My absence shall be explained on a separate blog post. Today I want to address recent changes in Baltic equities portfolio: I sold Grindeks, portion of Apranga Group and bought a stake at MADARA Cosmetics.

Inexcusable mistakes valuating Apranga Group

Perhaps you remember my last portfolio update, where I outlined Apranga Group as a potential investment idea. At least I named it as a risky move. I hope you thought with your own head, otherwise we both have learned something.

Rookie Mistake #1: Including one-off items

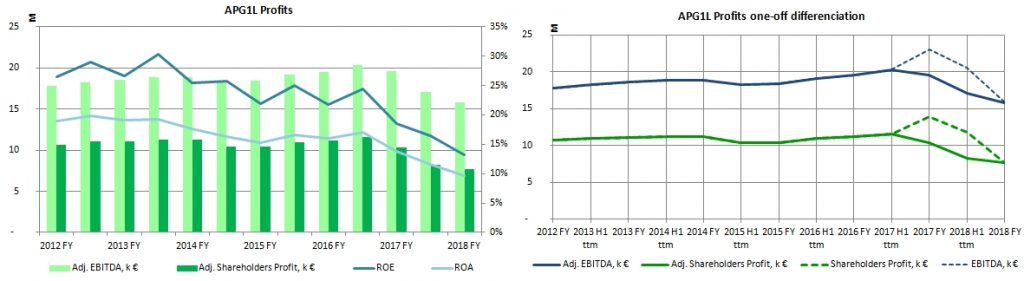

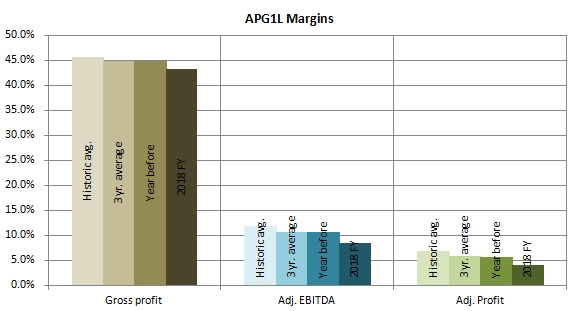

In 2017 third quarter Apranga Group sold real estate, receiving 3.5 Million Euros. I did not go through old reports to analyze the nature of net income. Below you can see the real situation on APG1L EBITDA, Net Profit and Balance Return Ratios dynamics.

Right chart clearly shows distorted image. Grounding financial decisions on non-adjusted profits has proven me wrong. My bad.

Mistake #2: Over-focusing on Trading

Sometimes I have time and I like to observe trading activity on Nasdaq Baltic. Order flow, bid/ask balance, building forces, turnover, company announcements etc. Apranga was one of those purchases, that arose from closely monitoring trading activity over the span of several weeks. Sometimes I buy as if I was a trader; even though my generalist nature does not allow for non-stop intense tracking of portfolio. I try to leverage this entering into positions that would be alright in the long run (strong balance sheet, macro environment, business specific timing).

While some of these alternate factors still hold on Apranga, I ignored the obvious extraordinary hot summer, which could have predicted worse 2018 H2 result. People don’t go shopping for clothing when they are sweating at the lakes.

No surprise, but still missed.

APG1L what to expect

It’s obvious Apranga Group goes through some tough times and margins contraction. Rimantas Perveneckas, CEO of the Group comments that 2019 significant reduction in turnover is to be expected due to significant CAPEX of 12-15M into reconstruction and opening of Apranga Stores across Baltic countries. Reconstruction works should be finished by the end of 2019 summer and since September 2019 Group expects double digit growth throughout 2020. Ambitious, got to say.

I expect 0.1-0.12 € dividend per share dividends for 2018 FY. Recent turnover announcement seems refreshing, but at 2019 H1 full effect reconstruction should kick in and I expect APG1L shares to hit new lows. In previous post outlined challenges remain, however 2019 Q3 – 2020 H1 might offer speculation opportunities.

Updated Apranga Group Position

On 2018.12.10 I sold half of APG1L position fixing a loss of -20.56%. Lessons cost. Currently floating loss of unsold portion is at -25.2%. I want to visit Annual General Meeting of Shareholders and then decide further. Diversified portfolio helps.

Exit from Grindeks

There are good reasons and bad reasons to be among Baltic listed companies. Grindeks is the bad apple, which is directed by the lovely dude on the right.

I first bought Grindeks in 2015 June and some more a month later. Average entry price: 6€. Over the span of 3.5 years as a shareholder of Grindeks I had a chance to take loss of -30% and a profit of 68%.

Seems perfect for speculation huh? Well I did not adjust to the market workings of this stock. I had an idealist view, that it would be a long buy, and someday Grindeks would meet its intrinsic value of at least 10 €. Did not happen, will not happen anytime soon. Lipman is not the kindest person for minority shareholders and holding a stock for 1-2% yield dividends, while major shareholder cashes out millions to own pocket is something to endure.

My GRD1R position holding history in the chart below.

I exited on 2018.12 right before the rally. Again, perfect timing.

Including dividends position generated total return of +6.26%. An annual return (CAGR) of +1.79%. Or what I call frozen money. I need to rest from GRD1R. Maybe some other time I would ride some of those waves market keeps cyclically repeating.

While talking about Corporate Governance, let’s jump to the other side of spectrum where my fresh acquisition was made.

Entry to Madara Cosmetics

I have watched this from the times it was mentioned about being listed in the beginning of 2017 (ticker MDARA), same as I watch media for Enefit Green arrival now. Madara Cosmetics is a Latvian organic cosmetics manufacturer. I don’t want to expand too much, but I like what they do and most importantly HOW they do it.

Excellent corporate governance, periodic webinars, ESG (Environmental, Social, Governance) reporting, global growth in organic products, aside from financials what attracted my attention.

I entered before 2018 unaudited results came out at 7.5-8€ range.

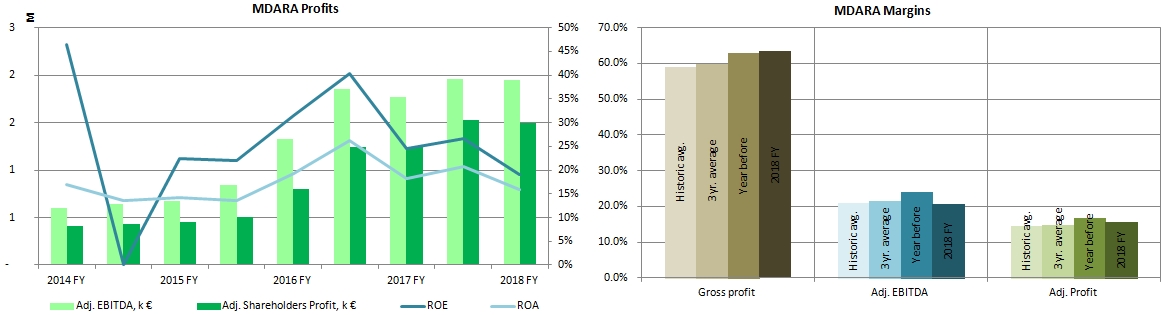

Madara Cosmetics financial analysis

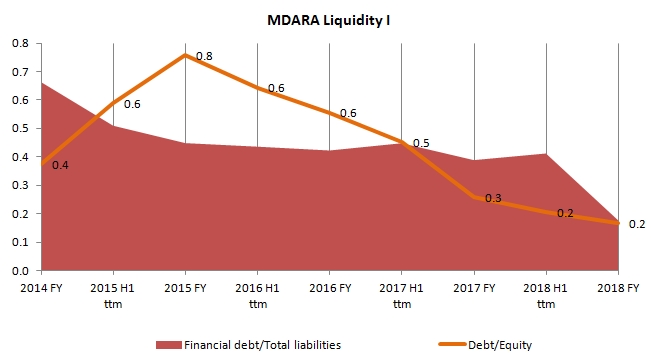

Debt level is very conservative, which I do like very much.

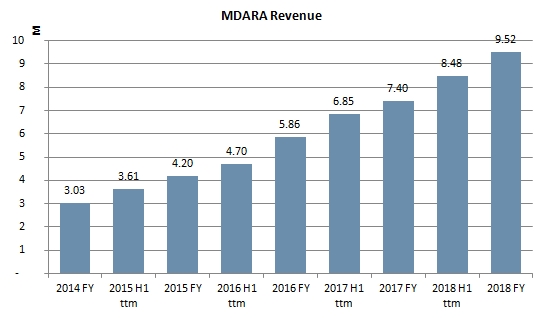

While from 2014 to 2018 Company’s Revenue grew over 3 times:

Margins were sustained at high levels. 15-20% ROE, you name it.

Market valuation at 8€ and 2018 FY last unaudited results:

- 13.7 EV/EBITDA;

- 20 P/E;

- 3.7 P/tBV.

Not too cheap. But it’s a growth stock.

Madara Cosmetics Dividends

Company does not have official dividend policy, but aims to distribute at least 25% of it’s annual profits. In 2018, for 2017FY company paid 0.09 € dividends per share, which was 27% payout ratio.

Expansion

In last webinar Board Member Uldis Iltners painted a great picture of opening sales channels. In 2018 unaudited report advertising costs were up nearly 100% reaching nearly 1M Euros. Company as well as do I expect brand awareness and growth to show up at the increased bottom line in the upcomming years. So far they are doing really good.

Know a CEO

Lotte Tisenkopfa-Iltnere is Madara Cosmetics CEO. It’s nice to know some of the people you are trusting your funds.

updated 2019.09.03: original video has been removed.

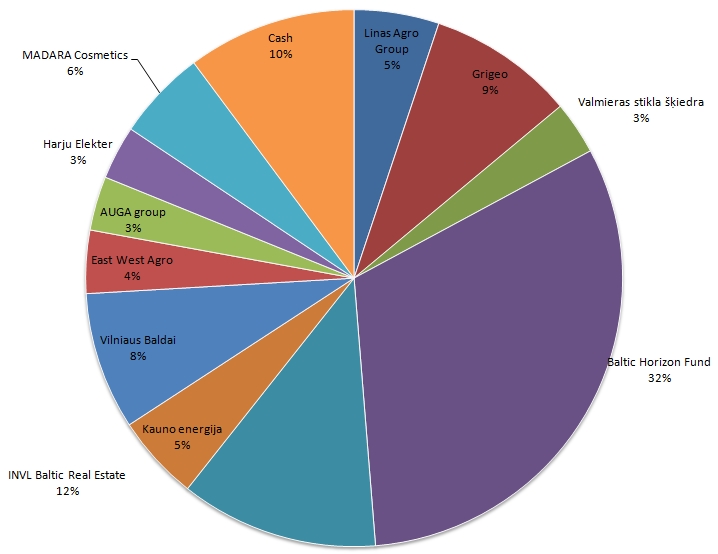

Updated Portfolio Structure

At 2019.03.01 session last prices, portfolio structure looks like this:

Hopefully I will manage to make a market overview again. Most of the unaudited reports are already in. Have fun.

This is not a financial advise. Read my poorly written disclaimer. Other Wonders in Baltic Equities market are here.

Leave A Reply