Yesterday Investors Association had an event to discuss current global and local financial affairs. Few weeks ago for the first time I made some notes and found it quite useful as information is stored better. My friend, who was unable to make it to the previous meeting sure was grateful for the summary I had supplied him, hence … this post. So, how local professionals see things?

Global overview – Paulius Kabelis – portfolio manager at „SEB investicijų valdymas“

- 2017 was historically very good for mutual fund managers. Sharpe ratio, which measures reward to variability was in all-time highs for 2017;

- Headlines for 2017: the world is finally in sync. Meaning all markets are moving in one direction – up. Previously developed countries were lagging behind due to high inflation, local politics, crisis associated with low oil prices; EU lagging behind with numerous potential populist elections etc;

- Recent (March) correction in markets somewhat normalized P/E ratios, while companies keep improving profits (however what many analysts fail to mention is relationship of profits with share buyback programs and what adjusted profit would look like without financial engineering);

- German business environment index PMI saw a decrease in momentum mainly due to recent US – China “trade war” sanctions and stuff. Everyone seems to be more cautious.

- China’s GDP component of export is decreasing in its weight (growth is increasingly maintained via other components);

- “Recession indicators” are all still silent:

- yield curve, although getting flatter, is still not inverted;

- spread between companies bonds and government bonds are still at lows; a spike in the spread usually suggests there is tension in the market;

- PMI indexes are above 50, meaning business managers assess business environment positively;

- Government expenses/investments are not slowing.

Conclusions: increased nervousness in the markets; strong economy; central banks will be very careful about their policy; stocks are more preferable than bonds at this point.

Local market – Arvydas Jacikevičius – broker at „INVL Finasta“

- In Autumn 2018 ECB will cease to stimulate economy via quantitative easing (QE);

- Among central European markets our Baltic Market is only more expensive than those of Romania and Bulgaria;

- Developed markets are priced at the different dimension in comparison to Baltics (paraphrasing, obviously);

- Baltic market trading volumes are somewhere between 6-8 times lower than Romania’s or Czech Republic (the old liquidity problem, but this time from the angle of potential looking at the regional stock exchanges);

- Averaged Baltic market dividend yield for 2016 year stood at 5.22%;

- Regulatory update on restricted time to trade for insiders: one month leading up to estimated date of results announcement;

- Norwegian fund actions in Baltic Market:

- BUY: EWA1L, MDARA IPO’s, Inter RAO, PVZ1L, TKM1T;

- SELL: APG1L;

- Note: fund liquidates some of the assets if prices are going up (maintaining same value), (SAB1L case).

Bonds – Karolis Kybartas – “Girketa” investment manager

- First ECB rate increase should be around the middle of 2019;

- Karolis thinks FED will be more cautious than market participants expect;

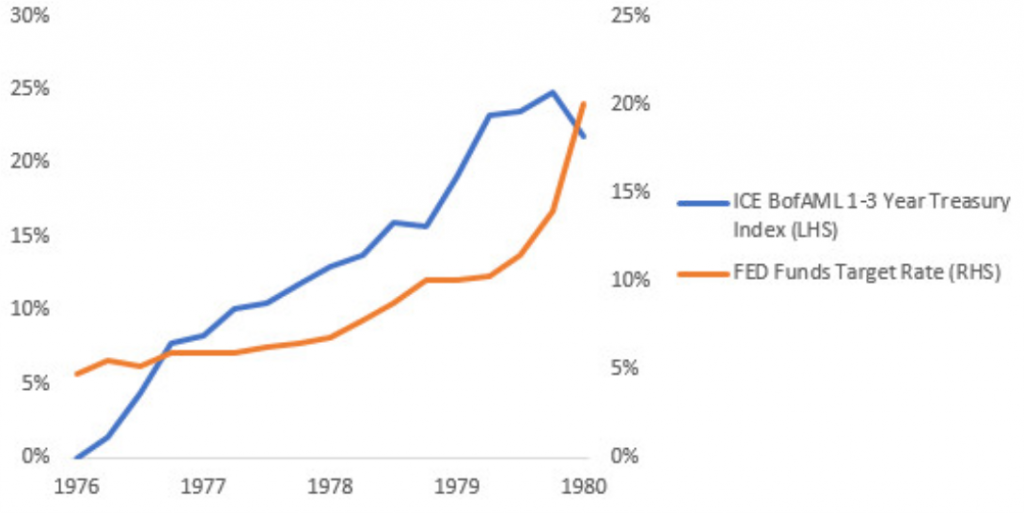

- Remembering the rate increase 76-80’s – 1-3 yr bonds government bonds outperformed all other asset classes (I ain’t no bond masta, but this one example is far from convincing me there is a great investment idea in bonds at this point);

- Main driver for long term bonds yield/prices – inflation expectations;

- Passive investing in bonds does not work. Bonds must be managed (worth remembering);

Apranga Group, Dividend Stocks, ECB, Economy, FED, Investing, Investors Association, MADARA Cosmetics, Pieno žvaigždės, Tallinna Kaubamaja Group

Leave A Reply