Epilogue

You were interested in the title. You are in for the value. Everyone is in for it. Not everyone has an idea where to find it. You open it up, scroll down to see the length. After realizing reading the whole thing will take more than five minutes you either found yourself in another browser tab, or reading first paragraph trying to evaluate if potential time investment reading this work would bring any value. At least that’s what I do… Let’s talk about money.

Purpose in the middle of a thread ball

For several months now I bear the burden that I have to write about money. Maybe I will help, show the way, or give a kick, which would change course of your cruise at least a one degree. Bill Gates said: “Most people overestimate what they can do in one year and underestimate what they can do in ten years”. Thus if today I change your direction at least a little bit, in N years, when you arrive at different station you most probably won’t even question what would have been happened if then you did different. It seems like in my head, on specific frequency I am receiving several radio stations and they interfere with each other to transmit a clear signal. Not because it’s hard to focus, but because topics are extremely intertwined in each step. This is kind of an apology for feasibly unacceptable, limited structure text, closer to stream of consciousness. But let’s try.

Change the world. Which one?

We look at the same world, but see obviously different things. Why is that? Selective focus. Unconsciously filtering what we find interesting, acceptable and only with a glimpse of eye catching topics that wobble us from our values sledge. Why do people fall under populism? Why do people let technologies win over human interaction? Why don’t people meditate? Why are there so many people in poverty? Why aren’t people questioning the righteousness of existing truths? Why do people watch crime stories on TV? Why instead of food, burgers are chosen? Why kill ourselves with nicotine and alcohol? Why western democracy degenerated to plutocracy? Why oh why… Usually you close your eyes. Hands droop. You won’t change a thing anyway. Wrong. Water cuts through stone not because of its strength, but of its persistence. I see a change from the other side. Through the pull, rather than push strategy. It’s important to realize, at the same time your life is the most important thing and utter zero worth. For you – it’s all you got. For the world, whether you are in it or outside of its bounds – no difference. Everything will keep flowing as it had before. You may attempt to change outer world, but you can change inner world rules now instead, because you live there more actively than in outer one, maybe you just didn’t give it a thought. It’s important to understand yourself and where do you stand on this ball of dirt. What do you believe in and how those beliefs will stand in face of global winds?

Pull is the ideology, which does not lack idealism; perfect peace (within self for start), empathy for surroundings, sustainable development. In other words conditions, in which hatred, greed, arrogance are unable to exist. If everyone would tap into this strategy, we wouldn’t have to move heaven and earth trying to change something on the outside. Results would naturally manifest themselves out there. Recently I have read about Auroville. Do you know why this will never happen on full scale?

Who are you?

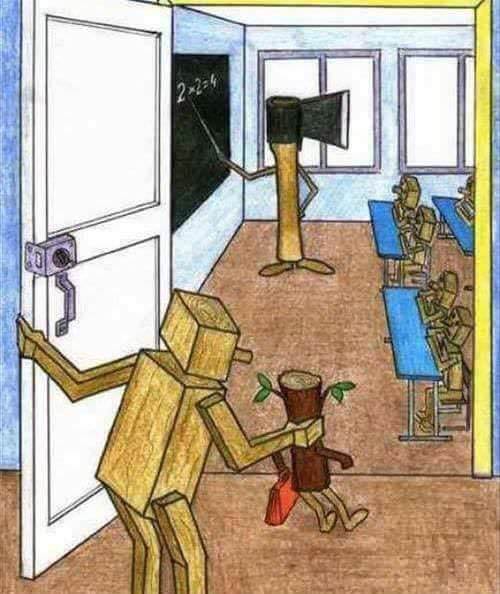

You think you are Jing, Samantha, Daniel or whatever your name is. As if one word could unlock your individuality. I propose we are damn sponges. Few percent of genetics, family-installed values programs and the best part (because you can consciously change it) – your surroundings. Not just the neighborhood. Not what you remember, but all the signals that reach your brain. Scent, taste, sense, sight, ear… What are you learning; what music do you listen to; what is your nutrition; where and how do you spend your vacation; how do you perceive and control your emotions; what do you read and watch; what is your spare time like, consciousness of your decisions; what people do you surround yourself with; why? I am in constant awe of the staggering effects of one’s surroundings. Why am I talking about this? Because for the longest time I was not satisfied with the way I was leading my life. In allegorical way I was planting apple tree in the sand expecting to taste the fruits. It did not go too well. Then a cascade of valuable resources (what’s the way I call all kinds of positive influences) opened the doors to new way of thinking; you start changing surroundings, re-plant your tree and enjoy the apples. That is the way of a change. All is needed is a desire.

Who am I and what do I see?

I classify myself as idealist, generalist, everlasting learning, libertarianism advocate, pseudo-philosopher. I have a theory – human is like an onion, having lots of layers. Each layer is applicable to different life situations, surroundings. One way we are among friends, other family, yet different with ourselves. Moreover tomorrow we might be totally different with ourselves than the day before. Therefore several years ago I decided to dive into neurology and philosophy. Both of them are essentially try answering the most important questions for me. Why humans behave one way or the other? What drives humans to achieve heights in professional life, steal a stein from the bar, create a family or experience a burst of aggression? One of two invokes science and the other has its peculiar, inner approach. I also believe that if all layers such as race, tradition, national identity, religion and bunch of others that have been raised with the body would be stripped away – we are alike. Just like babies. Without prejudices and social conditioning. However one usually does not feel this sense of unity. I think main drag for this is entrenched capitalism. A long shot. I will try to knit a causality chain.

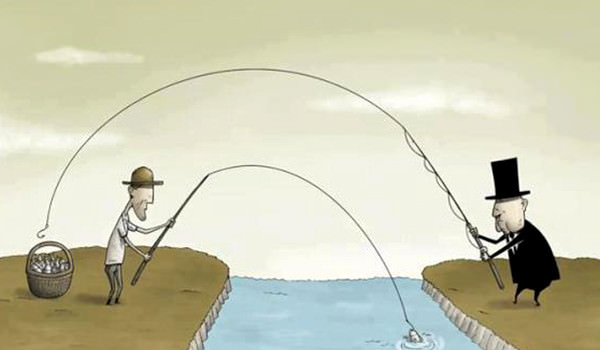

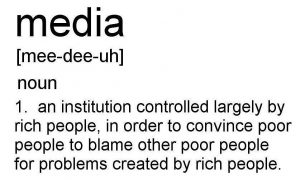

Capitalism as creative destruction

Aim of capitalism is to maximize profit almost without any restraints. Laws are somewhat drawing the lines for activities that would be intolerable by general public, but legislation is enforced by people. And what do people have? Flaws and greedy pockets. Let’s call everything we see outside the window an Establishment, something like “just the way things are”. Ok, let’s be more objective. The way author sees, subjectively. Establishment, whose goal is to maximize profits needs consumer with removed critical thinking, but not sufficiently dumb not to participate in job market or terminate his tax payer’s fate with self-destruction. I see this happening here, as well as in global arena. Food stuffed with empty calories, additives which negatively influence our brain makes it harder to hold attention. Alcohol slowly but surely develops chronic brain diseases. Media, content of which is dictated by systemic influence more often seeks to entertain and divide, rather than inform and inspire. What does crime TV show do? What function does it apply? Of what habit, virtue neurological pathway do people stiffen after while watching this kind of show? One study shows subjects who have been watching Fox news were less informed than those, who did not watch news at all. TV, as well as other media cast successful life image standards as if after ways of sorrows through education system, business launch or serve series of years in regular job, creating a family, having lots of shiny things to spoil about you could eventually feel elect only happiness in slavery (mind prison, because goals were set by society, not raised individually). Religion… Oh boy, this is a big one. May the responsibility for your life failures fall under superhero! This is god’s will.

Here we can turn up market laws. Supply (for establishment) is formed by demand from society. Is it? Really?

Governments, to have a reason for existing, must defend their people from other people’s attack. But not one people wishes to attack, or does attack, another. And therefore Governments, far from wishing for peace, carefully excite the anger of other nations against themselves. And having excited other people’s anger against themselves, and stirred up the patriotism of their own people, each Government then assures its people that it is in danger and must be defended. – Leo Tolstoy.

I state that Establishment artificially creates demand for centralized government organs through constant psychological terror. These terror waves are periodic. 9/11, Zika, terrorism, emigrants. Function of each one of these is to strengthen the belief, that anarchy (basically absence of centralized institutions) is nothing but bunch of skinheads with baseball bats aggressively approaching our property. If at this point you feel an urge to oppose, let me briefly defend my stance.

With guns you can kill terrorists; with education you can kill terrorism. – Malala Yousafzai.

N. Chomsky in one of his talks has opened my eyes. Third world today is third only because it was exploited by the west to support economic growth back home. Yes, terrorists do exist. But they are far more rare instances than media depicts. These are elementary explosions of suppressed anger towards the injustice. Fear is very effective tool to support the establishment. Any social reforms (prostitution, drug legalization for starters) seem radical and absurd, when in practice opposite is true. These are only feathers. Nobody talks about decentralizing government (except for recent rise in Icelandic Pirate Party), although there are real models how to protect your property, control crime, secure social stability in libertarian society.

Though capitalism may be a drag at least to start ideal societal order, I named it as creative destruction, because it bore industrial revolution, internet, hacktivism, blockchain is being born, AI will be and what I call – non-advertised, real individual freedom. I believe the day is coming when humanity will not be afraid and main occupation will be creativity.

Let’s put idealism aside for a while. We live here and now. Each of us strives for highest qualitative parameters of our lives. I suppose there is no need explaining money does not bring happiness. However everyone would agree our day to day existence is easily embittered in western world when there absence of financial stability. Now, since only first cracks appear in capitalism wall, let’s explore how we can manipulate juncture to our benefit.

In search of passive income. Brief financial autobiography

I do not recall anyone pointing out the benefits of conservative financial planning in my childhood. I somehow felt and knew it intuitively. Or maybe I saw how finance concerns were dealt with in my surroundings. If I was subjected to the popular Marshmallow test by the time I was a kid I believe I would have passed it effortlessly. If fixed deposits were to be classified as money market tool and one of asset allocation areas, then I began investing around my fourteenth birthday. Besides that I conducted plenty of passive income experiments on the side. Total costs of these experiments throughout the years ranged from time (no monetary investment) up to 2000 USD. Main profit usually was experience. Around sixteen I noticed someone in Runescape talking about earning e-gold to purchase memberships. Month later I was actively engaged in PTC (pay to click) market clicking advertisements making my first cents “on the side”. Around a year lasting time waste was terminated with cleanup of local PTC forum section and similar schemes. Then I dived into poker (freerolls mainly), sports betting, HYIP, investment-ponzi schemes (Banners Broker, Uinvest). Somewhere in the middle of these tests, around my seventeen, I was trading bonus dollars in Forex market.

Forex

One book, stack of articles online and the graphs, whole market took totally different look. Line chart became uninformative. Confidence in my knowledge rose each time price was following by drawn lines. Problem laid elsewhere. I was a kid with excess energy. I needed action everywhere. Market as well. It was boring and still when the markets closed at night or weekends. My enthusiasm and market volatility had a near identical positive correlation. When I returned from school I would log on to terminal to check which direction exchange rates would have gone from previous log on. Euro went up. Why. Reading specialized Forex websites for recent news soon extended my sight to global markets with less focus on dull exchange rate movement. When last fractions of my bonus cents were burning up, I realized the importance of emotion control in this market. I do not enjoy being an observer. I want to participate in the market. Then knowledge absorption is completely different. It does not vanish in oblivion. I buy it. It’s like buying gym membership or heading out to exercise equipment in the park. Result may be generated in either of those, but money mediation motivates better. Hence I urged to have an open position at all times. Ergo poor entry points. While trading my second bonus account I came to realize there are plenty of opportunities to even earn a living, but it’s nothing like spare time clicking. It’s a full or even overtime job. Timely I have read a shocking story of Forex trader Dj’Xas story on his personal sacrifices in the market, so I logged on terminal more infrequently. I have watched, traded and learnt basics of technical analysis in Forex for almost three years. In Forex, conversely to thousands of ad-driven victims I did not burn any of my personal money.

Transition from games to investing

I don’t know when exactly I had gotten an epiphany that losing money in Forex was easier than pissing on your fingers. Not because of leverage or volatility, but of physiology. The way body reacts to changing sign next to open position. It’s a gamble! Only stakes are placed in financial sector. To lose your money in stock market one of two must happen:

- Company goes bankrupt;

- Force Majeure. State privatizes company, seizes equity, war erupts, banks close their doors, tsunami blasts majority of servers or any other major crap.

The latter is out of our scope of control. This means if you do your homework perfectly – you will inevitably be in guaranteed profit. Ergo – capital markets.

Capital markets

In the late autumn of 2008 when I was approaching my eighteenth birthday I was laying my thoughts on where should I make my first step in financial markets. Few days after the birthday I went to see financial consultant in investment department of one of major banks in my area. I remember a close look on me. And today, remembering that day I appreciate the professional aid and honesty I was given nonetheless the client across the table was an eighteen year old kid. I left the building with mutual funds booklet the bank was managing.

Week later with approximately 30% of my savings I have had my first real investment – money market fund, which could profit from both short was well as long positions crashing markets, which in crashing market seemed like a reasonable idea. That time was in fact the perfect storm to load up portfolio with riskiest instruments, but bearing in mind the absence of financial literacy and experience I easily forgave myself. Year later I sold fund units with marginal decrease at -1% percent from original value. Global markets were reviving. Several articles praising the recovery of Japan stock market caught my attention. At that time I was green-washed – fanatic supporter of sustainable development and green energy. I wanted a stake in renewable market. I picked up Danish Vestas Wind Systems and German Centrosolar. I have to shamefully admit – back then I did not even open financial reports. My decision was based on technical analysis, articles and firm’s reputation image I got from internet. So there was my first diversified portfolio composed of three instruments – Japan stock fund and two stocks, at that time representing around 50% of my savings, I believe.

I kept a close look at prices. Fund suggested a conservative rise while renewable stocks, after delighting with solid paper profit eventually turned the other way. I sold at a mild loss and only years later came to perceive what was happening in EU with renewable energy strategy, feed-in tariffs, etc.

Baltic Market

In 2010 I discovered and allocated portion of my savings to local capital market. Later, to my own surprise, first portfolio in Baltics consisting of local Ukis bank –link] and Agrowill was worth only €50 back then. Probably distrust and mistakes of the past limited an appetite for risk. I look at transactions history in excel and smile. Agrowill was sold in 8 months with fairy 215,38% profit; Ukis bank was held till the end and after several years became a 100% loss (bank was forced to declare bankruptcy). Entry points? Strategy? Forget about it. Agrowill? Because everyone needed and will need food and farming land in balance sheet will always be valuable. Ukis bank? Because there was my secondary account and banks never harm themselves. There were rumors that Ukis bank failure was influenced by president, though Agrowill, which was on a brink of bankruptcy as well, successfully restructured its debts and glinted in my portfolio. Although majority of local investors are skeptical of technical analysis in Baltic markets due to low liquidity, though I will never forget how LNA1L was squeezed in wedge letting me not only to fix a conservative profit, but avoid downtrend ahead.

I keep a close eye on around 40 stocks in Baltics since early 2010 almost daily. At the moment of writing just a little above 60% of portfolio is allocated in Baltic market. I have no idea why didn‘t I start in home market.

What the hell am I doing here?

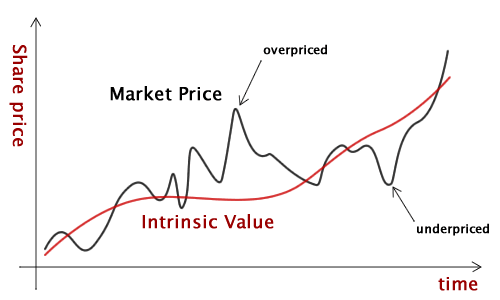

After a year of guessing based on other investor opinions in forums, own technical analysis, history of dividend payments, stocks liquidity and maybe several more criteria I understood that dipping a heavier coin without deeper understanding of company’s valuation will be scary. I started reading financial reports, which at first seemed boring; I followed what mathematical models exist, that could reveal intrinsic value of a stock. In general I separated the notions “price” and “value”. Since then seemingly equivalent terms, appeared to diverge in stock market. With experience, knowledge and background of targeted media pieces of financial markets puzzle started to make sense of why is this divergence present. I began calculating relative valuation metrics myself. I enjoyed it. On spare time, me – engineer undergraduate, diving in totally different world and my knowledge based money is making more money. What a strange world. Tectonic plates shifted. I painted a vision of compound interest and similar gibberish. Growth of portfolio, first based on savings from gifts, summer jobs later became more stable with standard “8-17” work.

Paradigm shift. Why do you need money?

Up until fourth year of my bachelor I was a perfect billet.

That is a creation of establishment number #X. I know specific people, articles, movies and YouTube resources thanks to that I started kicking myself and grow outside of limits of systemic parameters. That was a start and after graduation, without ideas of what shall I do in life next I guaranteed two more years of certainty in establishment. At that time I met people, who in their thin wallets are able to find generosity and empathy to buy homeless bread or cigarettes, sharing remnants, living today without a throughout strategy for future. Personal testimony of this today is one of the best lessons in my life.

In late 2012 I noticed video games were consuming too much of my time, so I challenged myself not to play for whole next year. Soon enough I had to make an exception for chess. I’m not particularly proficient, but I know I got better since I started beating 10-minute live matches. That contributed a lot on board, as well as outside of it. I noticed a better peripheral sight of topics, valuation on different planes. Extrapolation of chains of events from present details gained precision and each confirmed prediction built confidence. Till then a blind goal to grow portfolio and acquaintance to people having completely different world outlook hit my face with wet rag and arose existential questions for portfolio and my relation to money.

The question remains: what will you do with those numbers?

Why would I need it? A house? I have a roof above my head. A car? I have my “bucket”. A new one? So I could impress someone? Not interesting; not me. Create a charity fund? No, a little too young; don’t know how it works. Relation to money became entirely dull. I generally started modeling scenarios what would happen if I were to lose everything. Not portfolio. Everything. Around the same time a deeper understanding on own emotions arose; what kind of beast Ego is, what does it want and how to deal with it. This mental practice and asking critical questions is very healthy and liberating process. I started monitoring what people am I following. Do they, after achieved professional Olympus and public recognition preserve the morals, or do they fall for greed? What lies beneath their words? I feel an incredible respect and gratitude for a row of people for sharing their experience and wisdom, people I will never meet.

Material goods in their teachings will never an end goal, but rather an inevitable result.

Gradually losses of individual open positions stopped concerning and nagging. I calmly began evaluating whether loss was due to my fault or elements that were unable to recognize before entering position. If I couldn’t predict that, why would I beat myself up? Entry strategy emerged, which was absent before. Now I know what I rationally expect from position and model why behavior if it turned -5%, -15% or -25%. Emotional preparation for buying a stock is done during analysis stage.

Vigilant reader might have noticed the question raised in paragraph title remains open. It’s for a reader. I have my answer. Conversely to ambassadors of fallen morals I’m certain I will never build my fortune on others misery. In fact quite the opposite…

Why don’t eastern Europeans invest?

I smile. Our region was raped pretty aggressively throughout the history. Political, social repression has left a deep mark of fear and distrust in our parent’s culture and lives. Jealousy, deceit of state as well as neighbor. Eye for eye. I’m a 90’s kid. I’m trying to communicate financial literacy among my contemporaries as hard as a need to keep interest in politics. Not the last two months before election, but consistently. Sadly interest is poor. I think to myself: “Damn it, generations changed. Where did conservatism, fear come from? Don’t you like money? Additional income source? Advantages that come with compound interest?” I expect financially illiterate parents may not teach their children what they don’t know, then my look turns to educational system. I had economy class for one semester in gymnasium; another one in university. I’m not certain if that’s only me, but I remember nearly nothing. Something about supply and demand, some on net present value. Why? No, I have a better one. Why economy lecturers aren’t millionaires? They know the markets and its laws pretty damn well. Conveying a capital of knowledge should be a hobby, not a day job. So why are we so distanced from finance? I feel personally hurt by existence of poverty, short term loans market (the very fact there is a demand for this market), extent of time deposits and overall illiteracy in finance (18 page). Ultimately if we don’t posses that, how can we judge whether it’s good or bad when state borrows on negative interest? The good or the bad guys raised retirement benefits? Our investments usually start (and end) at pension funds, or at best key scenario – real estate. Which isn’t bad, but real estate lacks liquidity; cycles are present same as everywhere, and if you decide to enter, you have to have a bundle of large banknotes or big chunk of numbers in your e-banking window.

Today’s kids are familiar with the idea of money

Another layer. Data vs cash plays especially critical role in finance, money comprehension for Y, Z generations. Data here stands for any form of digital transfer of value. Today’s kids are growing in an environment where you can see cash dying in action. Why so – is a different topic. Apart from technological revolution in place or casual user-friendly payment experience I see two greyer reasons, that is financial monitoring of individuals, collection of data and the fact that spending money in digital form is far easier. Children that grow and will grow between transactions via phones, NFC, swipe or biometrically lose the concept of money. According to Adam Carroll it becomes an abstraction, thus it’s more difficult to hold it as a limited resource and acting conservatively becomes more challenging.

V.Plunksnis, the chairman of Lithuanian Investment Association in one of recent seminars accurately laid the thought pattern under which young people does not decide to invest. I have a spare 100 €. Say I allocate it to stock market and expect a solid return of 10%. What is 10%? It’s 10 €. That’s few. I would rather save a larger amount and invest then. Studies, job, years pass and one stands with 10 000 €. Now that’s money for a young fella. It’s a bit scary to dip this amount to markets. No experience and the column of knowledge on finance is overwhelming at first sight. I would rather improve the quality of life, buy a new car or repair an apartment. That’s how door to investing closes before one catches a chance to enter. Now is a good time to return to Bill Gates quote in the beginning. It should sound more meaningful in this context.

Why I invest?

I have plenty of reasons to invest.

- I don’t like dependence and captivity. Job is a relative thing. One day it is present, tomorrow it might as well be absent. A large chunk of jobs were wiped out by industrial revolution, some are disappearing today, and another portion will become obsolete within next decades. You are safe if you work in niche or with particular abilities. However if you drive a truck or cashier, I would rather learn something that could not be replicated by artificial intelligence straightaway (superb article, btw). Put it in other words – investing – is a creation of secondary income.

- Hedge against inflation (almost not essential today).

- Appropriate diversification through various markets, currencies, asset classes protects against systemic risks. E.g. hypothetical, although quite real theft of your assets through ECB decision to devaluate Euro.

- I get frustrated with spare money lying around, not making more money. A watch, notebook, car (not talking about antique investments which I have no knowledge nor experience yet) does not work. It fulfills a function.

- I admire an idea of owning a piece of business without actively engaging in it. Someone scratches a head how to earn money while you sleep. For you personally as well.

- That is a way of life. A way to improve. Investing, as an activity – is damn wide. You get news from a wide range of sources. What is happening in local, foreign markets, economy, politics, how do companies perform, commodities and salaries expenditure dynamics in reports, what specifics do certain markets bear, what investment ideas or opportunities arise today, tomorrow. Why certain markets or companies within them fell/grew. Few examples: City Service left Baltic stock exchange and started trading in Warsaw Stock Exchange. Position became dependant on EUR/PLN. I was forced to track polish zloty exchange rate and with a tail of an eye observe what news influence push zloty rate around. Another example: K2 LT – first crematorium in Lithuania debuted with successful IPO. During analysis I became familiar with cremation statistics in Western Europe, future outlook in local market, main competitors in region (foreign), service fees, specifics of activity, demographic ratios of Lithuania. Keeping an eye of market reaction to political events, natural disasters, relations between markets itself – is a whole different, but no less interesting thing. You come to realize money is like water and markets and asset classes act as vessels. Water is never still, only poured from one medium to another. And if your drop appears to be in a vessel which experiences a start of inflow – amusing time awaits.

- Stock market is by far the best training ground for emotional control.

- I would probably lie to myself if I claimed dopamine is nothing to do.

- Vision for a better tomorrow for my surroundings and myself.

- So I could show it’s easier than it seems. And go ahead at least a little the regrets for past decisions.

When to buy and could juggle with numbers be called an art?

Sometimes, when trying to comprehend certain process, values of organization I follow Plato’s steps and divide up to whole numbers. In finance – whole number is a human or robot (algorithm). Algorithms guarantee volatility noise, humans – errors in rationality and buying opportunities. Basically in investing, as in any other trade, the goal is to buy a quality product below its intrinsic value.

Conversely to shop, stock market gives this opportunity quite often.

I admire photography, cinema and dainty music. I would not like to smudge the word “art” with current financial system. However if a man enjoys solving tasks, analyzing stocks on different layers maybe it’s not a sin to borrow this word?

To find a cheap gem (undervalued financial active, especially in current steroid fed market) is an art, in my opinion for two fundamental reasons:

- Everyone is looking for a gem;

- Underpriced active always has its reasoning. It’s most likely not a opportunity to buy, but an absence of knowledge; This absence may be filled up after buying, or never.

Strategies, stock picking criteria are individual and passing article goals topics, so I will restrain from specifics. I am grabbed by other things and want to share several more epiphanies.

Cognitive biases, behavioral economics

Cognitive biases are cognitive errors or deviations that prevent objective and rational valuation of the matter and take according actions.

One of the most exciting things in investing is own biases identification, then seeing that in other market players. Rationalizing the situation, bending, misrepresenting facts to favor a belief, cherry-picking data. Boy that is transfusing experience to observe. Psychology (and its foundation – neurobiology to my mind) and economics meet in separate discipline – behavioral economics. Dan Gilbert is one of scientists that points out our cognitive biases in personal finance (present versus future value of money, instant versus delayed gratification and bunch of other interesting experiments.

New dimension – time. Measure of effectiveness

In the end of 2014 I noticed I’m becoming more and more satisfied with the decisions in my portfolio, however I do not assess money in time. Meaning I’m not utilizing situations when blue chip stock could be sold for a temporary position in stock that shows significant growth in sales, profit and overall market sentiment. Money makes money in either way, but with a timely exit from growth stock, capital could be used more efficiently. I wrote a piece on time. Recently I calculated CAGR for open and closed positions. Basically it is a return over time unit. Velocity, acceleration would be somewhat similar to day to day life. Absolute return could be deceiving. If a 5-year long position generated 5% total return, calculate a CAGR. You will immediately see there is not much room to be glad about it.

Getting to know Bitcoin

I read Medium. Not everything. In 2015 Mike Hearn article appeared questioning Bitcoins technical development challenges and thus overall existence of this new currency. Something about block size, significant volatility in transaction fee size and some other geeky stuff. To me, newbie in the field this made an impression. I knew a place where I could expect some expert replies. With tact I admitted being new to Bitcoin and seek for answers for Mike’s arguments. Thank to men, that in subsequent comments neatly smashed trivial technical challenges to smithereens leaving me with thought that withstood till this very day – Mike Hearn is associate of banks consortium. This ended my questions on article and started an observation of news on Bitcoin, blockchain. During the following year I have tested Bitcoin transactions, also diversified fraction of portfolio with non-systemic value units based more on ideological basis than on speculation. In ten years my cryptocurrency holding value might be near zero, or might as well be valued 10 000 €. I assume both of them realistic.

Two approaches to learning

Reaction? Two things should be distinguished. What I have learned listening to experts and what I have actually experienced in practice. Practice: I did two transactions. One of them in working hours; second – Sunday evening. Both transactions were processed in 10 minutes or less. Distance between sender and recipient has no difference for this technology. I could have donated to charity in Ghana or buy myself a kebab in same duration. Fee applied for both transactions was 0.05%. I could have sent 0.02 € or 1 500 € – the amount does not do much as well. You know what’s best? My personal data never left. Transaction is direct between sender and recipient and we don’t need any mediator. We trust mathematics. After experiencing Bitcoin myself I felt like the one I have never been before – an early adopter. Cool feeling.

I had no doubt financial revolution will creep in everyone’s life. Inflexible banking industry will eventually be squeezed between competition and regulation. A very interesting time at finance is on the doorstep.

Theory: there is this computer scientist Andreas Antonopoulos. I don’t know many programmers, but I think barely few are proficient speakers as well. Andreas is expert on both of these poles. For few years now his main occupation is traveling the world and telling the story about development of blockchain, arising future contours of technology, newest areas of application, challenges and solutions to a wide public. To familiarize:

What I hear from his examples in history, explanation and argumentation on technological side, opportunities of application and answers to really challenging questions incites my hope for better world. Without oppression, power structures, holey data security and what‘s most important – freedom to own‘s equity.

What are dollars or euros backed by?

I should educate myself more in history of economics, but gold standard story went basically like this. Back in the day dollar was backed by something. That something was gold. Meaning every dollar in circulation was equivalent to real amount of physical gold. If you went to central bank, you could have theoretically asked to exchange your dollar to a mote of gold. When great depression came, due to lack of gold reserves, high unemployment rate and need to stimulate economy, the fixed rate with gold was let loose and central bank of America (FED) was free to regulate not only the cost of money (interest rate) but money supply as well. What happens when supply of a product is increased? Price drops. Inflation happens (product being money itself here). Although process is not so direct as in macroeconomics, because quantitative easing (QE) mechanism is different, though gist of it is the same. Our money is being stolen through reduction of its value. But if money isn‘t backed by anything physical what creates value? Belief. We attribute value to everything. If tomorrow we decided to trade in grain, tobacco or water – currencies would cease to possess function, meaning and thus value.

Here lies the fundamental advantage of Bitcoin protocol – it was designed to replicate supply of precious metals. The further down the road, the more difficult is to obtain; strict, mathematically described supply algorithm of newly introduced units into economy and knowledge of total sum of supply makes Bitcoin easily predictable. Value is same as everywhere – dictated by public interest, but without systemic risk.

I want to distinguish the terms „blockchain“ and „bitcoin“.

Blockchain

This is an open-source technology that is the basis for bitcoin – virtual cryptocurrency – one of blockchain applications. The future of bitcoin might end someday, maybe even in coming years, but there are reasonable premises to think what blockchain brings to the world might be as revolutionary as internet in late 90s.

I’ve heard rumors there was an editing – ideological war in Wikipedia, because there are people there that want blockchain, but reject any associations with bitcoin. Under article “Blockchain”[link] in Wikipedia the word “bitcoin” kept appearing and disappearing. Interesting. Saudi Arabia recently announced it would host all of its government papers on blockchain by 2020; Estonia was working with blockchain for quite some time now. Even if this first experiment of cryptocurrency would fail, I’m sure central banks would one way or another propagate current FIAT currencies on the rails of blockchain.

I give you content Mark, you give me nothing

You get that your produced content (as well as this article hopefully) provides some added value, right? Facebook writers stack papers to Mark. The working principle behind social networks has flaws. Not only do I produce content, but content itself produces traffic, which is basically advertisement (= money) engine. No-one feels robbed?

Steemit is the first blockchain based social network, which has not gained many media coverage. Steemit users get rewards for their content based on community valuation, which should theoretically drive content quality up. Some more info on Steemit is in Huffington post. Sure, today is a niche project, whose main driver is a reward for content, which isn’t necessarily mean quality. However let’s not fall under failure of imagination the idea could one day reach Network Effect and put Facebook into the shelf next to MySpace.

What do I most admire about blockchain? It’s openness. Corruption likes the shadow. Scams in daylight are only done in dictatorships. Open source code makes it very easy to bring responsibility for betrayal of public trust. And that, in certain sense would create conditions to flourish justice.

Bitcoin development

Money buys out morals. Rare resists the power of a symbol. State promise to pay retirement benefits, bank’s promise to return your money and a lot of other promises that are mediated by man are soft promises. I hold trust as one of the greatest virtues in human relationships. If a promise is based on math – it’s a hard promise, and its execution beforehand is based on programmed algorithm.

Media outlets periodically claim bitcoin is dead. For the record, there even is an online archive for this kind of nonsense. I look at the fact – number of transactions. If it grows, then network is developing.

Assuming that after connecting my notebook to internet all my private data is potentially available to everyone, for few months I have been researching how to secure my cryptocurrency in the first place. (if someone catches some data of no interest today, does not necessarily mean it would not be in ten years, when btc capitalization is potentially hundredfold. Let’s be honest. Nether I or you need bitcoin. Why should we learn all the business about wallets, security, technology, if we are all happy with euros? Well the world still has around two billions of people without access to financial services (couldn’t find more fresh data source), that cannot participate in global trade. Experts suggest bitcoin infrastructure will be first implemented there. In emerging economies, where inflation eats more than people, bitcoin finds shelter. Economies of Venezuela, Brazil, and Argentina this year went through the chimney and people there are already familiar with bitcoin. They now know. Chinese sit on bitcoin train due to capital flow controls by local governments.

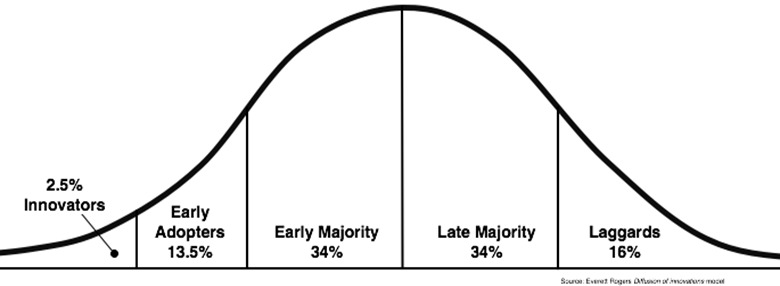

Looking at curve of diffusion of innovation I think today bitcoin stands in the very innovator stage.

So there is still time to prepare some popcorn. We still see the ads, whole movie is ahead.

Big data, big brother, big mistakes

Internet rapidly invaded our homes with all its advantages. Only then questions on privacy, systemic data collection were conceived. If topic is new to You, short intro:

Orwell’s predictions are most evident in America. After whistle-blowing nationwide spying on its citizens E. Snowden was accused of treason and is now forced to stay in Russia. You don’t have to look that far. I remember a thread in uzdarbis.lt forums where the story of (at that time) minister of Lithuanian parliament was laid out on tapped phone calls. Having a little power or influence in this world is enough and if you are not liked by someone one step above, dealing with you will be as easy as turning off this article. Government is one. It has its own purposes. Private sector is another thing. Google, facebook, youtube. All the clicks, comments, likes, shares, browsing history, tags in trips (GPS tracking) – it’s your life is someone’s cloud without your consent. Fuck it, let them have it, you might say. But I am prone to believe that big data products in development are targeted against rather than for prosperity of casual citizen. Take elementary filter bubble or neuromarketing for example. Did someone had to ask you? Did they have to? I’m certain they had to.

Futurists claim personal data will be taken care of more cautiously. Some say we could even purchase something if we disclose some of our personal data. Personal financial data is as open as Hillary’s Clinton’s emails if serious hackers (including social engineering if necessary) are on it. Aren’t you bewildered by this?

Projects like TAILS shine some hope that unwanted personal data travel through internet might be stopped. Bitcoin protocol provides pseudonymity, which means I can be anonymous if I choose to. Separate tools are there to ensure that. Most of people mistakenly see anonymity as a primary tool for criminals. That is the pumped message of those trying to stop development of the network. Yes. Criminals use bitcoin. They also use cars, internet, Euros, offshore accounts. Tell me something I don’t know. Statistics are against objections (16 page).

The beginning

We are used to consume, not grow. Answers are often given with questions; one thing we are left to do is take a decision. I tried to leave open ends in the article: more space for self-reflection, discussion. If there your own personal answers appear, this will be the ultimate value of an article.

[…] The most destructive belief that I followed was Gondon Gecko. Who said greed was good. And it‘s bullshit. Greed is not good. It‘s ambition that‘s good. And it‘s passion that‘s good. When you got greed in your life, the first thing that goes out the window is ethics. – Jordan Belfort

Leave A Reply