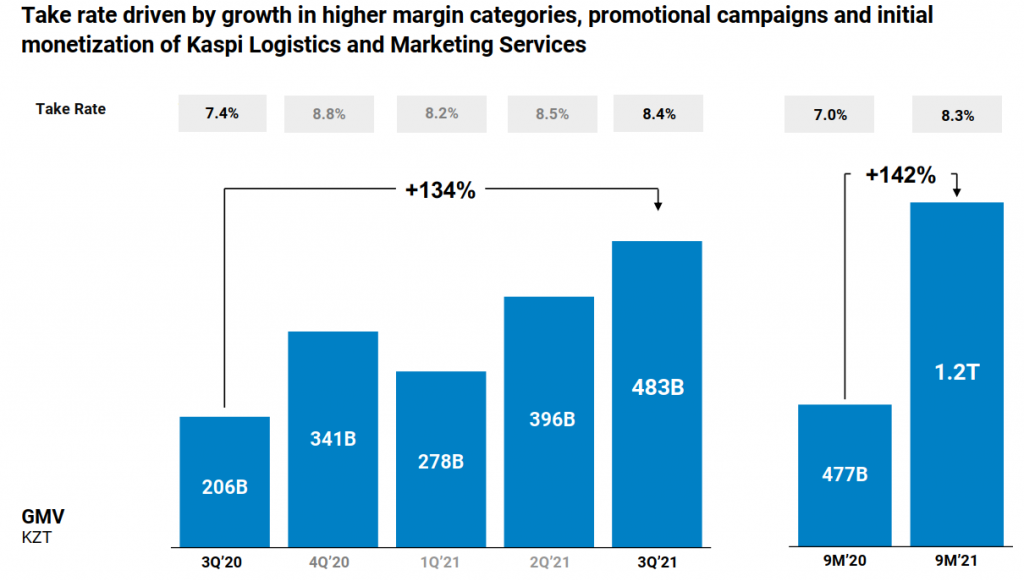

GMV growth YoY exceeds doubling. Take rate is also expanding due to higher-margin categories.

In an interview, CEO spoke, that logistics is something Kaspi is seeking partnerships with (Keeping it asset / CAPEX light). Currently majority of purchases for consumers are free shipping and delivered within 2 days (not to forget KZ is 9th largest country in the world).

I suspect Kaspi has given enough aggregated business volume for shipping carriers, that carriers are the ones in fact subsidizing free shipping. And Kaspi owns logistics software (from what I understand).

Net profit margin is even greater for Marketplace and as of 2021 Q3 was 66.4% (having expanded 400 bps from 2019).

Fintech

That’s the legacy banking, on top of app, with sprinkles of modern BNPL for consumers. All things lending.

In 2020 Kaspi was leader in consumer loans with 32% market share and second in terms of retail deposits (18% share).

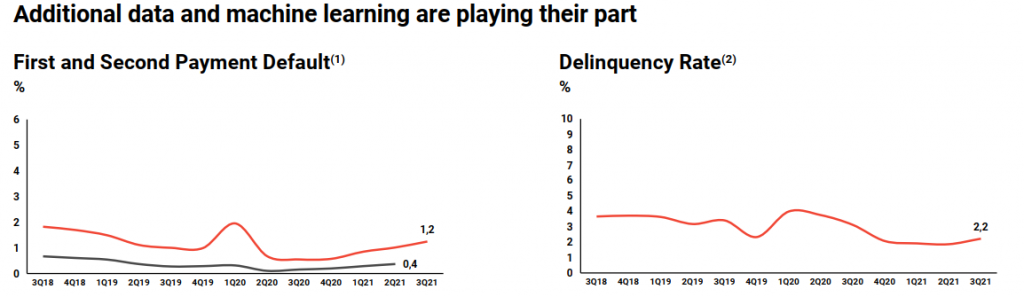

As all (I suppose) modern lending – Kaspi.kz utilizes all of the data it has on user, additionally, it has access to external data sources: LLC First Credit Bureau and JSC State Credit Bureau and Pension Centre.

With time, more data -> better risk profiling -> higher profitability. Classical machine learning in action. However notably models have been hit off-track in 2020 Covid.

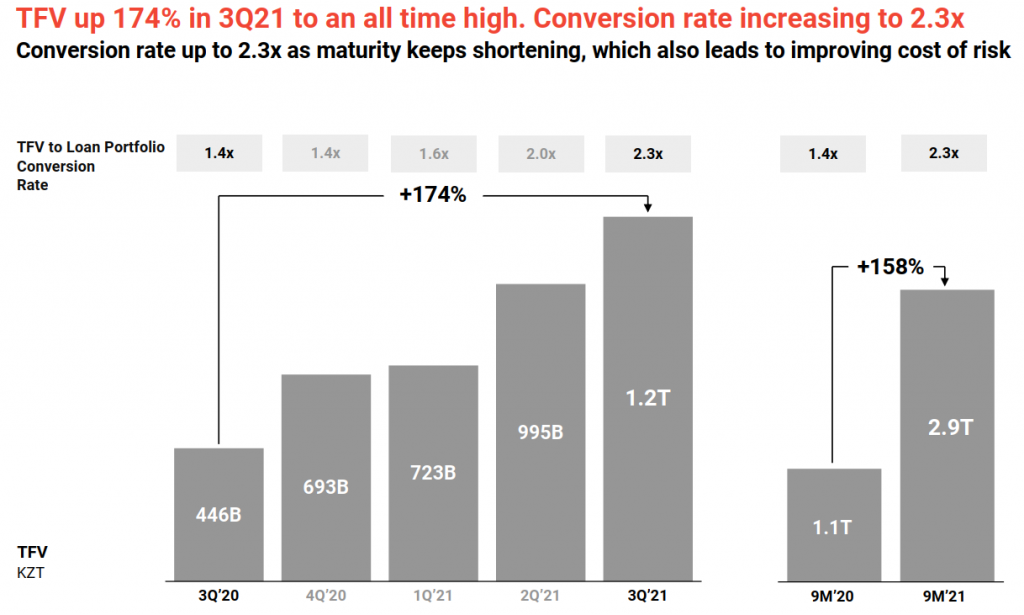

Total value of loans (TFV) provided via app is on a steady growth:

Fintech segment net profit margin for 2021 9M was also solid: 38.8%. Expanding more modestly 500 bps since 2019.

Consolidated Kaspi.kz Fundamentals

Here’s how segments have been performing lately:

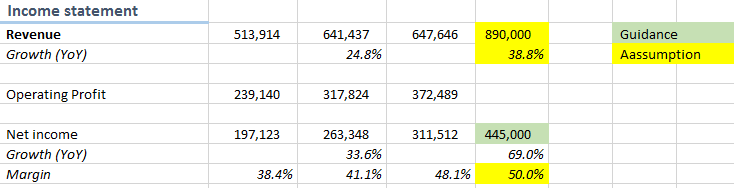

Here are consolidated financials for 2019-2021 years with Net profit for 2021 taken from revised to the upside 2021 Q3 guidance for full year.

Last reported quarter, revenue grew +55% YoY, net income +90%…

Similar to Reliance story, Marketplace and Payments are the new drivers for the company and reacceleration in growth.

Consolidated margins are a testament of network effects and economies of scale again, for both of these new growth drivers. Not only it’s a startup with moat, it’s a high cash conversion, profitable startup.

Valuation

At 85.75 USD of GDR at the time of writing, this company trades at 16.1 forward (guided) P/E.

Assuming 534 Million KZT in EBIT and 2021 Q3 balance sheet EV/EBIT is at 13.4.

Want a fun excercise? Let’s see how these look on 2021 9 months income:

- 23 P/E;

- 19.2 EV/EBIT

Not too shabby either for solid growth and margin expanding profile.

Dividends

…and it pays dividends… From IPO prospectus:

The Company intends to pay dividends annually in the amount of at least 50% of net income, calculated under International Financial Reporting Standards (“IFRS”)

On 445 Bn KZT, at current price, we are looking at 3.1% dividend yield.

Upside Potential

Layering, Cross-selling and ARPU Growth

There’s this story floating around: Kaspi bought a local ticket company, integrated it into it’s SuperApp and saw a growth way above, what it was growing on it’s own. That’s a real proof of SuperApp accessibility doing its magic. One are for growth is just developing and layering additional services and products.

Maintaining new services adds little to costs, but may contribute significantly to bottom line.

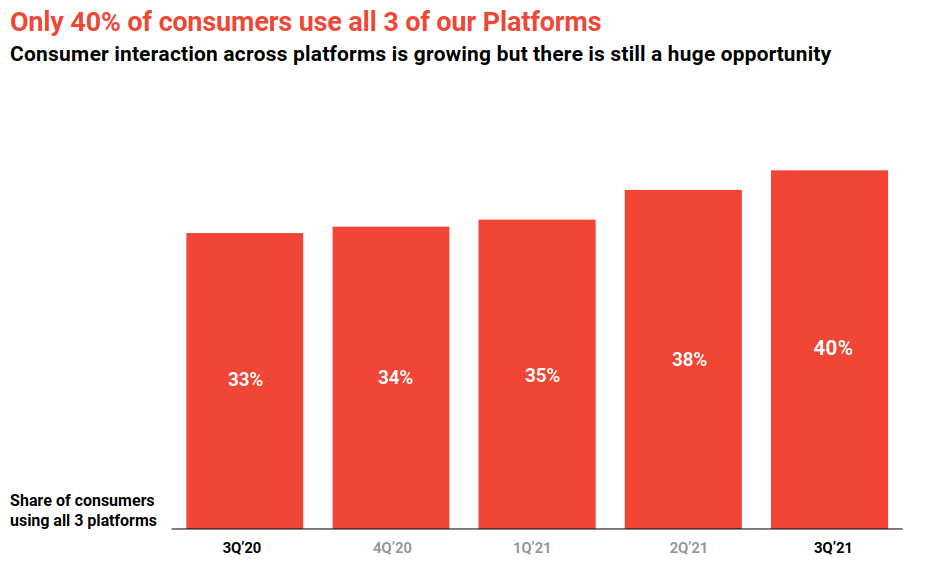

Cross-sell is another. As of 2021 Q3 only 40% of customers use all three platforms. Of course you won’t make everyone take out loans, but I saw Payments MAU < Total MAU’s, which is way easier jump. On-boarding to marketplace is also win-win.

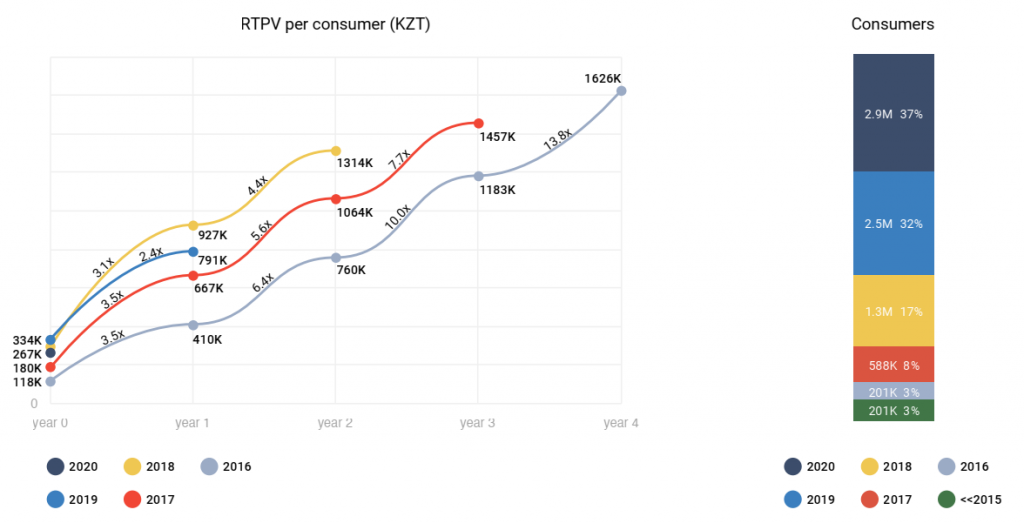

ARPU Growth is another area. Each landed customer is likely to spend more over time as he gets used to shopping/ paying online through the App. Cohort data for both RTPV and GMV look alike:

ARPU growth is somewhat automatic. All Kaspi has to do is maintain high level of customer service.

Saturating Kazakhstan Market

Kazakhstan population is 19M. Kaspi monthly actives crossed half population last year. Notably, DAU/MAU is second best after WeChat among SuperApps.

70.2% of Kazakh population falls under 15–64 years, so I would assume a realistically reachable population is around 14 – 14.5M. (2021 Q3 MAU: 10.8M), which is another 30%+ growth. Not to forget network effects in place compounding profits.

Either way, management already sees the ceiling in home market and speaks of international efforts more often lately.

International Expansion

Online business model makes it way easier to travel across borders. Central Asian region still very much cash-based, but other neighboring markets have tighter competition (my impression on learning about the company). Another regional quality – low e-Commerce penetration and low consumer leverage.

Kaspi is already active in Azerbaijan (population: 10M). In 2019 it acquired real estate and auto classified companies. In 2020 report company notes:

In Azerbaijan our three leading classified platforms have continued to scale their users, revenue and profitability since being acquired by Kaspi.kz in 2019

Another notable thing, is regional marketplace, opening opportunity for merchants to grow their business in outside markets.

In October Kaspi announced it completed the acquisition of a Ukrainian bank. Basically, it’s a banking license purchase. Ukrain population: 44M.

Kaspi.kz has a real shot to become a regional SuperApp for Central Asia markets.

Risks

It’s fair to say, Kaspi stock has a regional discount attached to it. No US company with comparable growth rates and profitability could be sold at 17 P/E. This obviously comes with risks.

Adverse Anti-Monopoly Policy

Kazakhstan is democracy on paper, authoritarian in nature. If upper management is friends with government players, I would assume Kaspi is protected. There are even four reasons I think government is unlikely to come after Kaspi:

- Kim Vyacheslav is known to have relations inside government. At one point he served as an advisor to the prime minister;

- My general impression from reading Facebook comments: people love the app, I would assume are even proud of it’s home-grown roots. Government attacking private company would look bad in the eyes of the public (as much as gov. cares, of course);

- It is is gov’s interest to encourage the use of online payments. This lowers shadow economy, gives more observability.

- President Tokayev met with Kaspi founders in 2021 Feb. Gov. services availability through the Kaspi.kz app is an indication of public – private relationship with current leadership.

Taxation is however another discussion. Similar to Evolution, I would argue certain aspects of business could be squeezed harder.

Shareholder Shakeout

There’s a shady entry – exit story of former president Nazarbayev nephew Satybaldy, who supposedly sold this stake before London IPO in 2020 October. There could be a number of informal or undisclosed shareholder agreements between three major parties owning Kaspi.

Co-founders were not willing to share specifics to Forbes on the issue, which sheds some negative light on the subject.

Baring Vostok Exit

Baring Vostok Fund has been an early investor in Yandex (Russian tech giant) and eventually sold their stake. Recent filings show their position decline. This may put sustained pressure on share price if their strategy is eventually exit via public market.

Departure o major institutional shareholder would also be seen as a negative in some investors’ eyes for sure.

Failure to Expand Interntionally

In light of recent headlines on Ukraine it may sound crazy, but I’m trying to get into management’s heads and think through. Worst case: Russia indeed invades and takes over Ukraine, when dust settles, it’s still unlikely Russia would kick its’ ally’s business out of a market. But it would be painful period of uncertainty for sure.

As mentioned above, I did not dive into any specific countries for potential payment or ecommerce fintechs, but my general understanding is other countries will pose greater competitive pressures. Execution and timing are key.

Kazakhstand’s Political Stability

Few days ago I shared an article by Armenian Weekly. This and other readings on 2022 January deadly protests formed my understanding of situation:

Nazarbayev officially stepped down in 2019, but remained a shadow control figure and actual chairman of KZ’s Security Council until 2022 January. People hate the guy and for the longest time assumed second president since independence Kassym-Jomart Tokayev to be a Nazarbayev’s puppet. However January’s events hints, that Tokayev is gaining or gained autonomy. Putin seems to respect KZ boundaries as well and sustained Russian troops presence would have gained negative sentiment among KZ population (Russia as former oppressor).

What seem to have happened in January is an opportunistic gang clash for power.

Regionally everyone wants stability in KZ. Especially Kazakhs. To my own surprise Kazakhstan’s Tenge (local currency) has floated quite beautifully through the crisis. Strong export economy may be the reason:

A real risk one has to be aware of is exposure to business, that primarily conducts its affairs in KZT. Tenge has been devalued in the past.

2022 Q1 Numbers

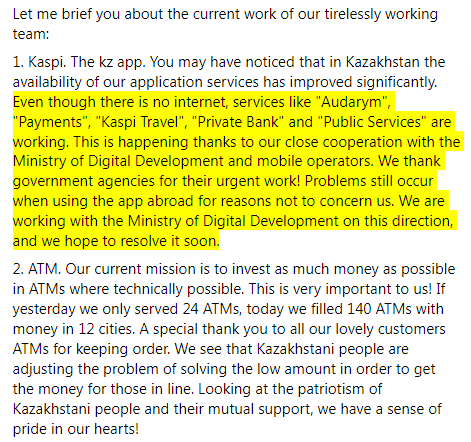

Positive in a negative light. Kazakhstan has shut down internet for nearly a week during clashes in January. I could not download Kaspi’s filings from investor relations. You might expect a dip in 2022 Q1 numbers, however short the disruption. But according to this post from CEO on Facebook:

The government assisted Kaspi in providing its essential services. Also note worthy, 3 point in the same post remarks on the damage done during revolt on headquarters (?).

Position Details

Easiest way to access Kaspi.kz stock is through London GDR’s (1 GDR = 1 stock). ISIN code: US48581R2058. Link on LSE.

Last year my curiously was flirting with Russian stocks for their relative valuation and quite diverse selection. Kaspi.kz is a middle, that satisfies a regional risk / reward profile I was seeking exposure to. Next week I’ll be initiating a position with a family member in a joint purchase. My portion of the position will amount to only 1% of portfolio. Consider it a starting – learning position.

Just a reminder to read my poorly written disclaimer.

Closing Words

Market is usually right. Companies growing 40% with expanding bottom line at 50% net margins don’t trade at 17 P/E. Although Kaspi had nearly a green-field opportunity, making its way into new markets will likely be a lot more pushing elbows, however currency devaluation is primary risk in my opinion.

Kaspi has build from the ground up what western companies like Facebook (f|_|ck you meta) only now aspire to do – a SuperApp, that consumers use daily for payments, shopping and other financial or government services. This is a very strong business with modern SaaS buzzwords like network effects and economies of scale actually showing up in financial statements.

CEO is a clear leader. Self-made billionaire from Georgia is humble and always unsatisfied, which drives innovation.

If company maintains its execution, as market trust builds, there’s a reasonable chance for multiple expansion. There’s also a fair shot Kaspi.kz becomes Central Asian SuperApp.

Recommended Material List

To continue learning about the company, this is a non-exhaustive list of material I found most useful:

Leave A Reply