Time and time again I prove to myself, if I don’t get distracted from markets and keep a close eye on movements, announcements I can trade profitably. In last post I outlined the reasons why I entered Inter RAO Lietuva (Lithuanian company traded in Warsaw Stock Exchange under ticker IRL).

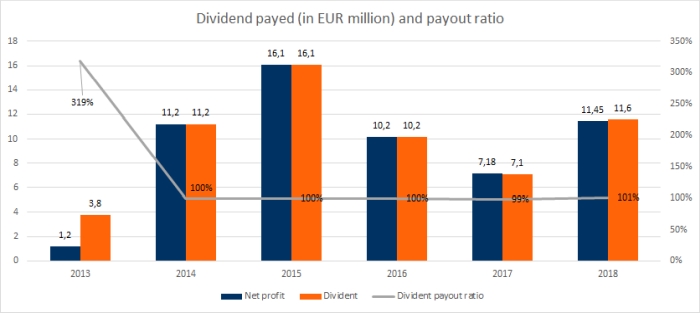

Inter RAO Lietuva dividends

As expected, company distributed all of its 2018 profit or 0.58€ per share. At my 12.55zl entry price this means an astonishing 16.7% dividend yield after taxes.

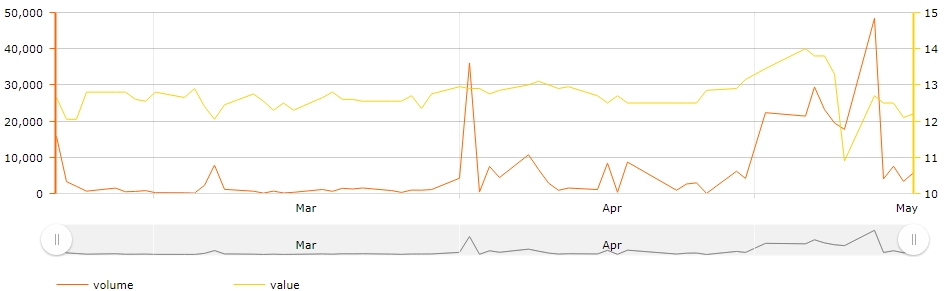

10th of May was an ex-dividend date and price plummeted to 10.5 zl level, however at the same week I’ve done some research on taxes, that will be introduced in Latvia and Estonia in autumn, this year.

Taxes on Russian electricity in Baltics

As I mentioned in the last post, baltic states are unhappy with cheap electricity flooding the market. Estonia might be the most angry one and had been suggesting taxing Russian electricity as Finland did years ago. (More about Estonian electricity production in this article).

EU countries are subject to Carbon emission taxes, that are indeed fair, in my estimation and contributes to shifting energy market towards sustainable electricity generation. Below is the chart of CO2 European Emission Allowances price.

The higher the CO2 emission allowance prices, the easier it is for Inter RAO Lietuva to push its Russian-made electricity to Baltic Market, because Russian electricity is not subject to this taxation. This 20-30€ price for each Megawatthour makes all the difference.

So it seems, Latvia and Estonia had finally found the common ground on the issue and will tax Inter RAO’s electricity starting autumn 2019. More on this in Estonian media article.

Predicting Inter RAO Lietuva Financial Performance

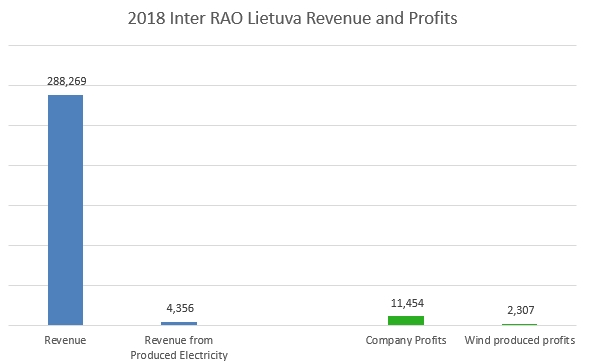

I knew the winds had been stronger in the Q1 of 2019 than average, so own electricity production must have been stronger, however let’s not forget the scale:

So on the same taxing research evening I ran into another article:

It has been reported earlier that Lithuania has more than doubled its electricity production in Russia in the first quarter of 2019. Overall, from January to March, 1,697 billion kilowatt-hours of electricity were delivered to Lithuania, which is 2.1 times more than in the first quarter of the previous year (0.805 billion kilowatt-hours). Similarly, in the Baltic Sea region, Finland increased its electricity imports from Russia by 41.5%. In the first quarter of 2019, 2,181 billion kilowatt-hours were delivered to Finland, while in the same period of 2018 Finland imported 1.541 billion kilowatt-hours.

Control the information, don’t participate in the madness

On Friday (dividend ex-date), as mentioned price tanked to ~10.5, on Monday, Q1 results were released and stock gained up to 20% during the session, which is when I succeeded to exit at 13.1zl.

After I discovered that article, I went a step further and checked to see if there is data available about electricity flows among Lithuanian borders. And sure enough it does exist. I did not proof check with reported results though.

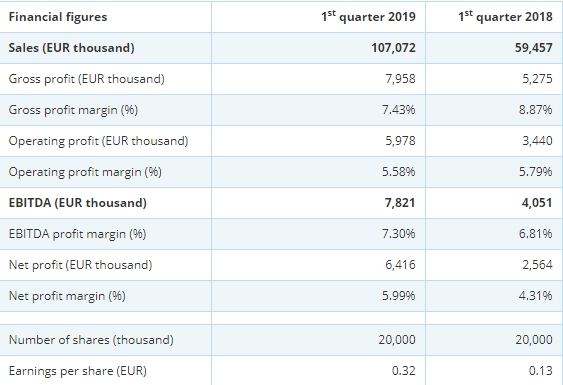

Inter RAO Lietuva 2019 Q1 financial analysis

It’s splendid. During Q1 of 2019 Company managed to earn 56% of 2018 financial year net income. Revenues were up 80% yoy. Key data:

Trailing twelve month numbers:

- EV/EBITDA 3.3

- P/tBV = 3.25

- P/E = 3.81

- Cash/Market Cap = 20.9%

- Debt / Equity = 2.

Note that 11.6M dividends for 2018 FY have been deducted from Balance and “worse (a.k.a real)” ratios are provided.

Why exit IRL then?

I attended Annual General Meeting of Shareholder’s. I asked about potential impact on imposed taxes by Baltic States. After some juristic mumbo-jumbo no sound answer was provided. Not a good sign.

Another thing, that I had forgotten before – synchronization with EU power networks shall be finished by 2025. From then on, I don’t know what will IRL’s business will look like.

Wind business operates at around 50-60% net profit margin, but without further investments I can’t see nice prospects there. If we negate electricity trading business, dividend yield from wind-produced income should stand at 5% (evaluating only depreciation and maintenance costs).

While real impact of autum’s taxes by Latvia and Estonia will only be visible in a year, I see no reason to stall the money that long. As always, with money cows – I’ll keep an eye on what’s happening with Inter RAO Lietuva.

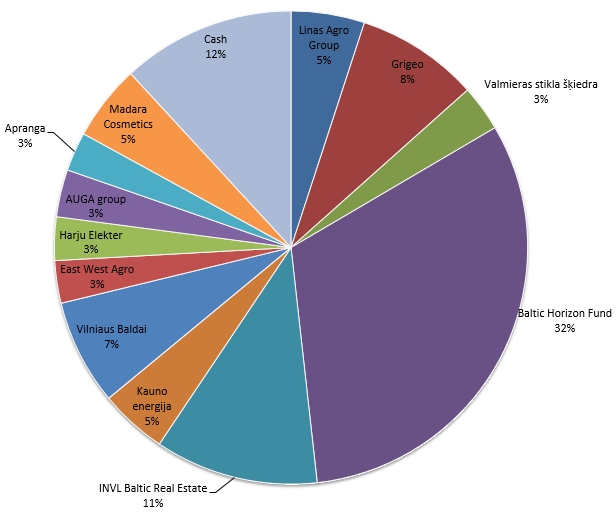

Updated Portfolio Structure

Two months in Inter RAO Lietuva yielded a total of +18.5% return after taxes. Updated Portfolio Pie Chart:

You can find all my portfolio actions explained here.

Leave A Reply