Up until the end of 2020 I couldn’t find a quantitative bridge between value and growth investing. Loss making companies priced at 30x sales seemed absurd. Amazons, Microsofts, Facebooks and Apple’s of US market always seemed expensive until 2019 December when I started reading their fillings and saw (to my surprise) their 20%+ growth rates at current scale. As if light switch had been turned on…

This post is dedicated to my past-self “value investor“, who dismissed big tech 30+ P/E ratios for a number of years. This had an enormous opportunity cost on my portfolio. Perhaps you could avoid the same bullet.

Post turned out pretty big. Feel free to jump to sections of higher interest.

Unconscious Competence

Do you believe in unconscious training? Park Chan-wook’s movie Oldboy (2003) depicts a man imprisoned for 15 years with a TV set in a little room. He trains watching TV, and what do you know? Kicks ass when he’s released.

Visualization and observation in some cases is as powerful as real training. In US market I too, observed for nearly a year before making significant portfolio reallocation to US equities. Only near the year end I read Hayden Capital 2020 Q3 letter, that is based on 1999 Michael J. Mauboussin paper. Both of which had confirmed my intuitions on what matters in high-growth companies investing. More on that later. Let’s start from ground up.

Money Flows in Macroeconomics

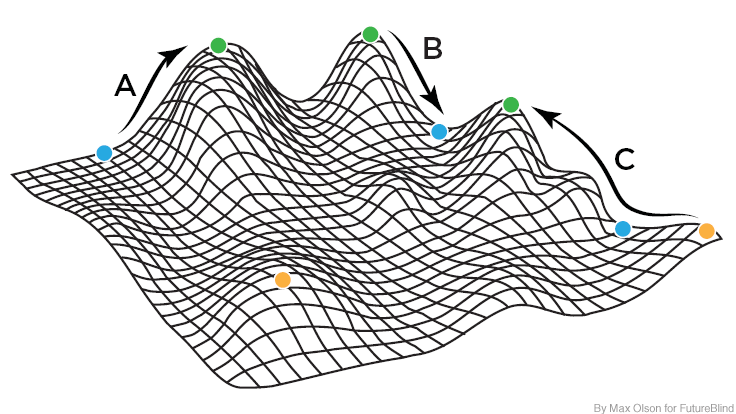

Basins

Equities and all the trading that is happening in stock market is just a lake in the global market’s playground. It’s really important to visualize money flows as a river, flowing on a path of least resistance. In money flows terms – highest reward/risk ratio based on manager’s policy (be it pension fund, gov. fund or private investor).

Regions are like continents: Afrika, Asia, Emerging Markets, Frontier Markets, Developed Markets, (Mars Market 2040?). Each region has its’ lakes: Private Equity, Venture Capital, government/private bonds, equities, commodities…

Capital Reallocation

Individual regions and dependent lakes lay on the ground of RISK. When region or lake (asset class) risk increases, ground level around that point increases. Gravity does its job, and money flows moves away towards lower risk regions or assets.

Some tectonic power examples forming peaks (increasing risk for asset class/region) and valleys (higher reward/risk ratio):

- terrorist attack;

- policy changes;

- sudden government changes (Coup d’état);

- exposing company of fraud (fish in a lake, fishes share “water”)

- central banks’ policy & statements;

- macroeconomic data;

- climate disasters;

- other… (how would SpaceX announcement of asteroid mining shake up commodities?)

Like a nerve system in human body, money basins’ network is connected. Everything matters, everything affects everything else.

Corona Crash – Steep Learning Curve

I saw Inside Job at least 4 times. The Big Short – at least three. We know the story of QE1,2,3,4… Yet still, you can not kill a naive investor inside believing stock market has roots in real economy.

Most of businesses close up completely. Consumption halves, everyone is in panic. Last time global pandemic hit was 100 years ago, and markets were completely different. Dotcom had a drawdown of -49%. Global Financial Crisis? -58%. Everything closes and we stay at home? What does intuition tell you should happen?

I was wrong. In 2020 I met several unheard thoughts – frameworks. This is one of them:

Do you want to be right, or do you want to make money?

Knowing the Lake

Cognitive Dissonance

I opened a trading account ant put ~1% in February. Soon I had to watch my shorts get burned by unprecedented stimulus.

One evening I even had a severe breakdown. I counted 14 issues hitting me from all angles at the same time. FED creating wealth inequality, greed triumph over small business survival was one of those 14. I thought my shorts were “moral” in a broad sense. Wallstreet had to follow real economy and experience pain same as small business owners. Sure.

So yeah, I bought more important lessons in investing. I watched market, read read and read…

Current State of Markets

So what were / are the facts? Where are we?

US Market is the Most Developed

It’s safe to say US Market dictates tone on investor sentiment for other market sessions around the globe. That’s the most advanced and watched market.

Takeaway? US market most effective and pricing of equities is as rational as it can get.

Innovative Market

Why, for the longest time, no country could breed giants such as Microsoft or Facebook? Lobbying fires both ways. On one had, companies are very free to innovate. Trying/breaking. On the other, markets such as EU are very bureaucratic and stifle innovation. How many tech stock compounders do you know in EU? Adyen? What else?

Asia, LatAm, African startups. But they have to show some track record of trust, before I would be interested.

Takeaway: It’s more likely to find high-growth, quality business in US.

Market Lords

During Trump’s Presidency we had Goldman insiders inside the office. Mentioned above movies show clearly, that major market movers are just a bunch of self-regulated bankers getting rich on sidelines of law.

Takeaway: Don’t question market’s morals. That’s not profitable.

Passive and Concentrated

World’s top programmers and data scientists that care about money work for banks – building predictive market models, looking at alternative data and route HFT. Most of market noise volume is algorithmic – emotion agnostic. Passive investing (ETF’s) are on the rise, increasing liquidity problems in one place, in others – lifting water lifts all boats (Tesla S&P500 inclusion price dynamic).

When we talk about market (S&P500) it would be mistake to assume it represents various sectors of the economy. Tweet from April:

Takeaway: S&P500 increasingly shows performance of “cloud” vs real economy. Markets also are increasingly efficient.

Monetary Policy

This one’s a biggie. Dollar monetary base M2 increased 30% this year. Majority of that went to markets, not the economy. Bond yields fell off the cliff. When zero-risk rates go to 0 or even negative, tectonic plates shift and money flows into higher yielding safe Tech names. Valuation gets distorted.

White lie by Powell: “we are not even thinking about thinking to raise rates” – will change when inflation catches up with rebounding economy and 30% increased money supply.

Takeaway: Low interest-rates makes big tech “new bonds”. Also makes valuation models for high growth stocks more accommodative.

Accelerating

Another biggie. Everything accelerates: technological innovation, amounts of data, computational power, information distribution speed. We are not adapted to think in exponential terms, but we must recognize the power law when we encounter one. QE sizes, market reaction (driven by real time sentiment on social media e.g.) are artifacts of changing times. Besides, as investors we are prone to put sticks in exponential growth.

The first rule of compounding: never interrupt it unnecessarily – Charlie Munger

Takeaway: expand evolutionary linear mind to accept and appreciate exponential growth.

Inflation is Here

Unaccounted in CPI, but inflation is ravaging across asset classes. Equities, real estate, collectibles, precious metals, Bitcoin. Everything what rich would buy is getting bid up.

Takeaway: CPI is flawed, allows riches to get richer. Matthew Principle.

Dipping the Toes – High Growth Stocks

We could go on and on getting to know the waters, I haven’t even touched on retail investor frenzy. But lets dip the toes into stocks. After all we came here to better understand them, but before talking “Stocks”, let’s understand business cycle first.

Evolution of Business

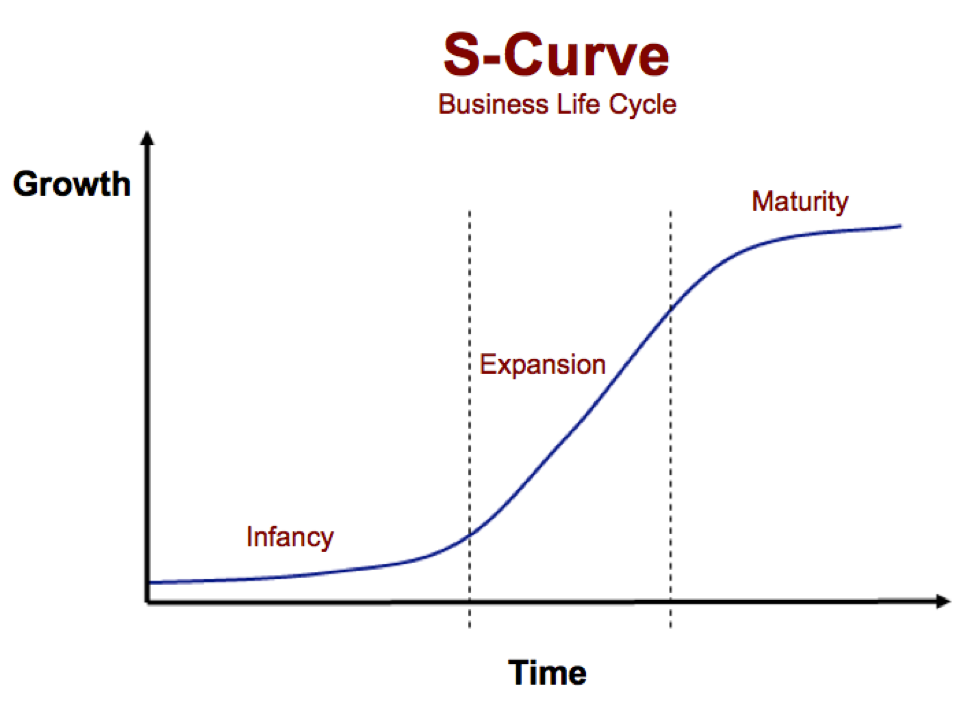

Again, we have to start from the top and be mindful of what business cycle stage a company currently is. Below is the business life cycle “S-Curve”.

Most listed companies have reached their maturity. They have a sticky product or service, have about maxed out international expansion. Cash flows are stable; company grows primarily horizontally through M&A until it’s gets too big and attracts regulatory attention. Examples: Coca-Cola, McDonalds, BlackRock, General Electric, Visa, 3M, Boeing… These are the businesses I was used to see and valuate in Nasdaq Baltic and other markets.

Other S-curves take into account inevitable demise if owners are oblivious to technological changes or incoming disruptors. This chart is more of an optimistic take.

On the other end of S curve we have young and ambitious startups. They often sell their product below their COGS. Often they aim to break even on effects of economies of scale. These business owners lack sleep, live under high stress, a wrong early hire can backstep company development for months. Their businesses grow revenues in multiples YoY; they burn investor cash.

First investors are “Angel”, then comes the venture capital (VC) raising rounds A, B, C, D… and beyond, until stakeholders decide to cash-out via public markets (IPO).

Finally in the middle we have publicly traded companies with high growth and often still unprofitable businesses, that value investors miss out on.

Characteristics of High-Growth Companies

Just to clarify before going forward, we are talking about:

- Internet-native technology companies;

- Bringing along a secular change in the industry or inventing a new market completely;

- Asset-light, high gross margin.

No Profit no Problem

Because nobody wants to get rich slow – Warren Buffet in response to Bezos question “Why doesn’t everyone just copy you?”

That’s actually a Forbes headline I borrowed (article is shit, though). I read a story once, that Amazon investors have constantly bothered Jeff Bezos with marginal bottom line. Amazon reported loss or a very low margin profit for a number of years. Investors wanted to tap into short-term returns with dividends or a significant price appreciation, that significant jump in profits would bring.

Legend has it, that Amazon reduced investments for one quarter, reporting outstanding profit, showcasing solid business – eager investors were silenced and Amazon continued with its long-term strategy of becoming “everything store“.

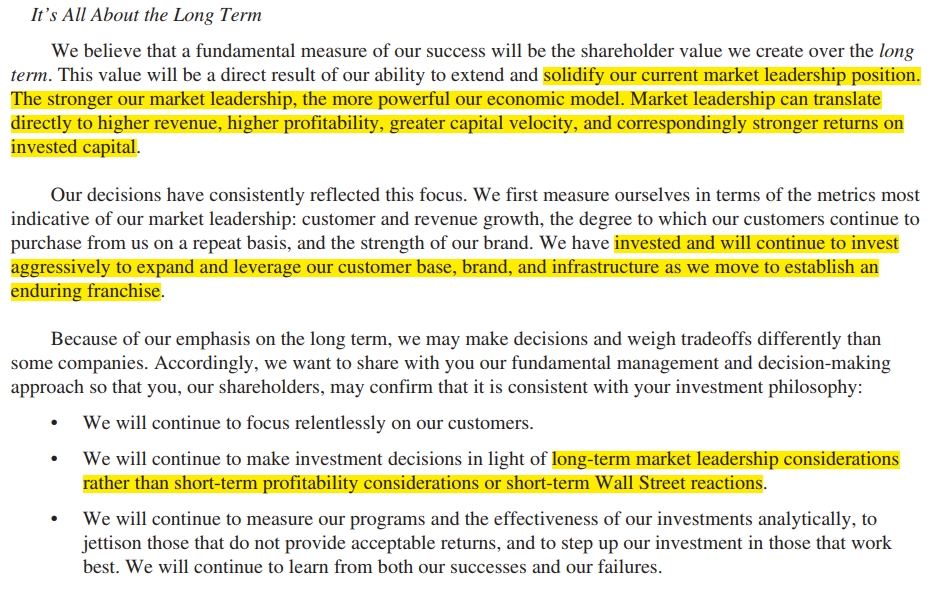

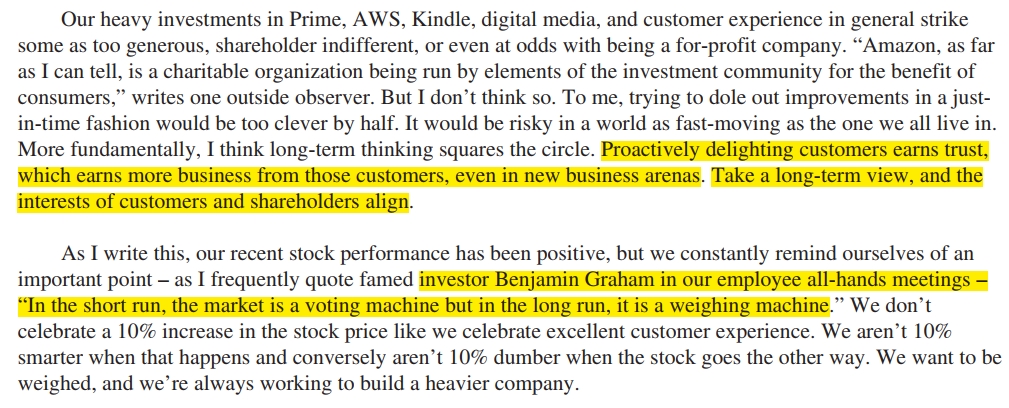

This is 2012 Bezos letter to shareholders. Reading though it, we get a framework to understand these high-growth “unprofitable” companies.

And the other bit, Bezos learnt from value investing masters…

Amazon only now, 8 years later since this letter was written, starts to tap into juicy profits, because it has gained a scale at which making same ROIC investments is no longer available. Competitive landscape has also changed dramatically.

Profit is just an accounting term. What really counts is operating cash flow. If company invests heavily in acquiring future cash flows, in P/L statement they will have a massive marketing expense eating profits to a loss.

High-Growth Company Playbook

So a typical high-growth company playbook looks like this:

- gain scale – filling a market ASAP;

- build moat – product and business strategy wise (product differentiation, one-stop shop solution, M&A, network effects brought by scale);

- ideally have high-switching costs – lower churn driving higher LTV (life time value);

- tap into network effects / economies of scale – reducing CAC (customer acquisition cost), driving profitability and solidifying moat;

- invest in marketing and product development – listen to customer feedback, grow recurring revenue base;

- aim at NDR (net dollar retention) >100%;

- dilute stock via stock based compensation (SBC) – aligning employees and shareholders (not necessarily).

That’s just off the top of my head. You must have noticed different terminology. Had my share of reading to know them myself. These come from startup investing world.

SaaS Beast

API is Application Programming Interface. A company exposes useful resources to 3rd party users or companies and charges based on resources provided, usage or simply with monthly subscription. That’s a software as a service (SaaS) company. A lot of companies rely on third-party API solutions to monitor, secure, provide various functionalities for its clients. Creating a solution to a problem in house is costly and prone to errors due to lack of specialization, especially when company scales. Specializing in house takes time and money.

Now that’s a beast. Think about it:

- code (API) development is a fixed cost;

- scaling in cloud (application hosting) has a marginal cost;

- it’s not a sale, it’s a lease, earning cash not for a year or two, but indefinitely – stable cash flows – root of value investing, remember?

- business is in part outsourced to client’s growth – growing client businesses increase usage / product modules driving growth in SaaS company;

- enjoys network effects. Usage generates data. More data -> better tailored solutions with machine learning capabilities;

Packy wrote a decent primer on API in December.

Case: Twilio

Twilio is a modern communications company. If you received SMS confirmation code when registering somewhere, chances are you have used Twilio services. To be more exact: website you registered uses Twilio API for phone number confirmation purposes.

Twilio went public in June of 2016. On last day of 2020 it returned x14.5 to its shareholders. Starting with motivation… For the record, I never owned, nor closer looked at their statements prior to this post.

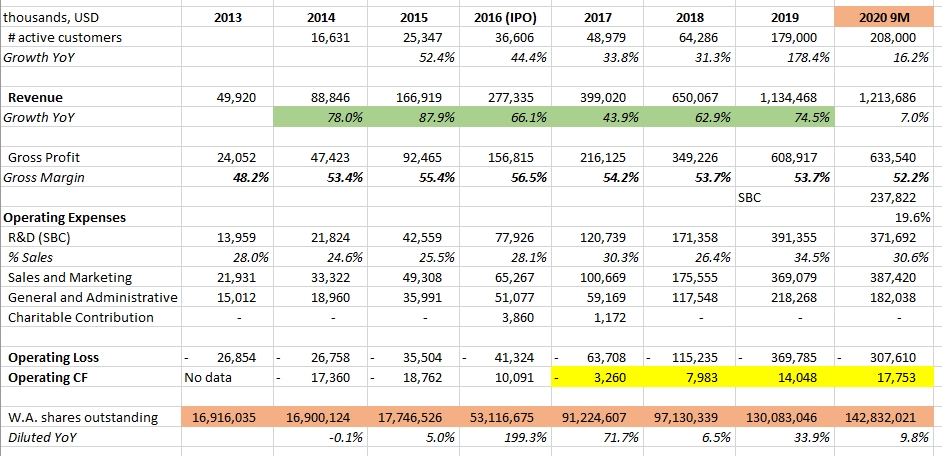

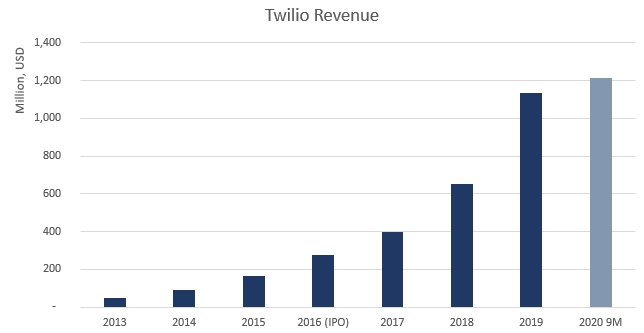

What do financials look like?

Yup, that’s a 52 Billion market capitalization unprofitable company on a surface. Let’s unpack.

- Gross margins stable at 53%

- Average revenue growth rate = 68%;

- Stock based compensation (R&D) is above average / high dilution;

- Marketing > Operating Loss. Here’s our profit;

- Operating cash flow turned positive and growing.

Gross Profit Margin

For a SaaS business, gross margins are fairly low, I assume they pay a heavy COGS for telecom carriers to use their infrastructure. What I personally target is gross profit >60%.

Once company maturity is reached, lower bounds of gross profit provide a optimistic outlook for operating profit margin. Ensemble Capital have two articles I really liked.

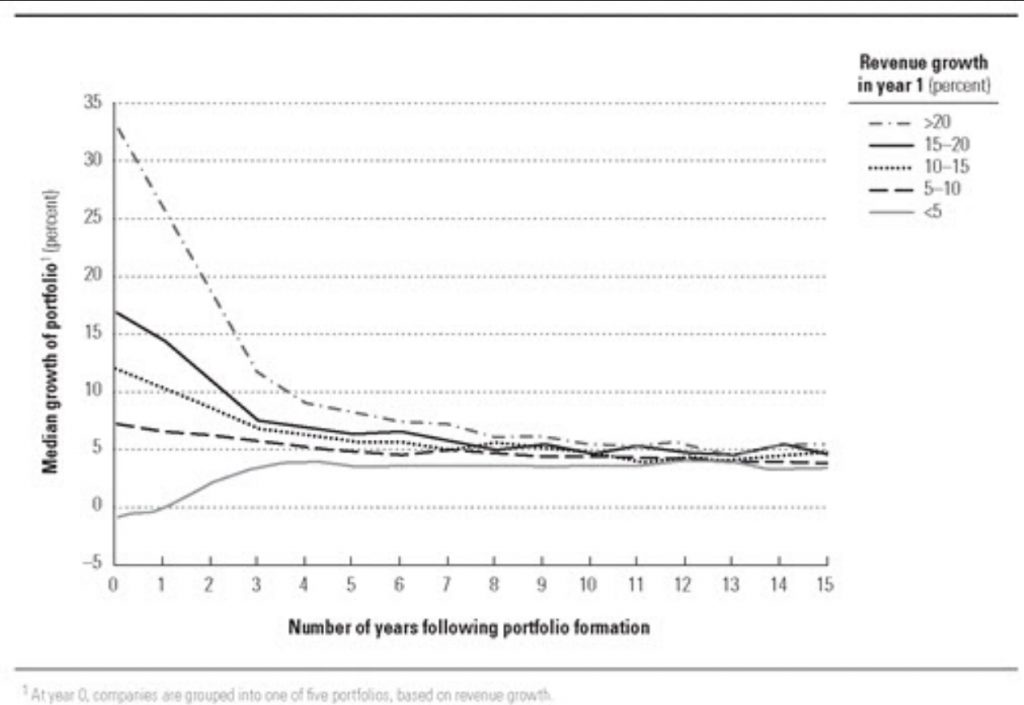

In first, based on McKinsey paper they show, that as companies mature, revenue growth rate decreases, weighting on portfolio returns.

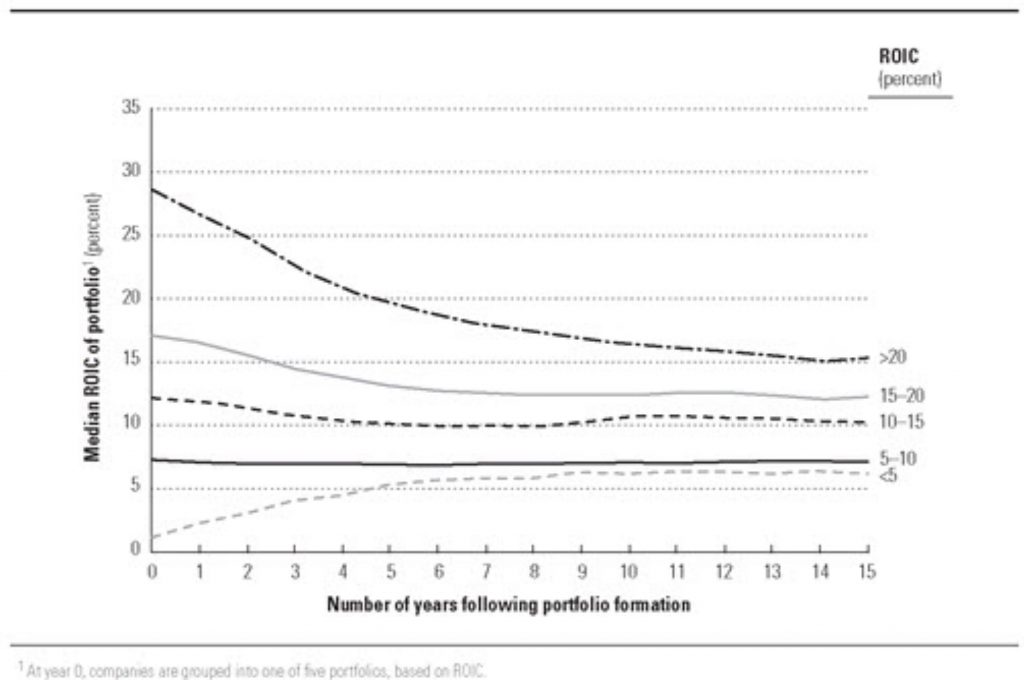

On the other hand, paying up for high ROIC business pays well long-term and provides a compounding vehicle. Value investors’ grail of compounding = high ROIC business.

In the second post they show how high ROIC generates free cash flow and translates into higher PE valuations.

Revenue Growth

Note, 2020 is only 9 months, already outgrown 2019. YoY growth rate averages at 68%.

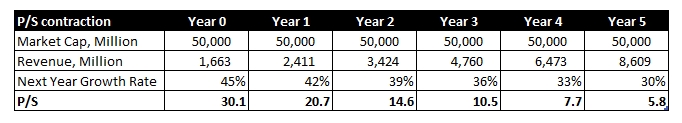

Based on Q4 guidance 2020 should end up with 1.66 Billion revenue, 46.7% YoY growth, which gives generous current multiple of P/S = 30.1.

Let’s assume 3% annual deceleration in growth rate, holding market cap steady and business as usual, how crazy are we talking about?

For SaaS, it’s accepted to use EV/NTM Revenue, taking into account debt and cash on balance sheet.

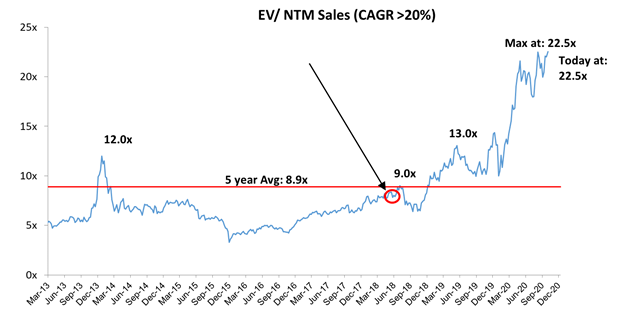

Yesterday MI Capital had a great thread on SaaS businesses, I want to borrow one chart to bring in industry context.

Your intuition may again tell you “bubble”. Speculative money is of course in the game. But this chart shows growing education in investor circles and taking positions in building next internet infrastructure. I encourage you to read MI Capital’s thread.

TAM

We have seen how growth can normalize traditional ratios, question remains, how big can these companies get? That’s where TAM (Total Addressable Market) term comes in.

Managements of high growth companies usually provide what they believe is potential revenue in the market they are after. Coffee-grounds magic. I don’t focus too much on TAM by managements, nor consultancy firms. I seek to follow broader trends in the market. Really liked this idea:

As investor, your job is to imagine multiple different alternative universes of the future and invest in the thing that is most common across most of them.

Growing Verticals

We assume current business “as is”. However through M&A or internal product development companies can unlock new revenue segments.

Example from Square: Square was founded in 2009. Mobile wallet CashApp was launched in the end of 2013. In 2020 Q3 CashApp brought home 48.5% of total gross profit. That business segment did not even exist before.

Important takeaway: technology companies can open up new revenue streams. Some of these can be totally new markets, others can aggressively enter competitors territory.

Stock Based Compensation

Plague of retail investor. Most of the times disguised under R&D cost in Income statement. Not all R&D = SBC, but typically a major part of it.

As an incentive employees and management are awarded with stock options and instruments such as RSU (restricted share units). I don’t know enough to give a comprehensive picture, but the gist of it is:

Management can be greedy and award them selves with huge stock option plans, dumping shares on the market as soon as vesting is done and options are exercised.

Show me incentives, I’ll show you the result – C. Munger

Since Twilio went public, it increased its shares outstanding ~+56%. For 2020 9M Twilio’s SBC/sales is around 19.6%. Reasonable for current stage. Mature companies have SBC/Revenue at 1-5% rate – that’s what you would find on Big Tech Statements.

What I have seen, it’s generally accepted for high growth stocks to have Stock based compensation below 20% from sales. Above that points to excesses greed/confidence of management. Ryan Reeves has a good blogpost on SBC and lays a positive rationale for SBC.

Operating Expenses

For most years, marketing spend for Twilio was above operating loss in absolute terms. Which means, Twilio decided at any time, current scale is enough, or perhaps marketing ROI has deteriorated beyond usefulness, Twilio would instantly show profits in income statement. Business is inherently profitable. Investments in future cash flows are eating bottom line now.

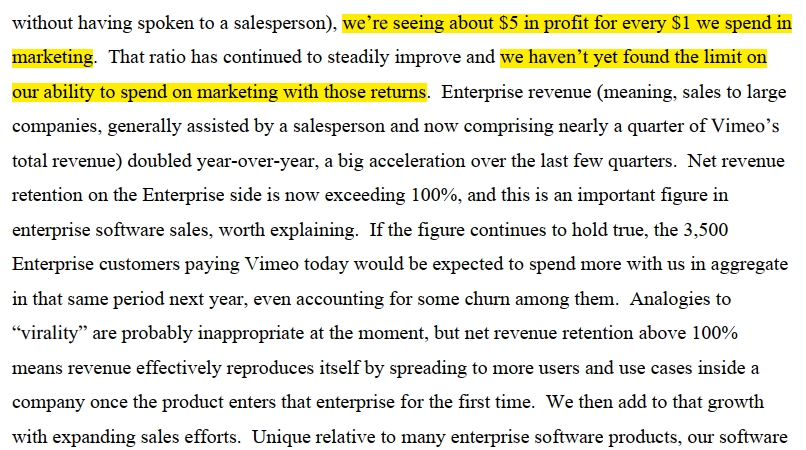

Another example I saw was in IAC Q3 letter:

500% return. Burn the profit, please. I’ll clap while you do.

SaaS vs Traditional Valuation Methods

Seem like a great businesses, right? When should we buy? The question I had myself for a looong time. Until I came to a conclusion, it barely matters [shocker].

Valuation Taboo

Fintwit has a bunch of podcast hosts and even more portfolio managers. On several occasions I have asked “What are characteristics of cheap SaaS company?” Even though I got engagement from hosts, that question was never surfaced on air.

I increasingly live under conviction investing community in general has no quantitative answer to SaaS valuations. The closest and most definitive I got was MBI’s research.

Financial Ratios

In this day and age, they increasingly break down. Especially when talking about SaaS.

- EV/EBITDA – EBITDA breaks. Early stages operating profit is negative; SBC has no cash outflows, but on GAAP basis it weights down on EBITDA, etc..;

- P/B – most of assets are intangible (IP of code). Book value can easily be negative;

- Debt/Equity – companies raise capital through bonds, loans and selling equity. The earlier the company, the less meaning debt level has. With growth of 40% Current loans/notes could be covered with +3 years EBITDA perhaps?

- P/E – goes without saying. -50 says nothing why company has 20B market cap;

Besides, ratios take the rear view. The higher the growth, the less sense it makes to look back.

Discounted Cash Flow (DCF)

Now I have a confession to make. I never did DCF. From systems engineering, we know errors compound. DCF’s take a lot of assumptions. Another coffee-grounds magic I thought. Again, I was mistaken.

This is a very serious analytical tool, I hopefully I’ll get a round to modelling my first DCF’s in 2021, the problem is: discounted cash flow method is suitable for stable cash flows. For some SaaS businesses it is. More often – it isn’t.

As mentioned above, companies invest in new product developments, acquiring competition, entering new or competitor markets. Revenue, investments, cash flows may be highly volatile on quarter to quarter basis.

So… What works?

Investment Approach in 2020

What worked in 2020, not necessarily translates into next years. Remember from macro analogy, individual stocks are just fish in a lake. When next lake get’s more attractive, money flows there, leaving stocks fighting for remainder water. Waiting for the next crash while currency is being deflated in billions has a sizable opportunity cost.

You invest in a market you have, not in a market you wish you had.

Reinforcing Market Effectiveness Thesis

I assume market effectiveness to a large extent. Goldman Sachs, Morgan Stanley and the likes have enormous resources. They can hire coders just to get a professional opinion on API code and documentation. This way they can gauge client (developer) satisfaction.

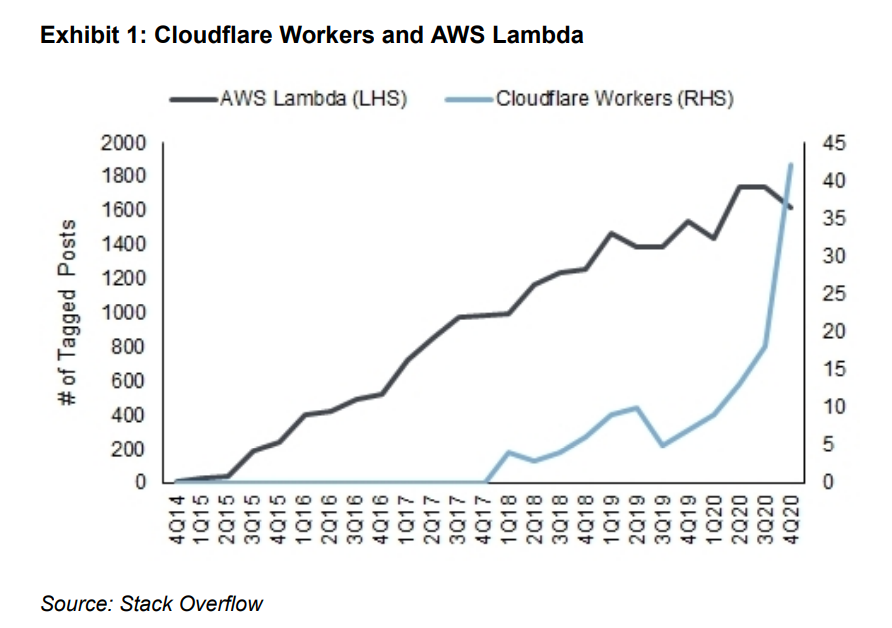

Increasingly Stack Overflow is becoming a goto site for smart money to get alternative data insights (how many developers are working on X framework vs other listed companys’ Y?). Here’s one example. Be mindful of different axis though.

They can also tap into surveys of CTO’s across many organizations to estimate client’s appetite, sentiment, investment spend, trends in IT infrastructure and technology stacks.

Real Options Investing

Unconscious competence… When in November I read Hayden Capital 2020 Q3 letter that is based on 1999 paper by Michael J. Mauboussin I was given labels for my actions. I highly recommend reading both. I will only transfer a fraction of insight in these papers.

Michael in explaining Real Options draws parallels with real options. Talented management must spot, create and exercise these real options when they see one.

An expectations-based approach to investing starts with a company’s stock price and considers what value driver estimates solve for that price. Using this approach, numerous financial analysts and pundits have concluded that many stocks – especially those that compete in rapidly growing, uncertain markets – are substantially overvalued. We believe that such an analysis is incomplete because it ignores the potentially meaningful value of embedded real options.

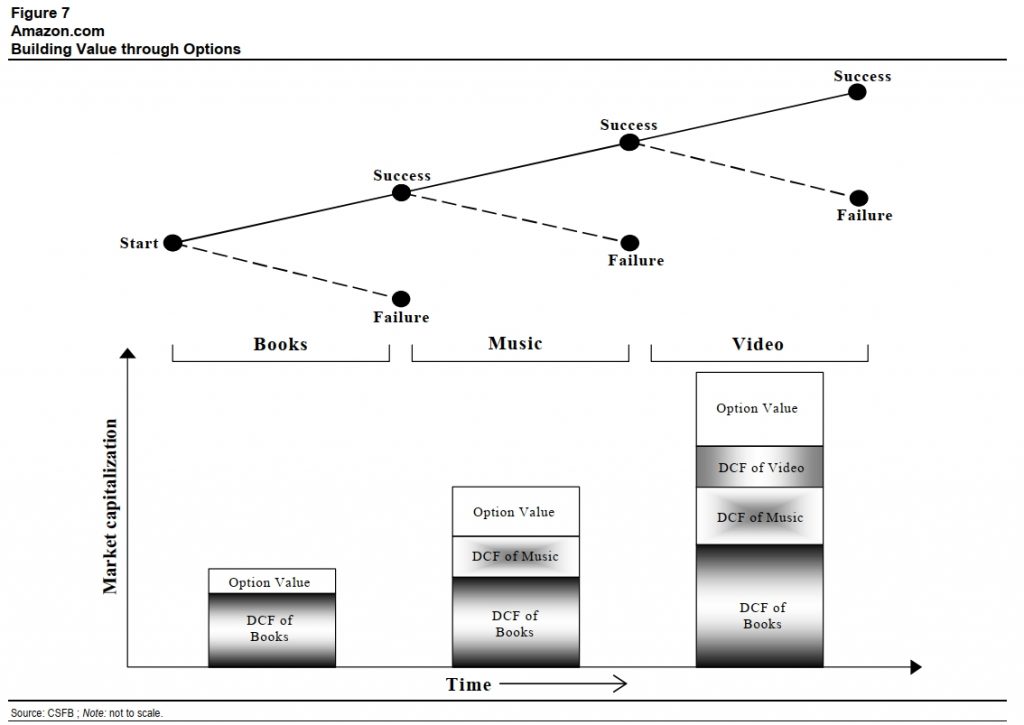

Traditional DCF model takes into account only current cash flows. However company makes investments, that are accounted today, eating today’s profit at the expense of larger future cash flows. Using 1999 Amazon as an example, it had cash flows from book sales, but it invested heavily in music and video later. Chart below gives intuition on shortfalls of DCF.

Non Quantifiable Factors Driving Real options

To complement DCF model, we must somehow evaluate probability and impact of venture bets by these highly innovative technology companies.

Is it valuing the unimaginable? Yes. Is the unimaginable valuable? Yes.

Here comes a lot of soft factors, most of which are based on management:

- Understanding business – product/service offering;

- Business strategy – what will management do next;

- Competition – how far, what are their product/service offerings? Which will the consumer/developer/business choose?

- Founders story. Are they still at the management? Why do they do what they do? What have they done prior before leading this company now? How successful were previous ventures?

- Access to capital, like many things in life is build on trust. What track record does this management have in allocating capital?

- Incentive plan. Rate of dilution, greed / fairness vs rest of stakeholders;

- Rate and track record of innovation – how successful were previous product releases?

Real Options Applicability

So it’s quite evident, we are turning away from numbers into venture capital world were trust and track record is everything.

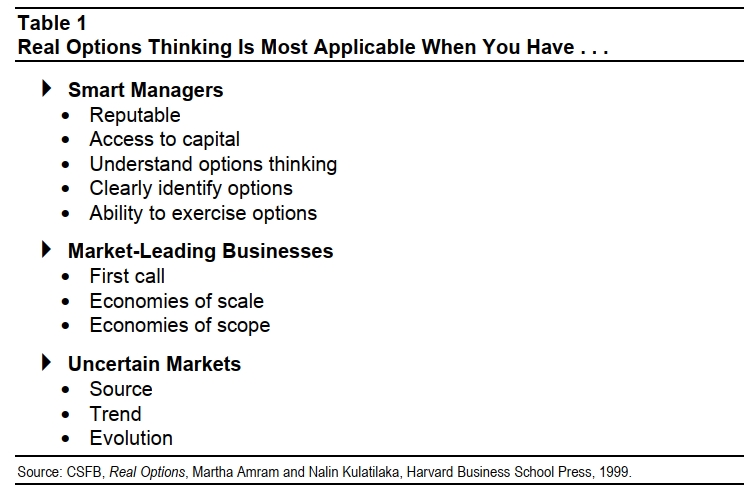

Michael’ paper has this check list, when real options are most applicable:

Scale, Scope

Paper describes 7 different options management teams can use. Scale up and Scope Up are two most common options exercised in high growth companies.

Scale up: Initial investments scale up to future value-creating opportunities. Scale-up options require some prerequisite investments. For example, a distribution company may have valuable scale-up options if the served market grows

Scope up: This option values the opportunity to leverage an investment made in one industry into another, related industry. This is also known as link-and-leverage. A company that dominates one sector of e-commerce and leverages that success into a neighboring sector is exercising a scope-up option.

Secular Trends

Observe what is happening. What I have previously ignored and is a huge help in investing is microeconomic environment of business. Does the sector in which company operates experience a secular growth?

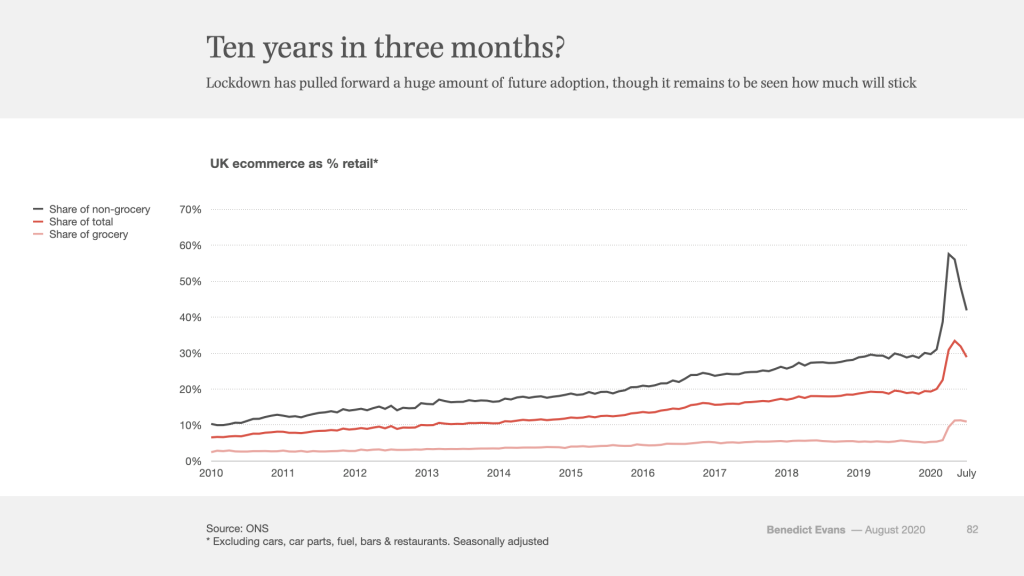

In 2020 we had witnessed a multi-year leap into the future on multiple fronts. Here’s a chart on ecommerce in UK from Ben Evans:

Investing in growing sectors stales competition threats, because growing pie (market) can provide enough revenue for every party involved before real battle of margin undercutting starts.

On the other hand contracting sectors experience zero sum dynamics. Oil producers for example try to out-supply market securing lower margin volume before the competition does, which drives oil prices down, hurting every party involved.

Sectors in Secular Growth

Below are just some obvious examples of cultural, behavioral, economic shifts taking place.

- ecommerce;

- fintech;

- data [everything] – storage, data lakes, analytics, predictions;

- semiconductors;

- biotech;

- infosec;

- renewables;

- EV;

- blockchain…

Market is Forward Looking

I have been observing US market more closely for past several years. I don’t have a long track record and I suffer from availability bias. Market in its current state is extremely far looking. Cheap capital makes investing a game of chasing expectations.

Good news is: a lot of companies are laying groundwork for next layer of internet infrastructure and will be around for a number of years.

But when market expectations are broken, don’t get surprised to see market re-calculating potential on high growth stocks. Here’s an example when Fastly issued warning on lower Q3 result due to Tik-Tok (largest customer) ban in US. -27.6% a day.

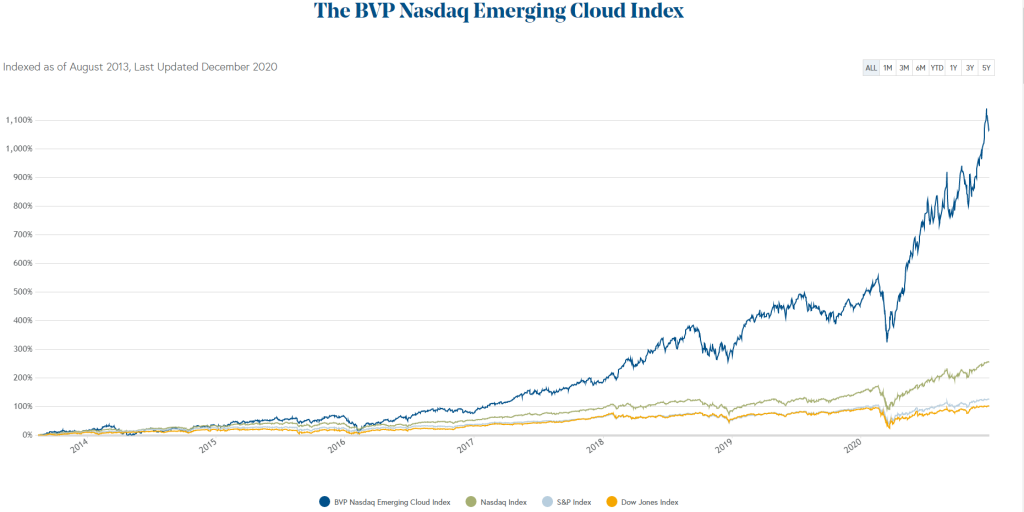

Nevertheless opportunities open up all the time. Cloud Index outperformance is clear and proves asset-light, high-margin business superiority.

Conclusion

In 2020, I have worked far more hours as an investor rather than programmer or engineer. 4 stocks in my portfolio across two continents have doubled in value. More on this in next blogpost.

Whether this was a fluke, remains to be seen. I’m at no delusion I did something special. Central banks can end the party at their will. Probabilistic intuition tells this won’t happen until inflation comes knocking at the door.

Shedding value investor skin I grew up in was not easy. Value investors screaming bubble, posting dotcom valuations clearly have not looked closer into these modern businesses, nor do they know some ’00 companies were pre-revenue.

Embarking on a path to understand why market pays 96 P/E for Amazon I have learned a ton about these new kind of businesses, their markets and world-class innovators and business owners. Learning continues daily…

I feel really privileged to learn among other investors those work I have referenced with links. I highly recommend reading through their work. There are countless more, who contributed forming unconscious competence.

According to Darwin’s Origin of Species, it is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself.

If you have learned something, show your gratitude sharing this with next investor you care about. Safe, and hopefully more open 2021 to You all! Happy New Year!

Leave A Reply